- The Sovereign Signal

- Posts

- Silver To S&P Ratio Indicates Silver Bull Is Just Beginning, Rumors of Chinese Exchange Halting For 1 Hour After Premiums Hit 20%, COMEX Raises Margin Requirements 10% On Silver Effective Today, Heavy Call Volume at $65 Indicates Next Ignition Point

Silver To S&P Ratio Indicates Silver Bull Is Just Beginning, Rumors of Chinese Exchange Halting For 1 Hour After Premiums Hit 20%, COMEX Raises Margin Requirements 10% On Silver Effective Today, Heavy Call Volume at $65 Indicates Next Ignition Point

Signals are stacking: collateral stress and option-gamma tinder meet a tightening physical market. If $65 holds, a forced-buyer cascade can collide with shrinking float—sending the silver bull vertical.

The silver-to-S&P ratio is turning up from a multi-year base, which is how every past metals leadership cycle started.

Pair that with structural deficits, financial repression, and a crowded, overvalued equity complex, and you’ve got classic rotation math: multiples compress, hard collateral re-rates.

The big money isn’t made sniping pullbacks; it’s made riding the new primary trend.

This is mean reversion - not overextension.

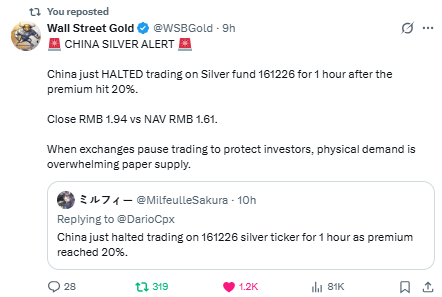

If true, that halt is a flare gun.

A 20% premium to NAV means buyers in China were willing to pay far above “paper” value just to secure silver exposure—classic sign that physical demand is outrunning available float and local arbitrage can’t fill the gap fast enough.

When exchanges pause trading to cool a premium, it usually means scarcity is real, not narrative.

Nine hours later, futures are trading near fresh ATHs around $64.78 fits the script: East-led demand and tight barrels force the global curve higher, paper chases physical, and the squeeze migrates into price.

Gold is ballast; silver is the blowtorch.

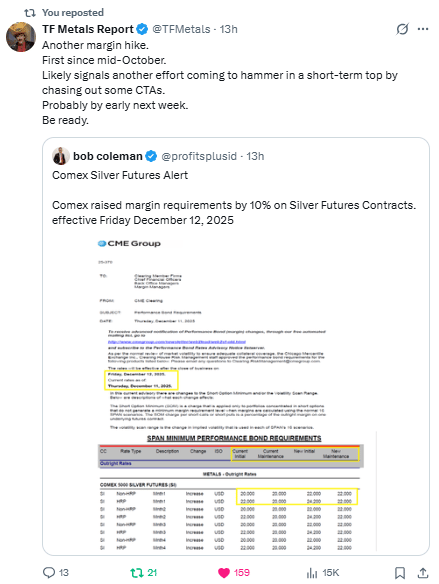

Both shorts or longs can get flushed—direction decides who bleeds more.

A margin hike raises initial/maintenance cash for longs and shorts.

If price dips right after the hike, weak longs get forced to trim or liquidate (often the intent—cool the rally).

But if price keeps ripping, shorts are the ones drowning: daily losses (variation margin) + higher required margin = compound squeeze and disorderly buy-backs.

First day of the hike and price is up.

That tells us the move isn’t leverage-only; it’s flow + scarcity.

If higher margin can’t knock it down, it usually means: shorts are eating higher variation margin, dealers are chasing delta, and real demand is still bidding.

Expect whippier tapes (they’ll try to run stops), but the signal > the noise.

Tactically: hold above ~63.8–64.2 (breakout shelf) keeps upward movement primed; sustained closes >65 open the air pocket toward 67–70.

If a shakeout comes, it’s more likely a liquidity test than a trend change unless we lose 62 with volume.

Margin hikes are testing weak hands; the tape is saying the strong hands are in control.

Those Jan ’26 $60 and $65 silver calls aren’t just “positions”—they’re a launchpad stuffed with cash.

You’ve got roughly 2,931 contracts sitting there.

At 5,000 oz each and ~$64/oz, that’s about 14.7 million oz of exposure—~$940 million notional.

Even with conservative pricing (≈ $2.5–$4.0/oz), buyers have likely spent $37–$59 million in premium to own that upside.

Why it matters: as spot holds >$60 and runs at $65, the dealers who sold those calls must buy futures to hedge—and the higher it goes, the more they must buy (gamma).

Layer that forced buying on top of tight physical and you don’t get a gentle climb; you get air-pocket moves where price rips to find liquidity.

In plain English: there’s a near-billion-dollar bet parked right under price, and if silver stays elevated, the hedging machine can turn it into thrust.

$65 is a magnet and a fuse.

It’s a round-number resistance with heavy Jan ’26 call OI clustered there, so a firm push/close above it forces dealer hedging (buying futures), which can turn a breakout into a slingshot.

Structure-wise, we already cleared the 58.8–60 shelf; holding that as support keeps the uptrend intact.

A daily close >65 followed by a weekly close >65 is the confirmation that invites momentum funds and squeezes shorts; that points to 67–70 first, then the mid-70s.

Bottom line: if $65 goes, it likely goes fast—not because of the drawing, but because of positioning, options gamma, and real-world tightness all pulling in the same direction.

We’ve swapped subprime mortgages for subprime “future compute”—GPU lease receivables, AI SPVs, forward compute sales.

That’s leverage built on promises, not cash flows.

When funding asks, “is this collateral real?”, haircuts jump, repo shrinks, and the AI narrative can’t post at the window.

Capital then stampedes to non-synthetic collateral—gold first, and the tighter cousin with industrial bite, silver.

Different ticker, same movie: once collateral quality is questioned, narratives die and hard money clears the panic.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply