- The Sovereign Signal

- Posts

- Silver's Multi-Year Structural Deficit Finally Forcing Price Higher, Silver Price Trading 7.55% Higher In China, Chinese Silver Inventories Getting Critically Low, COMEX Silver Longs Were Halved From September to December

Silver's Multi-Year Structural Deficit Finally Forcing Price Higher, Silver Price Trading 7.55% Higher In China, Chinese Silver Inventories Getting Critically Low, COMEX Silver Longs Were Halved From September to December

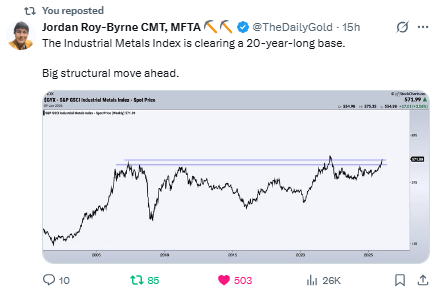

Industrial Metals Index is clearing a 20 year base. Who could’ve guessed the biggest commodities super-cycle would follow the biggest global debt binge?

Silver’s not rising on hype — it’s the 5th straight year of a structural deficit.

That means real demand keeps crushing supply.

Spot > futures, lease rates ripping, and margin hikes can’t cool it — because this isn’t a trader’s game.

It’s the beginning of a physical squeeze.

Silver just hit ¥20,000 in Shanghai (Jan 6th) — that's $89/oz in China vs $82.75 in the West.

For the 5th year straight, silver's in structural deficit — and China, driven by real physical demand, is now setting the pace.

Western futures are lagging, but the squeeze is global.

The East is bidding up real metal. The West is still pretending it's paper

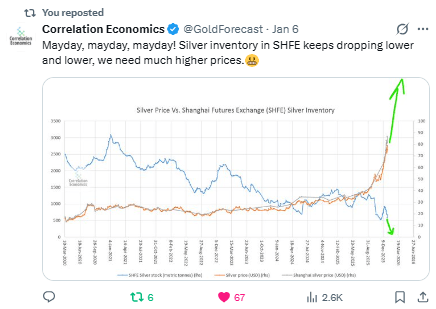

Shanghai silver inventories are falling off a cliff — and price is vertical.

This is what a structural deficit looks like in real time: 5 years of demand outrunning supply, and now the physical metal’s vanishing.

China’s bidding up what’s left.

The West’s paper price is lagging behind.

Silver’s not cheap — it’s mispriced.

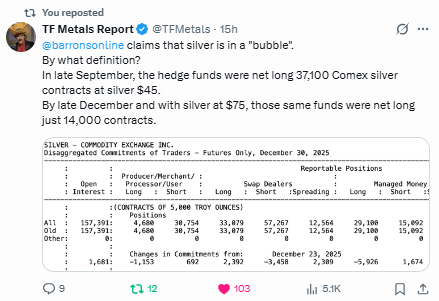

They’re calling it a bubble — but big money’s not even in the room.

Funds halved their exposure while silver ran from $45 to $75.

Shanghai’s paying $89.

Inventories are vanishing.

This isn’t euphoria. It’s a fire alarm in an empty building.

They say silver's in a bubble — meanwhile, JPM just dumped 5 million ounces into a rising market.

That's not profit-taking.

That’s panic-selling metal to meet demand.

SLV should be adding inventory on a price spike — not bleeding it.

The system’s stressed, and the vaults are thinning out.

This isn’t greed driving the price up.

It’s scarcity forcing price discovery higher.

The breakout from a 20-year base in the industrial metals index is a major technical and macroeconomic signal — and here's why it matters:

1. 20-Year Base = Generational Setup

A base that takes two decades to form isn’t noise — it’s accumulation on a historic scale.

When an asset class clears such a long-term ceiling, it often leads to massive, sustained moves.

Think commodities in the early 2000s or tech stocks post-2013.

This isn’t a short-term rally.

It’s the start of a new super-cycle.

2. Broad-Based Repricing of Real Assets

Industrial metals aren’t just about speculation — they’re tied to real-world production, infrastructure, electrification, and defense.

A breakout in the index signals:

Rising global demand

Secular underinvestment in supply

A shift away from paper and toward tangible assets

Silver, being both industrial and monetary, sits right at the heart of this shift.

3. Context: The Silver Squeeze

Layer this breakout onto what we already see in silver:

Spot price surging in Asia

Vaults bleeding metal

Funds still under-positioned

Silver is not moving in isolation — it’s being pulled higher by a broader macro trend.

That makes it not just credible, but inevitable.

Who could’ve guessed the biggest commodities super-cycle would follow the biggest global debt binge?

Now the U.S. wants to buy Greenland.

Not for tourism — for it’s location and what's in the ground.

Industrial metals are breaking out.

Silver’s vanishing from vaults.

Paper prices are cracking under real-world stress.

This isn’t just about markets anymore.

It’s about resources — and who controls them when the monetary curtain falls.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply