- The Sovereign Signal

- Posts

- Silver Regains Monetary Metal Status in India • COMEX Gold delivery spikes • BIS-driven paper dumps • U.S. may be Selling Gold to Fund FX deals • Extreme Fear on a –1% day • U.S. debt hits $38T

Silver Regains Monetary Metal Status in India • COMEX Gold delivery spikes • BIS-driven paper dumps • U.S. may be Selling Gold to Fund FX deals • Extreme Fear on a –1% day • U.S. debt hits $38T

These figures sketch a leverage-soaked system rotating back to hard collateral. Policy is re-monetizing silver and gold, why paper slams don’t cure physical scarcity, and how mounting funding stress channels flows into the base layer—setting up asymmetric upside in metals and violent squeezes ahead.

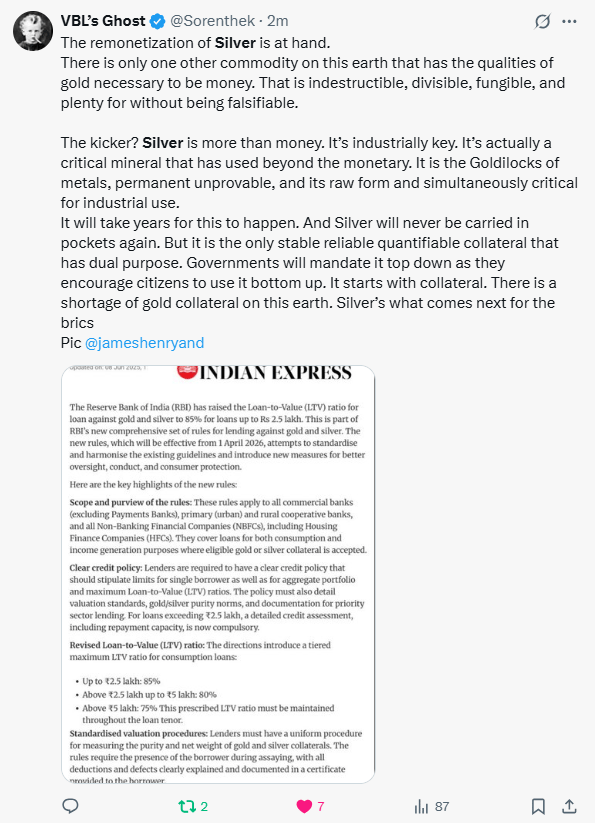

Silver just crossed from “shiny metal” to money-like collateral—and that changes everything.

India is letting banks lend against silver (alongside gold) with clear LTV rules. In a world drowning in LEVERAGE, making silver acceptable collateral does three big things at once:

Turns bars into balance-sheet assets: banks, businesses, and households can now pledge silver for credit → new, persistent demand that locks metal away.

Shrinks the tradable float: more bars sit in vaults backing loans → less supply for futures/ETFs → bigger moves on small buys.

Validates the “monetary” role: governments are effectively saying silver is a reliable, standardizable store—and unlike gold, it’s also industrial, so demand is two-engine (monetary + factories).

Zoom out: there’s a global shortage of top-tier collateral. If BRICS nations can’t source enough gold, silver is next in line—divisible, fungible, hard to fake. Policy tends to spread: once one big player upgrades silver to collateral, others copy.

Net: This is re-monetization by regulation. In a max-leveraged system, collateral is king—so making silver collateral is structurally bullish and squeezes the float. Small real bids can now move price a lot.

COMEX is flashing the tell you can’t fake: people are taking bars, not rolling paper.

Those spikes in “deliveries” mean buyers are showing up at the futures market and saying, “Don’t cash-settle me—hand me the gold.”

In a highly levered system, that’s huge: every bar that leaves the warehouse shrinks the cushion behind mountains of paper claims.

Less cushion → bigger moves → higher funding stress for shorts. Pair that with central-bank buying and tight float, and you get a market where dips are rented, metal is owned.

When players demand delivery in size, price discovery shifts to the side with atoms, not algorithms—and that’s bullish for gold (and by reflex, silver).

If this rumor’s right, here’s the playbook in plain English:

A big seller (Argentina) offloads gold through the BIS during thin European hours.

That floods paper markets, triggers momentum algos, and the herd piles on short—so you get the dramatic “air-pocket” dumps in gold and silver.

But that’s leverage theater, not a surge of real metal. Physical tightness didn’t change in an hour: backwardation/lease stress, ETF creation limits, and vault drawdowns say supply is still scarce.

When shorts crowd in on borrowed chips, bounces force buy-backs—and the snap-backs get violent. Coordinated/large paper waves can paint the tape, but they can’t mint bars.

In a world this levered, those slams are opportunities: they move price more than fundamentals, and the tighter the physical, the harder the rebound.

Signal | Latest Level | Interpretation | Zone |

|---|---|---|---|

10-Year Swap Spread | −16.83 bps | Still negative → collateral premium for swaps over cash Treasuries; credit/funding tension persists. | 🟠 Orange |

3-Year SOFR–OIS | 30.25 bps | Elevated/waning-liquidity tell—mid-term funding stress. | 🔴 Red |

UST–JGB 10-Year | 2.328% | Wide trans-Pacific gap; fuels global basis/carry distortions. | 🟠 Orange |

Reverse Repos (RRP) | $4.005B | Safety valve still near empty—little spare cash buffer. | 🔴 Red |

USD/JPY | 152.73 | Carry trade supercharging while global leverage continues making new records. | 🔴 Red |

USD/CHF | 0.7983 | Bid for “hardest fiat” persists. | 🔴 Red |

SOFR Overnight | 4.23% | Jump back up—overnight funding stress returning. | 🟠 Orange |

SOFR-VOL (o/n usage) | $2.957T | Heavy reliance on overnight pipes to keep markets greased. | 🟠 Orange |

SLV Borrow Rate | 6.13% (3.7M avail., −2.02% rebate) | Cheaper & more borrow available vs. peak → some short pressure relief, still elevated. | 🟠 Orange |

COMEX Silver Registered | 168.81M oz | Deliverable stock keeps bleeding—tight physical. | 🔴 Red |

COMEX Silver OI | 123,375 | Positioning lighter—de-leveraging after volatility. | 🟡 Yellow |

COMEX Silver Volume | 166,101 | Active but off extremes—price discovery choppy. | 🟠 Orange |

GLD Borrow Rate | 0.60% (7.7M avail., 3.51% rebate) | Easier to borrow—lending looser than recent squeeze. | 🟡 Yellow |

COMEX Gold Registered | 20.01M oz | Thin but steady; still a tight base layer. | 🟠 Orange |

COMEX Gold Volume | 507,114 | Heavy turnover—strong monetary bid/two-way flow. | 🟠 Orange |

COMEX Gold OI | 464,151 | Elevated commitment; macro hedging alive. | 🟠 Orange |

Japan 30-Year | 3.084% | BOJ boxed in; long-end stress elevated. | 🔴 Red |

US 30-Year | 4.579% | Long end still pricey funding; risk-asset duration sensitive. | 🟠 Orange |

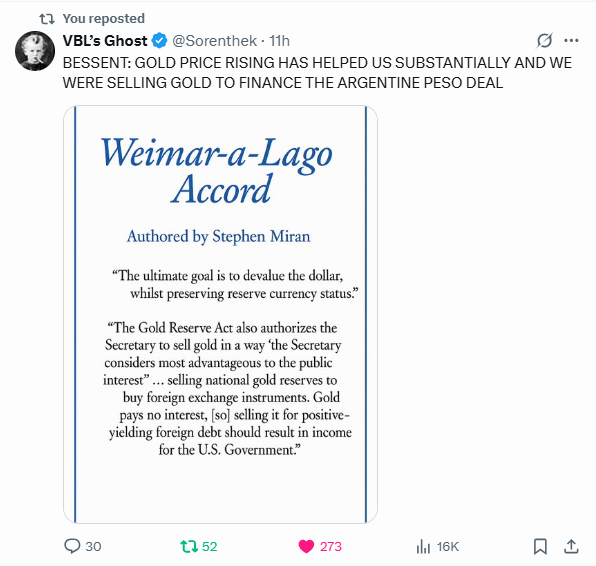

What this really says: gold is now a policy tool—on purpose.

Rising gold “helped us,” and they sold gold to fund the Argentina peso deal.

Translation: Washington is willing to use the nation’s bullion like a liquidity sponge—let gold reprice up (quiet dollar devaluation), then swap a slice into interest-bearing foreign assets to grease geopolitics.

That’s not bearish; it’s an admission. In an over-levered world, higher gold shrinks real U.S. debt and buys policy room without saying “QE.” Selling into strength is recycling, not capping: every ounce that leaves Western coffers gets absorbed by buyers who don’t resell.

Float tightens, price leadership migrates to the side with atoms. Financial warfare is collateral warfare. If the U.S. is openly managing with gold while China/EM keep hoarding, the base layer is being re-rated. Leverage trembles; gold (and monetary silver) gain structural bid.

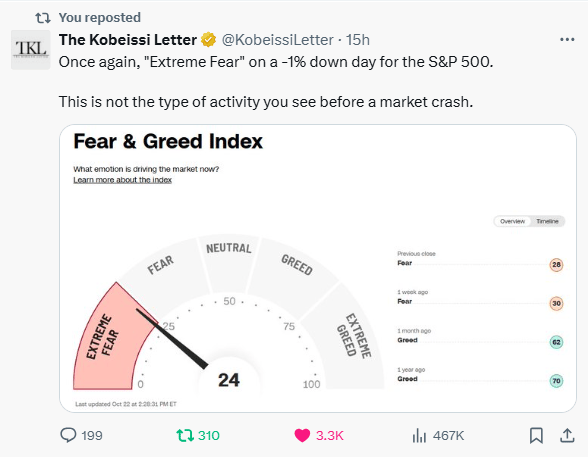

Extreme Fear on a –1% day = a market wired with gasoline.

If a tiny dip triggers panic, it means positioning is maxed on leverage and liquidity is thin—small shocks now cause outsized emotion and, soon, outsized moves.

That’s not “imminent crash” certainty; it’s fragility math: crowded longs, short-vol carry, and buy-the-dip habits colliding with higher funding costs.

In fragile regimes, correlations jump toward 1 and sellers must sell anything—which is why fear spikes before the price damage shows.

Positive read-through: when paper gets twitchy, capital hunts real collateral; that flow tailwind favors base-layer assets (gold/monetary silver) whose scarcity is already flashing in spreads and leases.

Translation: emotions are loud because balance sheets are tight—own what doesn’t need anyone’s promise.

$38T isn’t just a headline—it’s a regime.

Debt is compounding faster than growth, so the system must sell ever more bonds just to stand still.

More supply → higher rates or more balance-sheet tricks; either way, liquidity thins and leveraged assets wobble.

When funding stress rises, markets demand better collateral—not more promises. That’s why central banks keep adding gold and why silver’s scarcity keeps showing up in spreads, lease, and backwardation.

Positive read-through: The greatest wealth transfer in history is gaining steam. The more the world leans on leverage to paper this over, the more valuable base-layer assets become; small allocation shifts can push gold and monetary silver a long way.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply