- The Sovereign Signal

- Posts

- Silver’s Regime Shift: $40 Was the Spark, the $40s Are Only the Launchpad

Silver’s Regime Shift: $40 Was the Spark, the $40s Are Only the Launchpad

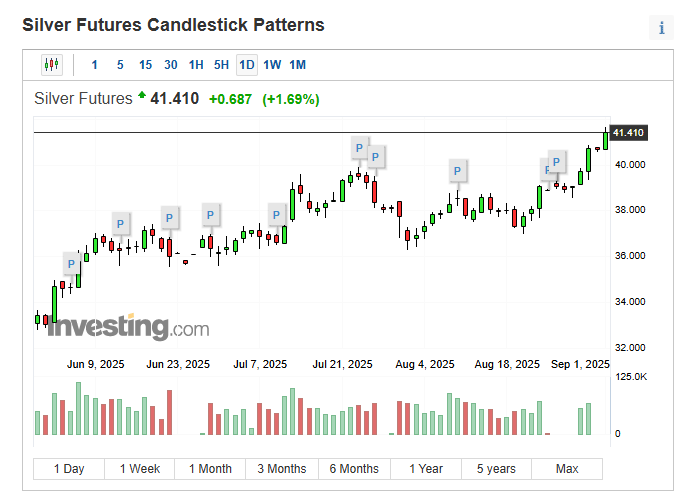

Silver didn’t just break $40—it tore through a psychological wall after spread trades collapsed, funds stayed far from max long, and commercials layered in hedges that will have to chase higher. The breakout through $40–$41 isn’t the peak—it’s the opening act in a cycle that will eventually re-price silver into an entirely new altitude.

Silver’s Next Act: Breaking $40 Was Just the Beginning

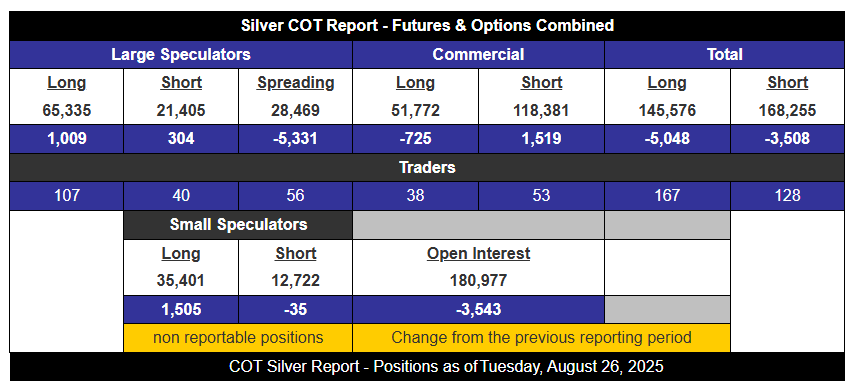

During the week of Aug 20–26, silver climbed from $37.34 → $38.96 (+4.34%), and then immediately ripped higher to $41.40 (+6.26%) after the COT report closed. Crossing $40 wasn’t just a price move—it was a psychological ignition point.

Credit to SilverSeek.com for the above table

What Changed Beneath the Surface

Funds added, but not maxed. Large specs (hedge funds/CTAs) inched longer, but they’re still far from the “blow-off” zone. Translation: plenty of fuel left to chase higher.

Commercials hedged into strength. Producers and banks added shorts, but that’s what they always do at the start of a new rally. As silver climbs, they’ll be forced to roll those hedges higher—adding fuel, not capping it.

Retail joined in—but not recklessly. Small traders bought, but we’re nowhere near euphoria yet.

The noise dropped out. Spread trades (the hedging “chaff”) collapsed by over 5,000 contracts. That freed up margin and cleared the runway for pure directional energy.

Total open interest dipped. That wasn’t weakness—it was the result of spreads vanishing. Price went up, leverage got cleaner, and the tape got more explosive.

Why It Matters

This is the exact posture you want before a decisive breakout:

Funds underexposed.

Retail leaning in, but not manic.

Commercials hedging in early, forced to follow higher.

Spreads unwinding, leaving a clean directional runway.

That’s why the surge through $40 → $41+ isn’t a random spike.

It’s the logical next stage of a regime shift where silver trades with less drag and more torque.

The Macro Backdrop: Fragility Premium

The COT report doesn’t exist in a vacuum—it’s lining up with cracks in the system:

10 Year Swap Spread deeply negative (–27 bps): lack of liquidity in Treasuries.

Reverse repo cushion drained (~$78B): liquidity backstop almost gone.

USD/CHF back below 0.80: global capital reaching for safety.

SLV borrow easy (0.47%, 4.7M shares available): tells us this isn’t just a squeeze—there’s oxygen left in the system.

Silver loves this cocktail: systemic fragility + clean positioning + psychological breakout.

Bottom Line

The COT captured a transition week: spreads unwound, funds quietly added, commercials hedged into strength.

That’s the setup for a Phase 2 breakout, not a blow-off. Breaking $40 lit the fuse. Breaking $41 shows it’s catching.

The next targets—$42–$44—aren’t just numbers. They’re where history, psychology, and positioning all collide. Silver just shifted regimes. The move isn’t over—it’s only beginning.

Signal | Latest Level | Interpretation | Zone |

|---|---|---|---|

10-Year Swap Spread | –27.28 bps | Confirms ongoing lack of liquidity in cash Treasuries: dealers continue preferring swaps (synthetic exposure) over warehousing real bonds. | 🔴 Red |

Reverse Repos (RRP) | $77.898B | Cushion remains thin, still under the $100B “stress line.” Treasuries continue to circulate “in the wild” with elevated collateral velocity. | 🔴 Red |

USD/JPY | 147.05 | Danger band intact; volatility tripwires remain critical at 140/160. Carry trade fragility persists. | 🟠 Orange |

USD/CHF | 0.7993 | Back below the 0.80 red line. Safe-haven bid remains strong — systemic fragility hedging flows alive. | 🔴 Red |

3-Year SOFR–OIS Spread | 29.4 bps | Holding near stress highs — lenders still charging steep “future anxiety premium.” Confirms persistent term-funding stress. | 🔴 Red |

SOFR Overnight Rate | 4.34% | Slight dip from recent highs but remains sticky. Elevated funding costs confirm repo pipes remain stuffed. | 🟡 Yellow |

SOFR Daily Volume | $2.87T | Market is chained to record nightly rollovers — paycheck-to-paycheck liquidity dependence. | 🟠 Orange |

SLV Borrow Rate | 0.47% (4.7M avail.) | Costs cooled slightly, availability steady. | 🟡 Yellow |

COMEX Silver Registered | 199.96M oz | Trending upward, offering some short-term cushion. Still razor-thin versus massive paper leverage. | 🟠 Orange |

COMEX Silver Volume | 74,699 | Moderate turnover — digestion of recent positioning moves, lighter than prior peaks. | 🟡 Yellow |

COMEX Silver Open Interest | 154,342 | Down slightly, trimming leverage, but levels remain elevated. | 🟠 Orange |

GLD Borrow Rate | .41% (4.4M available) | Stable for now. | 🟡 Yellow |

COMEX Gold Registered | 21.43M oz | Flat. Stocks remain wafer-thin against paper market exposure. | 🟡 Yellow |

UST–JGB 10Y Spread | 2.619% | Danger zone. Below 2.5% → carry fragility; above 3% → weaker UST demand. | 🟠 Orange |

Japan 30Y Yield | 3.212% | Near cycle highs. Ongoing upward pressure threatens global bond stability. | 🔴 Red |

US 30Y Yield | 4.918% | Pressing highs. Debt fragility at the global base layer remains severe. | 🟠 Orange |

Why Silver’s Breakout Above $40 Was No Accident

Silver didn’t stumble through $40—it launched through it. The setup made it almost inevitable.

Why It Happened

The week of Aug 20–26: price climbed +4.34%, while spread trades (hedging noise) bled out. That cleared the runway for cleaner directional moves.

After Aug 26: once silver crossed $40, psychology flipped. Models that had been neutral suddenly went long. With fewer spread trades dampening momentum, price could travel further—and it did, blasting to $41+.

Commercials hedged into the rally. At first glance that looks bearish, but it’s actually bullish fuel: as silver rises, those hedges must be rolled higher, extending the move.

The Path Ahead

Bullish Continuation (most likely near term):

Next COT may show large specs adding +5–10k longs or spreads, commercials adding more shorts, and open interest rising—all confirming the handoff from “hedging noise” to pure trend.

If silver holds above $41, the next magnet zone is $42.2–$43.6—old supply zones and trend thresholds. Once $41 is stable, that band flips from ceiling to launchpad.

Signals to Watch This Week

Open interest vs. price: If both climb together, the rally is in trend phase. If price rises but open interest falls again, it’s still bullish—but more short-cover driven.

Spread trades: If they keep shrinking, it means cleaner energy for the rally.

Commercial hedge ratio: A rising short/long ratio during an uptrend usually extends rallies, not caps them.

ETF flows & borrow: If SLV borrow costs rise and availability shrinks while COMEX stocks stay thin, silver’s fuel tank gets even bigger.

System stress markers: Watch for reverse repo balances under $60B, CHF under 0.80, or 3 Year SOFR spread over 30 bps—all signs the “fragility premium” is growing.

Bottom Line

This wasn’t a fluke. The COT showed a transition week: spreads cleared out, commercials hedged, funds dipped in but stayed far from “all-in.”

That’s the perfect posture for a breakout. The surge through $40 → $41+ wasn’t an anomaly—it was the logical next frame in the tape.

Silver is the pressure release valve for decades of increasingly distorted valuations across asset classes that rely on artificially cheap debt. One thing’s for sure - it’s just getting started.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply