- The Sovereign Signal

- Posts

- Silver Lease Rates Still Elevated In London, US Banks Are Now Net Long Silver Futures, Silver Headed For 8 Consecutive Monthly Green Candle, Bank of America Suddenly Bullish on All Commodities

Silver Lease Rates Still Elevated In London, US Banks Are Now Net Long Silver Futures, Silver Headed For 8 Consecutive Monthly Green Candle, Bank of America Suddenly Bullish on All Commodities

Who would have thought that a massive commodities super-cycle would follow the greatest global debt bender in recorded history?

Lease rates for the “white metals” (silver, platinum, palladium) are still elevated while gold sits in contango.

Translation: borrowers are paying up to source physical silver/platinum/palladium now, a classic tell of tight near-term supply, whereas gold’s term structure looks looser.

High lease rates + backwardation are what you see when immediate, real-world demand is stressing inventories—often a precursor to sharp upside bursts if that tightness persists.

In short: the white metals are signaling scarcity; paper prices are underestimating it.

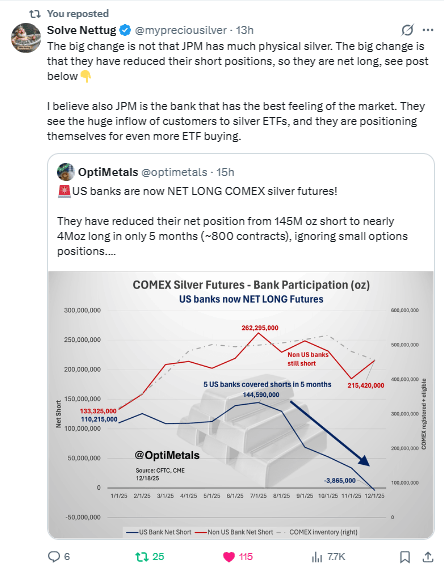

U.S. banks—historically the ceiling on silver—just flipped from a massive net short to a net long in a few months.

That means the players who usually sell rallies are now aligned with price rising (and likely front-running ETF inflows).

With fewer bank shorts to supply “paper silver,” squeeze risk and upside convexity increase, while pullbacks should get bought faster.

Net: the referee just joined the bulls—expect higher volatility and a higher stair-step trend.

Eight straight up months—never happened before—means silver isn’t just rallying, it’s re-pricing.

That’s what a regime shift looks like: supply-constrained metal meets global bid, paper shorts retreat, and every pullback gets swallowed.

Expect fatter ranges, faster recoveries, and new reference prices. NEW ERA.

Silver just broke free of gold’s gravity.

That means it’s no longer riding “inflation hedge” coattails—it’s leading on its own fundamentals: tightening float, Asia-led demand, and paper-market stress.

Leadership flips like this only happen at the start of secular bull phases, when the market begins to reprice the underlying asset class.

Bank of America—long rumored to be a heavyweight on the short side of silver—now telegraphing “every commodity will look like gold” is the dog that didn’t bark finally howling.

Translation: policy-driven heat (fiscal dominance, easier Fed, underinvestment) is about to collide with real-world supply limits.

When a house that’s historically cautious on metals starts blessing the whole complex, it usually means the secular turn isn’t coming—it’s here.

Read between the lines:

BoJ just hiked to the highest since ’95.

That’s the oxygen line for the yen carry trade—cheap-yen funding that’s juiced global risk for years.

155–160 = tripwire.

At ~157, a run to 160 risks VaR shocks: funding costs jump, hedges blow out, and leveraged “long-everything/short-vol” positions get cut.

If carry unwinds:

yen rips stronger, global risk assets de-lever (equities/EM/HY first), volatility spikes, and there’s a dash for pristine collateral.

Rates & flows:

rising JGB yields + higher FX-hedge costs make USTs less attractive for Japanese buyers; they either sell hedged paper or go unhedged—both are messy.

Metals read-through:

stress + de-lever = gold bid on safety/collateral quality; silver whipsaws but benefits as capital rotates from “paper risk” to hard assets once the dust settles.

Net: every tick toward 160 tightens the spring.

When it snaps, expect risk-off/volatility soaring—and a market suddenly very interested in real collateral.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply