- The Sovereign Signal

- Posts

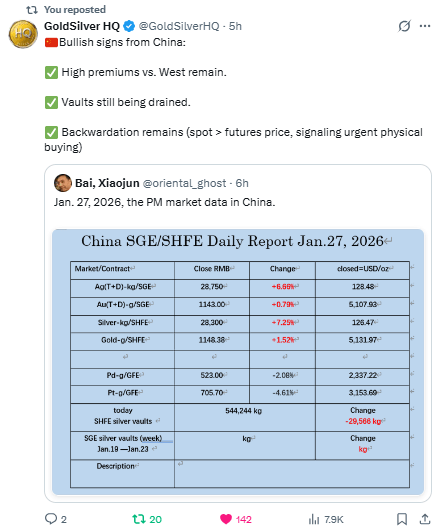

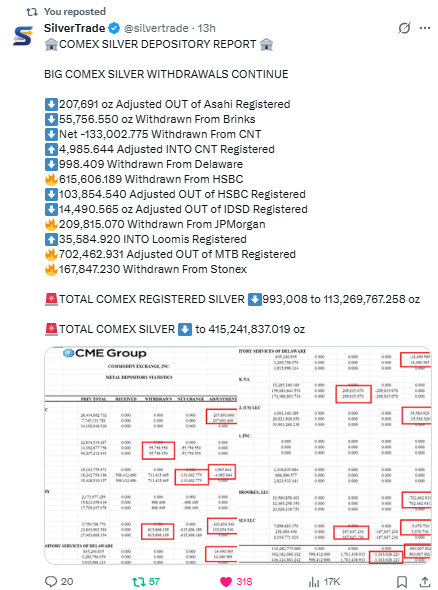

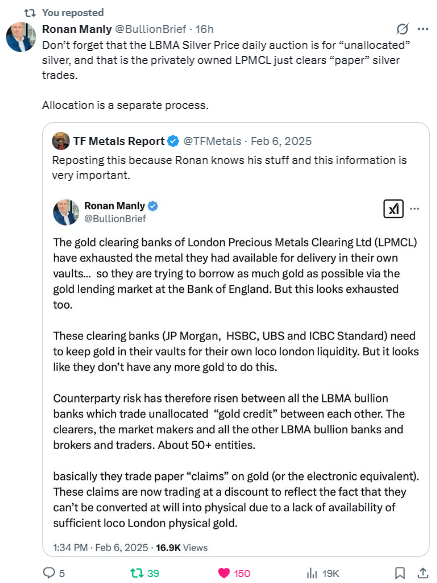

- Silver Premium & China Fundamentals, Massive Paper Trades vs Zero Deliveries, Speculators Dumping Futures & ETF Outflows, Shanghai Silver Premium Projecting $200+, COMEX Registered Silver Withdrawals, LBMA & Unallocated Silver Exhaustion

Silver Premium & China Fundamentals, Massive Paper Trades vs Zero Deliveries, Speculators Dumping Futures & ETF Outflows, Shanghai Silver Premium Projecting $200+, COMEX Registered Silver Withdrawals, LBMA & Unallocated Silver Exhaustion

This is physical market stress, not speculative chatter.

A sustained premium + backwardation means:

Traders are paying more now for physical delivery, not futures claims.

Premiums persist because physical is scarce and demand is urgent — especially in China.

China’s pricing is now leading Western prices — the less‑distorted price signal.

Financial markets have been dominated by paper claims on synthetic returns.Scarcity in the real physical market signals that paper pricing mechanisms are breaking down — a key turning point in systemic repricing.

This is not cyclical — it’s structural.

When physical demand dominates paper, the market edges toward real valuation.

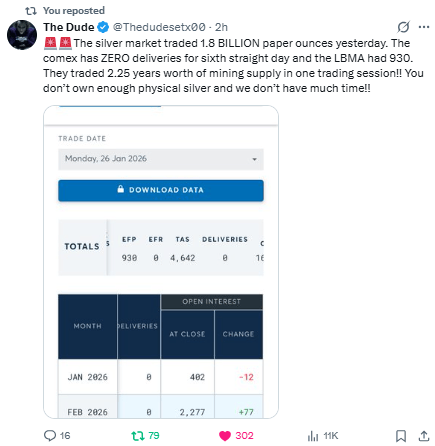

This is a narrative disconnect between:

Financial trading volumes (liquidity)

Physical deliverability (true supply)

Paper markets are trading massive volume while actual delivery is shrinking toward zero.

That’s a classic sign of dislocation — one of the earliest signs that the market is no longer anchored to fundamentals.

Debt super-cycles inflate paper claims.

Commodities super-cycles occur when those claims no longer correspond to real world assets.

This is exactly that: paper liquidity exists but cannot settle physically — meaning the market may soon force settlement via price discovery.

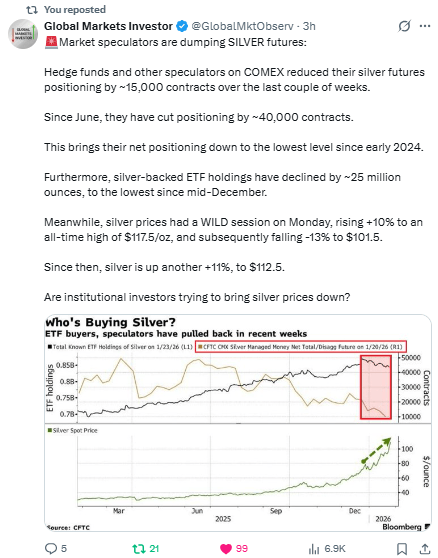

Short‑term financial players are spooked by volatility and market structure, not by fundamental supply/demand.

To smart money, this is a “shakeout” — weak hands exiting.

But institutional retreat now often precedes a structural inflection, as less sophisticated capital steps aside ahead of real price discovery.

Financial participants retrench first.

Capital then rotates to real assets.

Commodities go from “risk assets” to collateral anchors.

Speculator unloading is noise — the real signal is the divergence between capital flows and physical pricing.

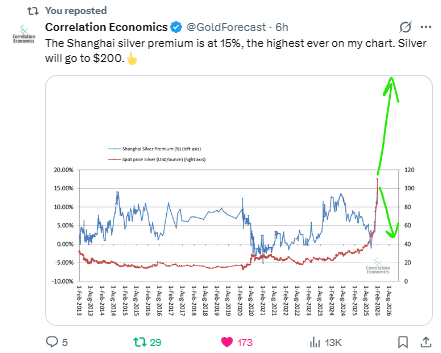

When the real global price (Shanghai) trades at a persistent premium to paper benchmarks (LBMA, COMEX), it indicates:

Paper markets are no longer credible reference points.

The market will ultimately price where real settlement occurs.

Arbitrage should eliminate that premium — but it isn’t, which means the arbitrage engine (physical movement of metal) is constrained.

Given global deficits and inelastic supply, the Shanghai premium doesn’t just exist — it must be absorbed into the global price over time.

Currency debasement and debt distress push capital to real goods.

Real commodities begin to anchor valuation.

When Eastern pricing begins to dominate, the West must follow — and the repricing overshoots in the direction of scarcity.

Registered inventories are the deliverable physical against futures.

Large withdrawals are not “paper moves” — they’re actual metal changing custody.

This is consistent with:

Premiums widening.

Physical shortages.

Backwardation continuing.

When inventory burns off, price discovery is forced upward.

Debt‑driven distortions create inventory draws, not just price moves.

That’s the genuine commodity squeeze born from structural deficits, not cyclical fluctuations.

This is the clearest confirmation yet of paper claims outrunning physical backing.

Unallocated contracts — which are promises against metal that isn’t set aside — are trading at discounts because they literally cannot be delivered into physical metal with certainty.

This is a collapse of the paper collateral layer beneath silver markets — a structural failure of the financial plumbing.

Debt super-cycles mask underlying scarcity via paper instruments.

When the base layer (debt) fails — when paper claims no longer represent real metal — markets must reprice physical scarcity instead of credit illusions.

This is exactly what a commodities super-cycle onset looks like.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply