- The Sovereign Signal

- Posts

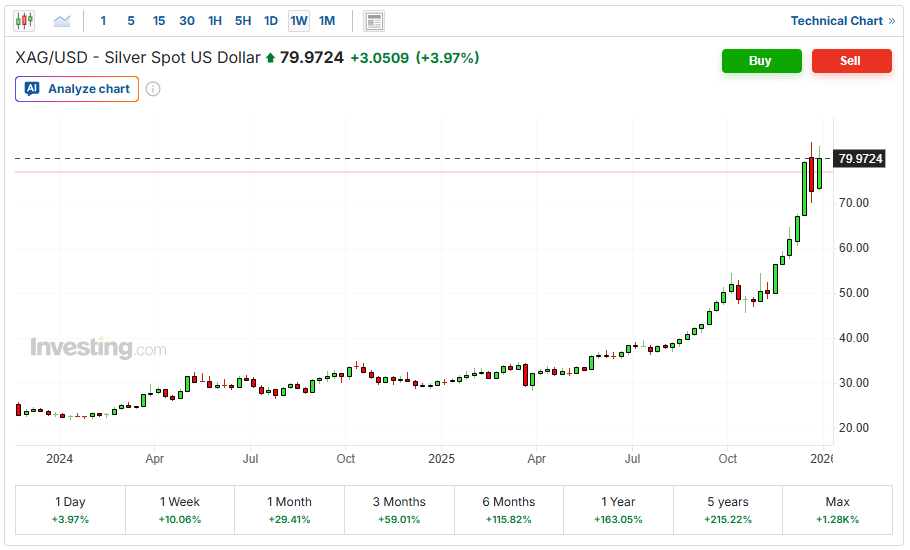

- Silver Longs Have Not Arrived Yet While 2X Leveraged Short Silver Fund Volumes Explode, Silver Closes Up 3.97% On The Day Bloomberg Commodity Rebalancings Began, Fannie and Freddie To Buy $200 Billion In Mortgages While Military Budget Rises $500 Billion, Binance Launches Silver Futures' With 50X Leverage

Silver Longs Have Not Arrived Yet While 2X Leveraged Short Silver Fund Volumes Explode, Silver Closes Up 3.97% On The Day Bloomberg Commodity Rebalancings Began, Fannie and Freddie To Buy $200 Billion In Mortgages While Military Budget Rises $500 Billion, Binance Launches Silver Futures' With 50X Leverage

The collective amnesia our society has had regarding what is real money is ending. But before that solidifies, crypto bros will be able to trade silver with 50X leverage. What could go wrong?

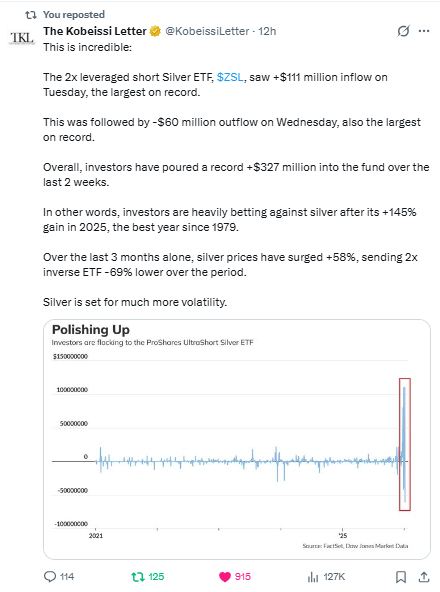

When silver is up 145% YoY, and people are still shorting it heavily or not going long, you’re looking at one of the clearest signs of under-owned strength.

That's how secular bull markets behave early on.

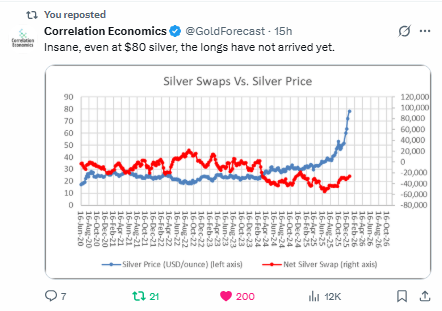

The first post — “even at $80 silver, the longs haven’t arrived yet” — is more telling.

Here’s why:

1. Behavioral Contradiction

It highlights the irrational disconnect: silver has gone vertical, yet positioning hasn't caught up.

That’s not just bullish — that’s scary bullish.

It suggests the price has been driven by structural flows or supply-demand imbalances without widespread speculative frenzy.

When the crowd does show up? Boom.

2. Fuel Still on the Sidelines

If this is a breakout and the longs haven’t arrived, then a major leg higher could be pre-loaded.

It’s like a rocket already lifting off, but the boosters haven’t even ignited yet.

In contrast, leveraged ETF inflows (second post) can be tactical, short-term, and often wrong at turning points.

3. Smart Money vs. Dumb Money

The swaps chart reflects positioning by institutions — often smarter money or commercial hedgers.

The 2x short ETF inflows?

That’s likely retail trying to short a runaway train.

Historically, retail pouring into leveraged inverse ETFs after massive moves has been a contrarian top signal — for the ETF, not the asset.

This chart isn’t just about silver. It’s a coffin nail for fiat illusions.

For 50 years, silver's real value was smothered under a blanket of money printing.

Now? It's breaking free — not spiking, but stabilizing at a higher regime. That’s how paradigm shifts begin.

Meanwhile, the government is throwing gasoline on the fire:

$200B into mortgages (again)

Military budget ballooning by 50%

This isn’t stimulus. It’s system strain masked as support.

The market isn’t peaking — it’s re-pricing decades of distortion.

The days of artificially low priced metals are ending. The days of real assets have returned.

Forget 1929 or 2008. This isn't a crash—it's a controlled burn.

Base metals and energy aren’t reacting to stimulus—they’re front-running it.

These aren't rallies; they’re re-pricings.

After two decades of coiling, they’re breaking out because the system has no brakes left.

The Fed isn’t in control. Politics is.

And political cycles now demand cheap rates and big checks, even if it scorches the currency.

The big mistake isn’t being too bullish now. It’s thinking that the fundamentals will never matter.

They just dropped a casino on top of a volcano.

Binance offering 50x leverage on silver futures isn’t innovation—it’s a flashing red warning.

Crypto bros are being lured into the most manipulated, systemically crucial commodity market with the promise of moonshot profits—on assets they’ll never actually own.

It’s not about silver anymore. It’s about control.

Speculators are getting paper gains while the physical market gets drained dry.

And when the paper collapses under the weight of its own leverage, the only thing that’ll matter is what you can actually hold.

This is the prelude to something breaking. Fast money meets a real asset that you can actually take delivery of.

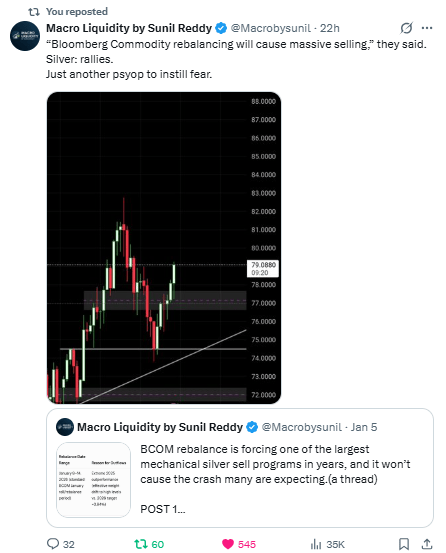

Lots of rumors of an impending silver sell off were floating around last week—Bloomberg rebalancing, fear-mongering, “mechanical” selling pressure…

…and spot silver still closed the week at its highest level ever.

Up 3.97% on the exact day the rebalancing supposedly started.

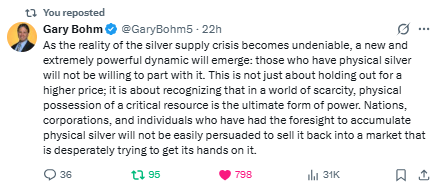

Meanwhile, physical silver holders aren’t just holding… they’re vanishing from the market entirely.

It’s not just a trade anymore—it’s power. It’s sovereignty in a world that’s will start panic over scarcity.

The collective amnesia our society has had regarding what is real money is ending.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply