- The Sovereign Signal

- Posts

- Silver’s Pressure Cooker: When Collateral Runs Thin and Paper Shorts Bleed

Silver’s Pressure Cooker: When Collateral Runs Thin and Paper Shorts Bleed

RRP’s wafer-thin Treasury cushion, SLV’s 95% borrow supply collapse, and a COT battlefield where commercials just surrendered — why the market’s next move could detonate faster than headlines can catch up.

This isn’t just about who’s long or short—every layer of the silver market is compressing at once.

Collateral buffer (RRP) is thinning: $80.303B at the Fed, sub-$100B in 5 of the last 6 sessions.

That’s a wafer-thin Treasury cushion for the funding system.

ETF borrow supply (SLV) is collapsing: 0.93% CTB with ~300k shares to borrow today vs 0.70% CTB and 6.4M shares a week ago — a 95.3% collapse in lendable supply in seven days.

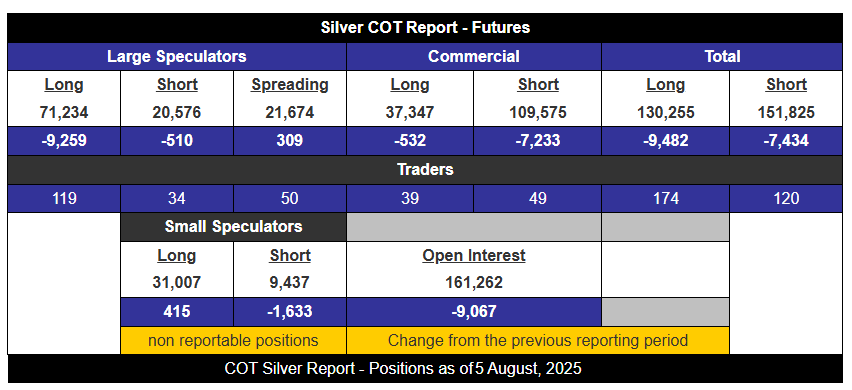

Paper pressure (COT) shifted hard: Commercials covered aggressively (–7,233 futures shorts; –6,979 futures + options).

Large specs took profits, slashing –9,259 futures longs (–9,114 on futures + options) while barely trimming shorts and adding ~3.47% more spreads.

Put together: every incremental short bet just got costlier to put on and riskier to hold. The last time RRP sustained a break below $100B while SLV borrow tightened like this was February 2025—and within weeks the March–April selloff hit. Different catalysts, same underlying stress.

What to watch this week

SLV borrow: Do costs hold/rise while borrowable shares stay scarce or fall further?

RRP: Does it remain < $100B (collateral cushion thin), or rebound (pressure eases)?

Signal | Latest Level | Interpretation | Zone |

|---|---|---|---|

10-Year Swap Spread | –26.6 bps | Either a major aversion to holding physical treasuries or a lack of liquidity in Treasuries. | 🔴 Red |

Reverse Repos (RRP) | $80.303B | RED ALERT: Now under $100B for 5 of the last 6 trading days. The last time this persistence happened (Feb), March’s selloff followed. | 🔴 Red |

USD/JPY | 147.52 | Breach of 140 or 160 remains a latent volatility trigger. | 🟠 Orange |

USD/CHF | 0.8088 | Safe-haven flow into CHF continues. Capital still migrating into silence and security. | 🟠 Orange |

3-Year SOFR–OIS Spread | 25 bps | Risk perception slightly eased from yesterday — but fragile trust in mid-term overnight funding persists. | 🟠 Orange |

SOFR Overnight Rate | 4.35% | Slightly elevated. | 🟡 Yellow |

SOFR Daily Volume | $2.817 Trillion | Close to record levels. The system remains heavily reliant on short-term liquidity plumbing. | 🟠 Orange |

SLV Borrow Rate | 0.93% (300k avail.) | SLV HEATING UP! — Rising borrow rate & collapsing share availability suggest acute shortage of physical is intensifying. | 🔴 Red |

COMEX Silver Registered | 190.4M oz | Physical supply remains tight. | 🟠 Orange |

COMEX Silver Volume | 107,430 | Still elevated after yesterday’s surge — this jump higher alongside SLV borrow spike hints at coordinated positioning. | 🟠 Orange |

COMEX Silver Open Interest | 156,969 | Aggressive positioning without froth. | 🟠 Orange |

GLD Borrow Rate | 0.55% (4.5M avail.) | Modest uptick — gold loans edge slightly higher. | 🟢 Green |

COMEX Gold Registered | 21.41M oz | Essentially unchanged — thin coverage. Any sudden demand spike could stress supply. | 🟡 Yellow |

COMEX Gold Volume | 414,490 | Massive uptick — strong sign of stealth accumulation or rebalancing into strength. | 🟠 Orange |

COMEX Gold Open Interest | 472,411 | Rising OI with surging volume = conviction positioning continues to build. | 🟠 Orange |

UST–JGB 10Y Spread | 2.766% | Sitting below the 3% danger line. Persistent breach could destabilize the yen carry trade. | 🟠 Orange |

Japan 30Y Yield | 3.079% | Long-end pain persists. BoJ’s yield curve control slippage is becoming entrenched. | 🔴 Red |

US 30Y Yield | 4.825% | The disbelief in the “soft landing” is still being priced into the bond market — not the headlines. | 🟠 Orange |

Credit to Silverseek.com for the above Silver COT positioning

Silver’s Paper Battlefield: Who Got Crushed, Who Covered, and the Two Gauges Flashing Red

Last week wasn’t just another tick on the COT chart—it was a knife fight in the paper silver pit, and one side walked away bleeding. Commercials got their clocks cleaned.

They didn’t just trim risk—they bailed on a massive 7,233 futures shorts, cutting their book to 109,575 contracts. On the futures + options combined ledger, the retreat was almost identical—6,979 shorts closed, leaving 115,070.

That’s a forced retreat, the kind that happens when the market moves hard against you. Large specs took profits. These trend-riders dumped 9,259 longs on futures (now 71,234) while barely adjusting shorts (-510 to 20,576). On the combined ledger, they shed 9,114 longs (now 68,526) and trimmed 395 shorts (now 20,026).

The only “bullish” activity for large specs was a +3.47% increase in spreads (+1,434 to 41,379 combined)—a hedging re-calibration, not an aggressive bet. The takeaway: commercials got squeezed into covering while large specs locked in gains.

Why this matters right now: This wasn’t just a paper shuffle—it played out while silver ripped from $37.105 to $38.542, forcing shorts to cover into rising prices. And now, here we sit—Monday morning, 5:38 AM ET—silver under pressure at $37.985, down $0.557. This is the tell: the battle isn’t over. Positions have shifted, but the real damage is still working its way through the system.

Bringing It All Home

If SLV borrow costs keep rising and RRP stays sub-$100B, both are screaming the same thing: collateral scarcity—but in two different layers of the system.

RRP is the current base layer collateral — high-quality Treasuries, often treated as ‘pristine’ in funding markets, that keeps global liquidity moving.

SLV is the most undervalued real base layer collateral — absolutely essential to the global economy, in a structural deficit for the 5th year in a row, the old-world monetary metal that can’t be printed.

When both are tightening at the same time, the pressure isn’t just in one corner of the market—it’s in the pipes, the wiring, and the foundation.

If RRP stays under $100B, the odds of a major liquidity event in the short term spike. We’ve already seen this movie: February’s RRP collapse set up the March–April selloff.

The headlines blamed tariffs, but tariffs were just the spark. The real tinder was the market’s obsession with pricing everything to absolute perfection. Once that perfection was challenged, the re-pricing wave hit.

Today’s setup is even more dangerous: perfection is still priced in, but the collateral base is weaker, and silver’s paper shorts are already limping. If the next shock comes, it won’t be “caused” by the headline—it’ll be the release valve on a pressure cooker that’s been hissing for weeks.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

📲 Cell: 704.497.7324

🌐 Undervalued Assets | Sovereign Signal

📧 Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply