- The Sovereign Signal

- Posts

- Silver's Paper War: Who’s Really Winning on the COMEX Battlefield?

Silver's Paper War: Who’s Really Winning on the COMEX Battlefield?

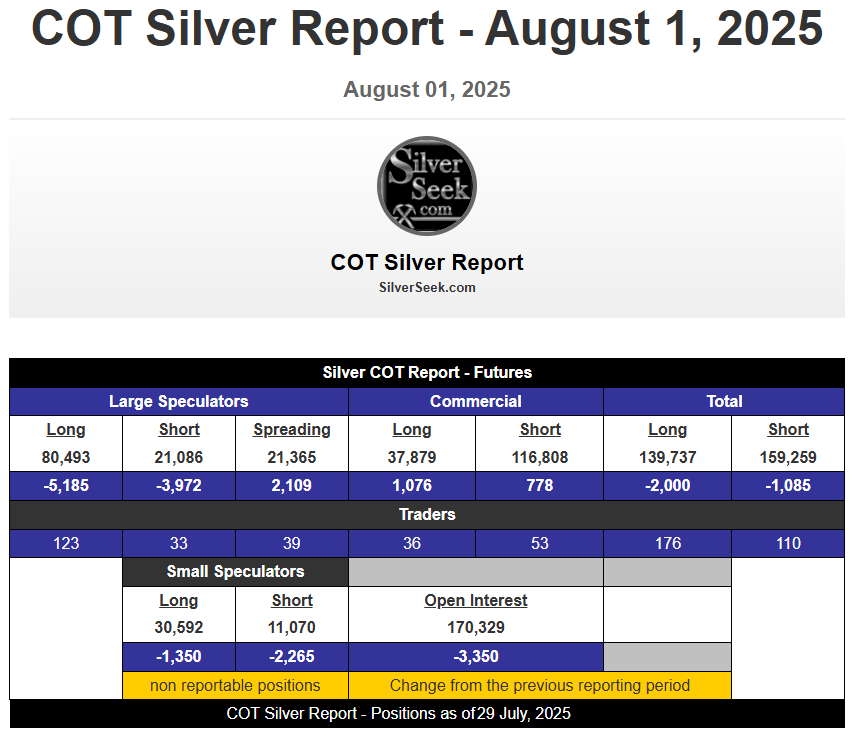

As silver consolidates near 14-year highs, the COT report reveals a deeper war beneath the price—commercials defending fragile short walls, speculators tactically repositioning, and volatility traders dumping options as liquidity tightens. This isn’t just a rally. It’s a structural shift on the world’s most transparent battlefield for precious metals.

At first glance, the COT Silver Report reads like a tug-of-war frozen in motion—specs, commercials, and small players all shifting positions like tectonic plates beneath the price.

…only the COMEX (Silver COT report) gives us the visibility to dissect who is pressing where, how hard, and what the battlefield looks like beneath the surface.

WHO’S WHO ON THE COMEX BATTLEFIELD

1. Commercials

Who they are:

Bullion banks (e.g. JPMorgan, HSBC)

Refiners, wholesalers, industrial hedgers

Occasionally large sovereign-backed entities hedging flows

What they do:

Mostly short by design (selling futures to hedge real-world exposure or leasing programs)

They often lease physical silver and use futures to hedge it, or hold forward contracts for delivery

Why they matter:

They set the tone of the COMEX—they’re insiders with access to physical flows. When commercials reduce shorts, it signals tightening supply or rising physical risk.

2. Large Speculators

Who they are:

Hedge funds

Leveraged macro funds

Algorithmic/momentum traders

Commodity Trading Advisors (CTAs)

What they do:

Chase trends and technical breakouts

Don’t hold physical—this is all paper trading

Typically net long in bullish cycles, net short in bear phases

Why they matter:

They’re the momentum force. If they pile in, it creates feedback loops (e.g. silver short squeezes). Their positioning shifts fast, so rising longs = growing bullish sentiment.

3. Small Speculators

Who they are:

Retail traders

Small-time metals funds

Family offices, newsletter crowd, long-term bulls

What they do:

Mostly net long

Prone to emotional swings

Usually enter late in the trend and exit early in corrections

Why they matter:

They’re the sentiment gauge. If they’re exiting while price rises (like in this COT), it can signal smart money is buying their fear.

Signal | Latest Level | Interpretation | Zone |

|---|---|---|---|

10-Year Swap Spread | –24.11 bps | The fracture deepens. This is synthetic capital refusing to trust sovereign collateral. Disbelief in the base layer remains entrenched. | 🟠 Orange |

Reverse Repos (RRP) | $97.426B | Sustained below $100B = watch out. | 🔴 Red |

USD/JPY | 147.70 | Watch out if this goes below 140 or above 160. | 🟠 Orange |

USD/CHF | 0.8083 | The Franc holds firm. Quiet capital is flowing into Switzerland’s neutrality—an old reflex in times of fracture. | 🟠 Orange |

3-Year SOFR–OIS Spread | 30.6 bps | Interbank term stress is spiking. Perception of mid-term funding stress is increasing. | 🔴 Red |

SOFR Overnight Rate | 4.39% | A 7 bps spike overnight is not incredibly rare but not a good sign. This rate is the hidden heartbeat of stress for global liquidity. | 🟠 Orange |

SOFR Daily Volume | $2.93T | Monstrous. Demand for overnight funds is near all time high. | 🔴 Red |

SLV Borrow Rate | 0.70% (6.4M shares avail.) | If borrow rate goes up and available shares go down, squeeze is on. | 🟡 Yellow |

COMEX Silver Registered | 191.58M oz | With 160K OI, only ~22.8% of contracts could be settled physically. A paper overhang on a tight vault. | 🟠 Orange |

COMEX Silver Volume | 75,097 | Trading activity picking up into strength. Paper players are making bets. Someone is trying to front-run the next move. | 🟡 Yellow |

COMEX Silver Open Interest | 160,088 | OI rising alongside price. The leverage ratio (~4.3:1) implies growing conviction—but also risk of unwind if challenged. | 🟠 Orange |

GLD Borrow Rate | 0.44% (4.7M shares avail.) | Still subdued. No breakout tension in paper gold—yet. But the crowd that moves early is starting to stir. | 🟢 Green |

COMEX Gold Registered | 21.16M oz | With 441K OI, vault coverage at ~4.79:1. Better than silver, but signs of tightening persist. | 🟡 Yellow |

COMEX Gold Volume | 269,844 | Volume surging. Someone's rebalancing big. This isn't random—it's a move telegraphing systemic shift. | 🟠 Orange |

COMEX Gold Open Interest | 441,731 | Stable, but large. Implied leverage is contained—for now. Still watching for directional flip. | 🟠 Orange |

UST–JGB 10Y Spread | 2.741% | Watch out if this gets and stays above 3% and pushes towards 3.5% | 🟠 Orange |

Japan 30Y Yield | 3.107% | Near all time highs. The bond market is revolting against monetary repression. BoJ faces a crisis in slow motion. | 🔴 Red |

US 30Y Yield | 4.846% | Structurally correlated to rising Japan 30Y Yield. | 🟠 Orange |

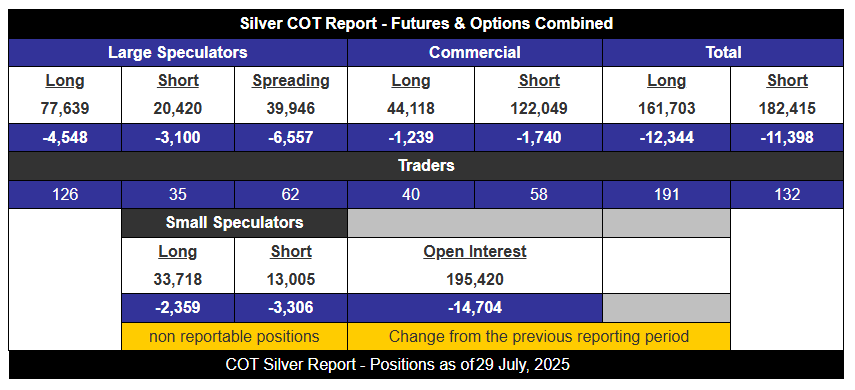

Futures-Only vs. Futures + Options: Why the Numbers Diverge

credit to Silverseek.com for the above image

Here's where it gets interesting.

FUTURES ONLY

Reflects directional commitment

Everyone in this pool is taking a price bet (long or short)

It's the cleanest measure of who thinks silver is going up or down

More transparent. Easier to interpret.

FUTURES + OPTIONS COMBINED

Example: a commercial may sell calls and hedge with futures

Includes delta-neutral hedgers, option writers, and volatility bets

A CTA might buy out-of-the-money puts as tail hedges even while net long futures

It muddies the waters:

Commercials may have offsetting positions across both instruments

A speculator may appear “short” due to put exposure, but is actually bullish if it’s a hedge

Biggest takeaway:

Open Interest dropped sharply in the combined report → Options volume unwound fast

Spreading positions declined by 6,557 → Speculators closed volatility trades, not added them

Spec longs fell faster in F+O than futures-only → Funds likely ditched spread trades or added protective hedges.

This suggests last week’s surge wasn’t just a clean directional breakout—it was a volatility reset, where complex positions were unwound and liquidity thinned, setting the stage for a more focused battle between momentum funds and increasingly exposed commercials.

Summary: Who vs. Who, and Why It Matters

Small Specs = Retail hands getting flushed, as the real fight begins

Commercials = House dealers defending a fragile wall of paper shorts tied to physical scarcity

Large Specs = Tactical sharks testing that wall for cracks, especially when open interest drops and price jumps

Futures-only shows conviction. Futures + options shows hedging behavior, tactical noise, and volatility pressure.

Silver is rising not just because people are going long, but because risk is shifting across the structure of the entire COMEX ecosystem. That’s the real signal.

Silver isn’t just another metal—it’s the pressure release valve for 50+ years of debt-soaked distortion. The COMEX battle has only just begun. And when the most shorted commodity breaks its 1980 all-time high, the illusion cracks. What follows will not be gradual. It will be explosive.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

When collateral means trust—and trust is visibly cracking across the COMEX and interbank markets—the wise don’t wait. They reposition before the dam breaks. Sovereignty isn’t a luxury. It’s the exit door before the flood. Move now—before headlines chase the real story.

Luke Lovett

📲 Cell: 704.497.7324

🌐 Undervalued Assets | Sovereign Signal

📧 Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply