- The Sovereign Signal

- Posts

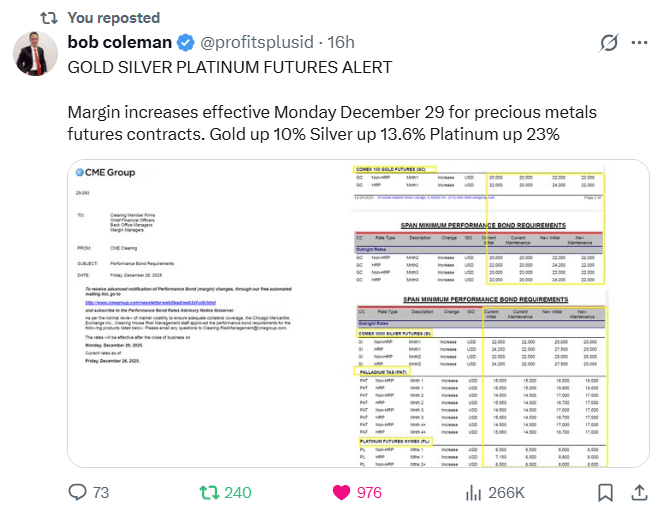

- Silver Trading above $90 in China, Silver Slammed Over $2 In Last Minute of After-Hours Trading Yesterday, CME Increases Silver Margin Requirements to 17% Effective Monday, Elon Musk Publicly Commenting On Silver Now, Traders Calling For $125 Silver Next Week

Silver Trading above $90 in China, Silver Slammed Over $2 In Last Minute of After-Hours Trading Yesterday, CME Increases Silver Margin Requirements to 17% Effective Monday, Elon Musk Publicly Commenting On Silver Now, Traders Calling For $125 Silver Next Week

One thing is for sure. We're in for a wild ride.

Looks like silver is going to $90 very soon.

China’s SHFE Silver price continues to be a leading indicator for US Silver futures.

Silver was up about 11.07% when I checked my phone last night after markets closed at 5PMET.

Now today I check the price and there’s a MASSIVE red candle on the one minute chart above that took the price of silver down about $2.50 in THE LAST MINUTE of trading. Unbelievable.

Thin-liquidity stop sweep.

Metals go illiquid into the 5–6pm ET Globex break.

A single chunky sell (or a bad print) can knifes-edge the 1-min candle $1–$2 without real two-way trade. That’s classic “run the stops, refill lower, vanish.”

Settlement math ≠ last trade.

The % change last night (+11.07%) was likely vs the prior last; most feeds later switch to official CME settlement (set earlier, on volume).

When the reference rolls to the official settle, your day-change can “shrink” even if the structural move stands.

Tape cleanup/revisions.

Data vendors often revise late ticks.

One ugly red stick can appear after the fact and make the close look slammed, even though it printed in a ghost-town book.

Bottom line: that candle screams liquidity hunt, not thesis break.

The tells that matter—Shanghai premium, backwardation, delivery drawdowns, and the –~7% 1-yr silver swap distortion—didn’t change.

Watch Asia’s open and the next settle, not the lone post-settlement axe swing.

CME just raised the cover charge: silver margin +13.6%, gold +10%, platinum +23%.

That’s the exchange admitting volatility is real and trying to cool leverage.

Near term you can get a jagged air-pocket as weak longs de-gross into thin holiday books.

Bigger picture, if price holds or pushes higher after a margin hike, it signals real bid—not borrowed courage—and sets up an even tighter spring for the next leg.

When the world’s richest man says “not good,” he’s telegraphing action: secure supply.

That means offtake deals, pre-pays, JV stakes—or straight-up buying a mine.

One move from Musk would validate the scarcity story, pull big manufacturers into a scramble to lock metal, and set off copycat hedging from autos, solar, and electronics.

Tiny market vs trillion-dollar balance sheets = avalanche risk.

If Elon blinks first, silver turns from “commodity” into a corporate arms race for atoms—and price discovers how small the float really is.

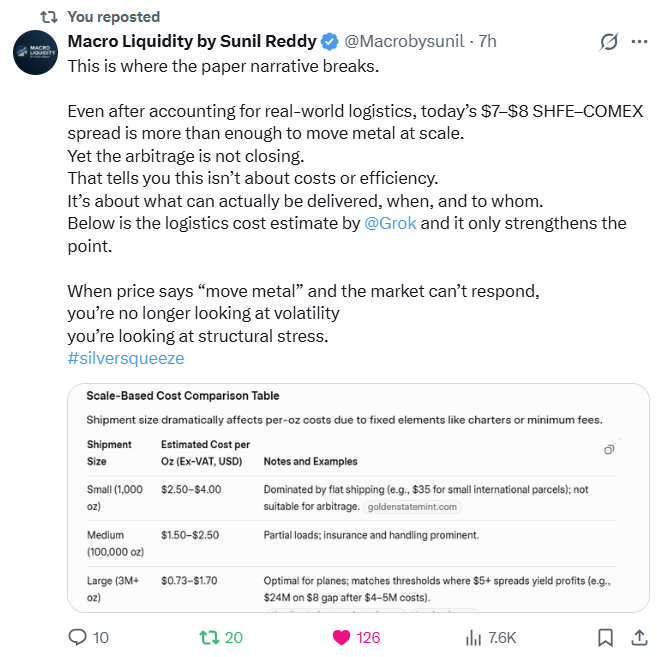

A $7–$8 SHFE–COMEX gap easily pays the freight to ship the silver, yet the gap isn’t closing.

That means it’s not a cost issue—it’s a can’t-get-it issue.

Paper said “ship metal,” and the real world shrugged because there’s not enough deliverable silver where it’s needed.

That’s structural stress, not volatility—and it’s why price has only one direction right now.

When the biggest silver consumers start buying mines/larger and larger amounts of silver ahead of time in order to save money as price continues to rise, available silver collapses and the market re-rates the whole sector from “commodity” to “strategic collateral.”

Tiny market + inelastic supply + industrials vertically integrating = market cap and price go vertical.

$125 next week is aggressive.

The real tell isn’t the target—it’s that serious traders are even modeling it.

That means positioning is thin, upside tails are fat, and every dip is getting hunted.

If Sunday gaps and holds despite margin hikes, the melt-up is alive; if it can’t hold, we could see a wicked shakeout before the next leg.

Either way, the tape is screaming: big moves, fast decisions.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply