- The Sovereign Signal

- Posts

- 💥Silver’s London Lease Rate Erupts to 39% as Global Bullion Plumbing Fractures

💥Silver’s London Lease Rate Erupts to 39% as Global Bullion Plumbing Fractures

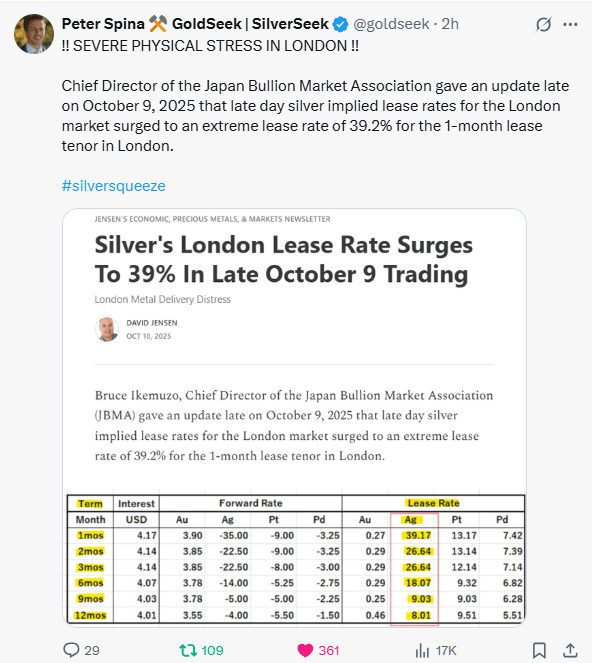

London’s 1-month silver lease rate hit 39.2% on October 9 — a level unseen in modern history, signaling extreme collateral scarcity. At the same time, the LBMA’s free-float silver stock fell –884 tonnes in September, leaving just 3,429 tonnes of deliverable metal. In Shanghai, JD.com sold out silver at $59/oz, while the SGE vaults hemorrhaged 44,595 kg in one week. To contain the volatility, the CME hiked silver margins 9.3% and gold 5.8%, forcing paper traders to deleverage just as physical demand detonated. Meanwhile, the yen’s collapse threatens to unwind the global carry trade that underpins this entire system.

A 39% 1-month London silver lease rate with a sharply lower 12-month (~9%) is an inverted, siren-red curve.

Translation: near-term wholesale bar scarcity—not retail coins—inside London’s good-delivery system.

Holders won’t part with bars unless they’re paid a ransom, which means bullion-bank collateral is tight now.

Why it matters—mechanics, not memes:

Backwardation trigger.

Forward price ≈ Spot + (interest – lease). When lease ≫ interest, forwards slip below spot.

The classic “short-and-carry” breaks; hedges and synthetic shorts become cash-bleeders → forced spot buying.

Delivery chain stress.

ETF share creation can stall while redemptions pull bars; EFPs can blow out; refiners and industrials pay up for immediate metal.

Retail shelves can look fine while the 1,000-oz bar market starves.

Squeeze dynamics.

This structure punishes shorts and rewards whoever sits on real bars.

If the inversion persists, you risk cash-settlement games, delivery delays, and violent price gaps.

Tactical read:

Own the thing, not the story (allocated/segregated beats IOUs).

Basis plays favor long near-dated / short deferred expressions or calls up front, but avoid naked shorts: carry is your enemy.

Expect volatility spikes—stress events don’t resolve with gentle music; they resolve with air pockets.

Bottom line: a 39% front-end lease rate is the market shouting, “I need bars today.”

That’s not sentiment; that’s plumbing—and plumbing moves prices when narratives are still arguing.

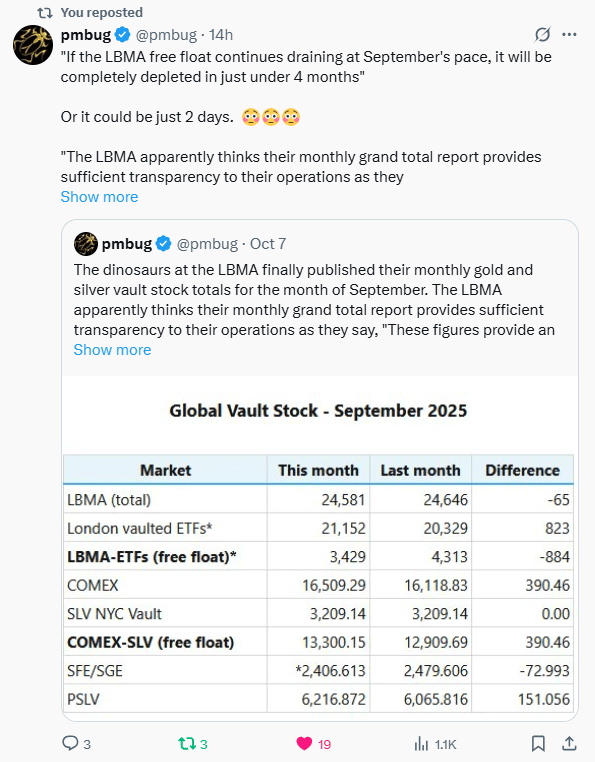

Only 3,429 tonnes of “free float” silver remain in London—the metal not locked inside ETFs or long-term custody.

That’s the blood in the veins of global settlement. And it’s draining fast: –884 tonnes in one month.

At this burn rate, the tank runs dry in under four months—but if panic hits, two days could do it. This isn’t inventory; it’s oxygen.

Every ounce leaving the system tightens the noose on paper promises stacked 100 to 1 above it.

When the “free float” goes, so does the illusion of liquidity. At that point, lease rates explode, EFPs fracture, and COMEX becomes a cash-settlement machine.

This is the silent bank run of sound money—a countdown to metallic truth.

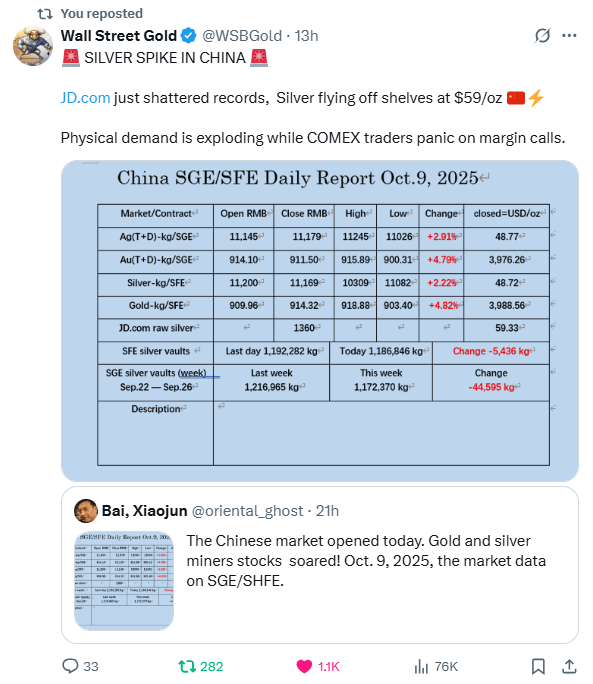

Silver’s ripping off JD.com shelves at $59/oz while the Shanghai vaults bled 44,595 kg in a week. That’s not speculative churn—that’s physical flight.

COMEX traders are choking on margin calls while Chinese buyers vacuum up what’s left of real metal. The East is cashing in paper illusions from the West, converting promises into atoms.

When Shanghai premiums scream and London lease rates detonate, it’s not coincidence—it’s the East–West arbitrage of truth. Paper silver burns; physical silver moves. And right now, it’s moving East.

⚠️ Liquidity & Funding Stress

Signal | Latest Level | Interpretation | Zone |

|---|---|---|---|

10-Year Swap Spread | −20.07 bps | Still deeply negative — the collateral premium remains extreme; dealers continue to prefer synthetic exposure over real Treasuries. | 🟠 Orange |

Reverse Repos (RRP) | $4.496 B | Collateral buffer now razor-thin — the Fed’s balance-sheet pressure valve is seconds from dry. | 🔴 Red |

USD/JPY | 152.73 | Yen intervention line obliterated — Treasury liquidation risk flashing red. | 🔴 Red |

USD/CHF | 0.8061 | Hovering near sub-0.81 — capital quietly rotating to hard-collateral safe zones. | 🟠 Orange |

3-Year SOFR–OIS Spread | 25.45 bps | Slight pullback from extremes but stress persists; cracks spreading through the front-end funding layer. | 🔴 Red |

SOFR Overnight Rate | 4.12 % | Stability improving slightly — mild easing in liquidity compression. | 🟡 Yellow |

SOFR VOL | $2.924 T | Massive interbank funding volume — markets still running hot to maintain basic flow. | 🟠 Orange |

🪙 Gold & Silver Market Stress

Signal | Latest Level | Interpretation | Zone |

|---|---|---|---|

SLV Borrow Rate | 12.19 % (15 K shares avail, −8.09 % rebate) | Borrowing at crisis levels — synthetic shorting smashing into a wall of physical scarcity. | 🔴 Red |

COMEX Silver Registered | 186.51 M oz | Big drop — deliverable supply vanishing; the physical floor is caving in. | 🔴 Red |

COMEX Silver Volume | 220,062 (HOLY SH*T — MORE THAN DOUBLED FROM YESTERDAY) | Unprecedented surge — violent repositioning as liquidity floods into real collateral. | 🔴 Red |

COMEX Silver Open Interest | 169,738 | Rising again — short side under pressure as conviction builds in the physical trade. | 🟠 Orange |

GLD Borrow Rate | 0.50 % (3.2 M shares avail, 3.6 % rebate) | Tightening modestly — institutional accumulation continuing steadily. | 🟡 Yellow |

COMEX Gold Registered | 21.65 M oz | Stable but thin — physical backing still razor-tight. | 🟠 Orange |

COMEX Gold Volume | 514,387 (HOLY SH*T) | Explosive repositioning — institutions sprinting toward real collateral. | 🔴 Red |

COMEX Gold Open Interest | 486,374 | Slight dip from highs — conviction remains strong as metals reclaim monetary primacy. | 🟠 Orange |

🌍 Global Yield Stress

Signal | Latest Level | Interpretation | Zone |

|---|---|---|---|

UST – JGB 10-Year Spread | 2.415 % | Still wide and sticky — Japan’s bond-market dysfunction bleeding into global funding channels. | 🟠 Orange |

Japan 30-Year Yield | 3.192 % | Yield-curve control breaking again — BOJ printing to defend the indefensible. | 🔴 Red |

U.S. 30-Year Yield | 4.688 % | Long-end repricing hard — collateral layer shaking as global liquidity contracts. | 🟠 Orange |

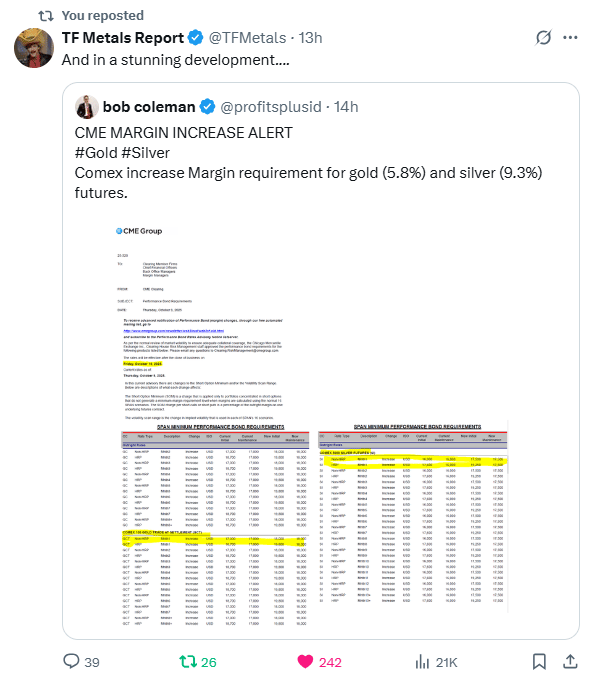

The CME just pulled the oldest trick in the book—raising margins mid-squeeze.

A 9.3% hike on silver and 5.8% on gold forces traders to post more collateral right as volatility detonates.

It’s a forced deleveraging—paper exposure collapses, liquidity drains, and only the strongest hands remain.

But here’s the irony: by crushing leverage, the CME strips away the paper fog that was masking true physical tightness.

When the dust clears, demand doesn’t vanish—it concentrates. Fewer players, same hunger, less metal. They’re trying to douse the fire, but all they’ve done is blow oxygen straight into the core.

The yen is cornered—either the Bank of Japan raises rates and detonates the world’s largest bond market, or it holds the line and lets the currency unravel.

Both paths lead to chaos: one implodes debt, the other ignites inflation.

For decades, Japan has been the shock absorber of global liquidity—borrowing in cheap yen to fund everything from U.S. tech to emerging-market carry trades.

But when the absorber snaps, the energy doesn’t vanish—it ricochets through the entire system.

If the yen breaks, the domino isn’t local—it’s planetary. Treasury yields would spike, derivatives would convulse, and gold would surge as faith in fiat fractures. The world’s fourth-largest economy is now the weakest link in the financial chain—and the chain is starting to smoke.

When Japan’s officials start talking about “one-sided moves,” it’s code for panic under the surface.

The Ministry of Finance is watching a currency free-fall, and words are their cheapest weapon before they start burning dollars to defend the yen.

But verbal intervention only works when markets still believe. If traders call the bluff, the next step is massive yen-buying—Treasury liquidation.

That means collateral flight, global yield spikes, and liquidity convulsions rippling straight into the West. This isn’t noise—it’s the opening act of a potential sovereign defense crisis.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply