- The Sovereign Signal

- Posts

- Silver's Dislocation Points To A Market That's Breaking, 17.5M Ounces Claimed For Physical Delivery in First 4 Days Of February on COMEX Against Just 104M Ounces of Available Inventory

Silver's Dislocation Points To A Market That's Breaking, 17.5M Ounces Claimed For Physical Delivery in First 4 Days Of February on COMEX Against Just 104M Ounces of Available Inventory

Spot down over 12% this morning while the world is literally running out of silver. What a joke.

Sorenthek — “Silver WTF / Dislocation”

Western (COMEX) prices are lower, while London and Shanghai show strength in physical demand — not speculative price chasing.

The imbalance means paper selling is being absorbed by real physical buying.

Leverage is unwinding — not just in silver, but across markets — which is exactly what happens when a debt‑heavy regime begins collapsing synthetic claims.

The market isn’t broken — the price discovery mechanism is.Paper markets can crash prices, but they can’t stop physical accumulation when participants stop trusting leveraged claims.

That’s the beginning of a collateral swap, not a bubble unwind.

DarioCpx — Delivery Notices (17.5m oz)

What’s being said between the lines:

In the first 4 days of February, 3,500+ delivery notices (≈17.5 million oz) were issued and accepted for physical silver.

That’s an unprecedented level of real delivery demand right after a price smash.

Meanwhile there are only ~104 million oz left registered on COMEX.

That’s not retail “panic buying.”

That’s institutional conversion of paper contracts into metal.

It’s the system’s plumbing showing stress cracks — people want atoms, not claims.

When delivery notices pop this fast, the marginal value of physical rises faster than paper can reflect it.

Karel Mercx — Silver as critical industrial metal

Reinforces that silver isn’t just money or speculation — it is essential to modern technology (conductivity, semiconductors, EVs, energy infrastructure).

Policy recognition (e.g., U.S. calling silver critical) matters because governments act on real strategic scarcity, not just markets.

This is exactly what happens when the economy shifts from financial claims to real resource needs.Silver’s role in technology gives it intrinsic, non‑cyclical demand — a rare property in commodities.

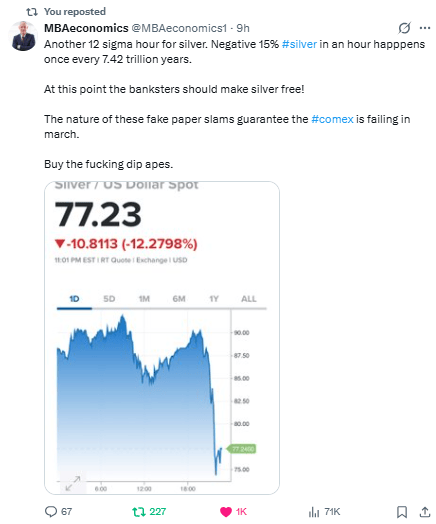

The magnitude and velocity of that silver price move — dubbed a "12-sigma" event — mathematically implies it should happen once every few trillion years.

That alone tells you this wasn't a natural market dislocation. It was more than likely engineered.

Here’s what’s really happening beneath the surface:

🎯 Not Organic – It Was a Volatility Weapon

Massive price slams like this aren’t caused by natural selling.

They’re typically coordinated dumps in thin liquidity to trigger stops, margin calls, and force liquidations.

The effect?

Push paper price down → spook weak hands → accumulate physical from panic sellers.

But it backfired. Why?

🧱 Because the Market Is Shifting to Physical

When trust in the collateral layer breaks, paper price slams aren’t deterrents — they become buy signals for institutions, sovereigns, and retail stacking physical.

That’s why record delivery notices and vault drain followed this “sigma” slam — not selling.

🔁 It’s Not a Breakdown – It’s a Transition

Paper markets tried to enforce an old regime of synthetic price discovery via leverage.

But this event exposed the underlying fragility of that system — and physical accumulation is now the response.

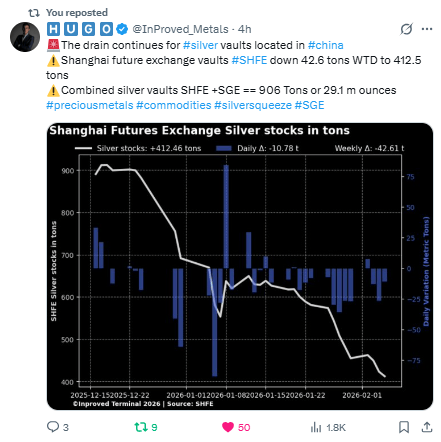

SHFE Inventory Drain

SHFE+SGE physical stocks are now ~906 tons (~29.1m oz), and dropping daily.

This physical drawdown is happening while paper prices are volatile.

Physical is moving from West → East, from paper → possession.That’s not typical supply/demand — it’s a transfer of collateral from less trusted holders to those who trust physical assets.

State of Wyoming Buying Physical Gold + Private Vault

A U.S. sovereign subunit is refusing to use big bank custody (e.g., JP Morgan) and storing physical precious metals independently.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply