- The Sovereign Signal

- Posts

- Silver Trading Above $78 In China, The World Is Running Out Of Silver..."It's Still Not A Squeeze, It's Accumulation With A Deadline" - Global Quantitative Easing Is A Race To The Bottom And Suggest Gold And Silver Are Just Getting Started

Silver Trading Above $78 In China, The World Is Running Out Of Silver..."It's Still Not A Squeeze, It's Accumulation With A Deadline" - Global Quantitative Easing Is A Race To The Bottom And Suggest Gold And Silver Are Just Getting Started

Silver trading above $78 in China is a magnet to pull it higher in the short-term. The silver rally is just getting started. Most investors don't understand the fundamentals that are causing this move to begin and ignore thousands of years of monetary history that precede the greatest global debt bender in recorded history.

Looks like silver is headed to $78 very soon.

China’s premium is the tractor beam.

SGE/SHFE printing $78–$80 is a price gap the West usually closes—Asia buys the dips, New York chases.

Mild backwardation =

“want it now.”

Spot Silver > Silver Futures = tight nearby metal, typically bullish into the next few sessions.

Flow fuel:

Heavy SLV call OI above spot + COMEX draws = dealers short gamma → buy up the ladder as price rises.

Near path:

$72 holds → $75 squeeze pocket → $78 tag (China parity).

If $72 fails on a close, momentum cools.

Not a squeeze—a countdown.

A squeeze is shorts panic-buying.

This move smells different: sovereigns/industrials/ETFs are methodically lifting offers for metal they must secure.

Deadline:

(March will likely be a big month) delivery windows, export curbs, year-end balance sheets, and contract expiries force buying by set dates, not “if/when.”

Tells:

persistent Asia premiums, recurring backwardation/lease-rate spikes, COMEX draws, and stair-step rallies (not blow-off wicks) = planned accumulation, not a short-covering puke.

Translation:

clock is ticking, metal is finite.

Price grinds up as big hands fill quotas—then jumps when latecomers realize they’re bidding into empty shelves.

Why “we’re running out of silver” isn’t hyperbole

Five straight years of deficits:

we’re burning more ounces than we’re mining. That’s math, not mood.

Inelastic supply:

~⅔ of silver comes as by-product from gold/copper/lead/zinc mines.

You can’t ramp silver without ramping those metals.

Dormant monetary bid waking up:

after 54 years of near-zero monetary demand, silver is being re-monetized as the global debt supercycle creaks.

Collateral squeeze meets commodity supercycle:

sovereigns/industrials/ETFs are stocking up at the same time that capex has been starved.

Result: thin tradable float + deadline buyers = air pockets higher.

Call it what it is: scarce collateral entering a melt-up regime.

Here’s what that candle is whisper-shouting:

Too many straws, one milkshake.

Five years running, the world sips more silver than it produces.

The glass was already low.

You can’t crank a by-product.

Two-thirds of supply rides on gold/copper/lead/zinc mines.

No “turn up the silver” knob exists.

Half a century of ignoring the vault.

We benched a monetary metal for 54 years—then the debt machine made everyone scramble for hard collateral at once.

Re-monetization meets resource cycle.

Governments, manufacturers, and funds are all reaching for a toy-sized float at the same time.

Read between the lines: when demand goes vertical and supply can’t bend, price doesn’t walk higher—it teleports.

Correction: that vertical candle isn’t the 4th-largest asset—it’s the 3rd.

Silver just leapfrogged Apple.

It’s the most electrically conductive metal on the planet.

It’s just. Getting. Started.

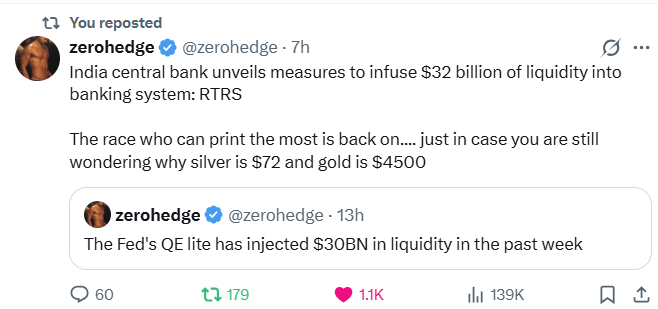

The money printers are back on—and they’re synchronized.

In a hyper-interconnected global economy, competitive debasement is a race to the bottom that pushes real, unprintable collateral to the top.

That’s why the eventual levels for gold and silver will shock people: the debt super-cycle is just starting its finale, and the pressure release valves are already hissing.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply