- The Sovereign Signal

- Posts

- Silver Primed To Head Towards $70 & Eventually Beyond $333 As Silver February Call Options Nearly Double And 9-Day Flag Formation Broken, Golden Fibonacci Extension Suggests $71 for SLV, Global Debt Reaches $345.7 Trillion - 310% of Global GDP

Silver Primed To Head Towards $70 & Eventually Beyond $333 As Silver February Call Options Nearly Double And 9-Day Flag Formation Broken, Golden Fibonacci Extension Suggests $71 for SLV, Global Debt Reaches $345.7 Trillion - 310% of Global GDP

Debt super-cycle, hard-asset rerate: with global debt at 310% of GDP and options flow torching the ceiling, silver takes the stairs two at a time—$70 first, then the long climb toward a three-handle.

Read: Flag broken, fuel lit.

Holding above the breakout = air pocket to ~$70 as stops flip and shorts scramble.

Thin float + fresh buyers = steeper, faster ramps; pullbacks get shallow and bought.

Translation: this isn’t hype—it’s mechanics.

Gold steadies; silver is in squeeze-mode.

Silver’s continued parabolic ascent (granted we can’t say over what time frame) will continue and shock all those who haven’t studied the fundamentals.

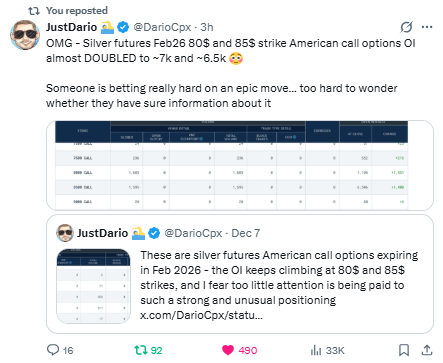

That jump in Feb-2026 $80/$85 American call open interest isn’t noise—it’s a siren.

Rough scale: the added open interest is about 13,500 COMEX call contracts, each covering 5,000 oz, so you’re looking at ~67.5 million ounces of upside exposure.

A simple yardstick is $1 per ounce of option premium ≈ $67.5 million in cash outlay.

For long-dated, far-OTM Feb ’26 $80/$85 calls, a reasonable premium is $1–$2/oz, which puts the spend around $70–$135 million.

That’s real money—pure conviction, not tourist flow.

Put differently: a player is signaling that deficits, export curbs, and policy easing won’t be solved by time; they’ll be priced.

The street is under-hedged to that path. If silver keeps grinding up, gamma flips, vega expands, skew steepens—and those calls become accelerants.

This is how quiet positioning turns into a visible squeeze.

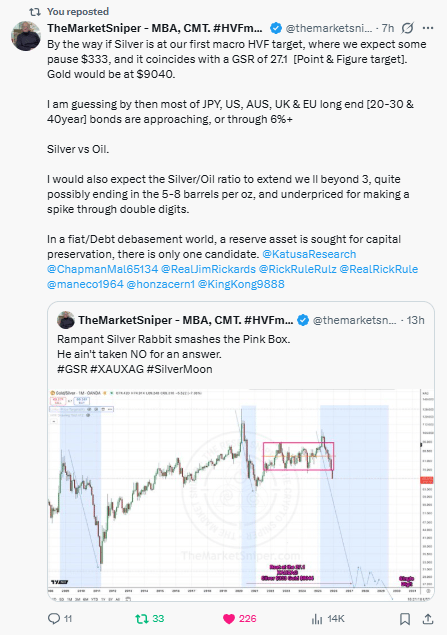

He’s mapping a full-blown revaluation of monetary metals into a debt-debasement world.

If silver hits his first macro target (~$333) with a gold/silver ratio near 27, gold would be ~$9,040—classic GSR compression you only see in regime shifts.

By then, he expects the long end of bonds near/above 6%, which screams debt stress → policy backstops → hard-money bid.

He also sees silver outperforming oil (silver/oil ratio rising to 5–8 bbl/oz), meaning industrial + monetary demand outpacing energy.

Read between the lines: the system chooses inflation over austerity, bonds revolt, and capital flees to base-layer collateral.

He’s saying the quiet part out loud: this “shortage” was baked in by decades of suppressed prices that starved new mines and flushed out weak hands.

You don’t conjure supply on a price pop—discoveries, permits, financing, and build-outs take years.

Meanwhile industrial demand is at records and silver has a fresh monetary bid.

To pry metal loose now, price must rise enough to overcome time, risk, and opportunity cost.

That’s why this move isn’t a fad; it’s the release valve on years of underinvestment meeting real-world scarcity.

A decade-long cup is breaking on monthly bars, volume is swelling, and the next clean magnet on a Fibonacci map sits near SLV ~$71.

If price holds above the neckline, you get air-pocket mechanics: shorts forced up the ladder, underweight funds chasing, and retail “silver bugs” piling in late.

That feedback loop—thin float, rising inflows, and dealers hedging—turns a breakout into a trend.

Translation: the big move is born on the monthly, not the minute; once it’s confirmed, it tends to run farther and faster than most are positioned for.

The gap between global debt and global GDP continues to exponentially increase.

Cutting off the debt hose would crash the stock market (leverage can’t go higher) and send the global economy reeling.

No major government will choose that.

What happens instead is the soft default we’ve used for a century: financial repression.

Policy rates cut below inflation, term premia capped with QE/YCC, liquidity facilities on standby, deficits financed at controlled yields, and periodic “temporary” programs that never quite end.

The debt stays; its real value is quietly shaved down.

Expect the by-products:

Inflation volatility (waves, not a straight line), with trend real yields pushed lower than a free market would allow.

Funding stress flare-ups that force fresh interventions.

Currency dilution and stealth capital controls (collateral rules, liquidity coverage tweaks, bank “guidance”) rather than overt bans.

Repricing toward scarce collateral: central banks keep accumulating gold; investors migrate up the hardness curve—gold for ballast, silver for torque, then copper/energy/metals tied to real build-out.

In short: the system won’t de-lever; it will rebase—by inflating away liabilities while revaluing the assets that can’t be printed.

Position accordingly.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply