- The Sovereign Signal

- Posts

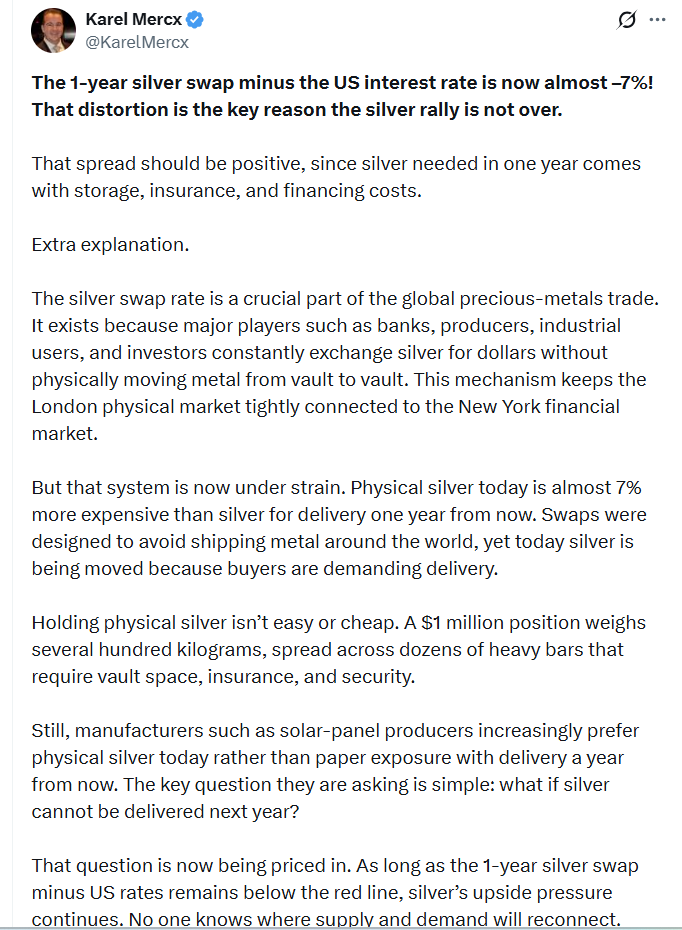

- Silver Trading Over $80 In China Ahead Of Export Restrictions Starting In January, China Silver Inventories Are Falling Faster Than Price Is Rising, China Silver In Backwardation While 1 Year Silver Swap Minus The US Interest Rate Is Almost -7%

Silver Trading Over $80 In China Ahead Of Export Restrictions Starting In January, China Silver Inventories Are Falling Faster Than Price Is Rising, China Silver In Backwardation While 1 Year Silver Swap Minus The US Interest Rate Is Almost -7%

What we're seeing suggests that despite silver's recent meteoric ascent, prices are charged to go much higher in the short to mid-term.

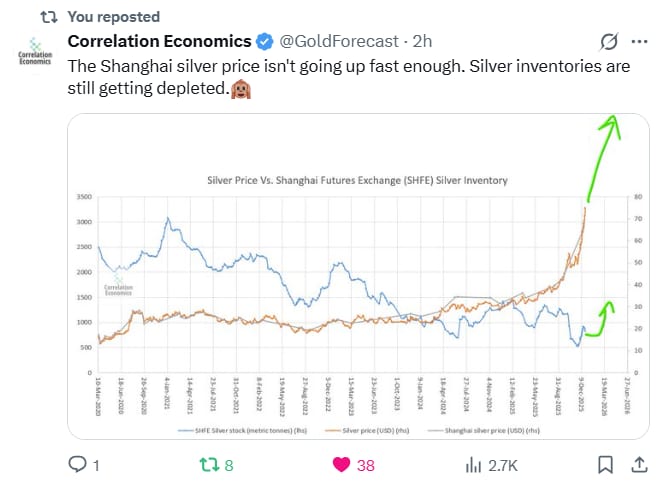

The price of silver in Shanghai has now become a leading indicator for the price of silver in the US.

Shanghai silver screaming into the $80s while COMEX sits low-$70s = a breakout premium that forces U.S. price to chase.

That gap isn’t sentiment—it’s signal: real-world demand is outrunning paper supply, arbitrage flows pull ounces east, and futures must reprice to secure metal.

Near-term: squeeze mechanics + China premium = rip higher.

Shanghai’s premium isn’t just “hot”—it’s a siren.

Silver inventories on SHFE are falling while price is rising, which means the current price still isn’t high enough to ration metal.

That’s a structural shortage, not a vibe.

As China hoovers ounces, arbitrage sucks inventory out of the West, COMEX’s paper has to pay up to keep atoms, dealers hedge by lifting futures, and the move feeds on itself.

This is how gaps become repricings.

The market’s telling us $70s isn’t equilibrium—raise the bid or lose the bars.

China’s Jan 1 export choke is more tinder to add to the fire.

Once China throttles physical outflows, the arbitrage pipeline that kept COMEX honest snaps, Shanghai becomes the marginal setter, and paper has to reprice to real-world scarcity.

That turns today’s premium into policy—vault drawdowns speed up, manufacturers bid now not later, and the “accumulation with a deadline” clock starts ticking louder.

In short: cut the export hose, and global price discovery migrates East—fast.

Shanghai: spot silver > silver futures and that backwardation is widening.

When buyers pay more today than for February, it screams “I need metal now”—inventories are thin, export choke is coming, and paper timelines don’t matter.

This is how price discovery migrates: futures are forced to lurch higher to the cash market—or get steamrolled by real demand.

The plumbing is also screaming: “I need the metal now.”

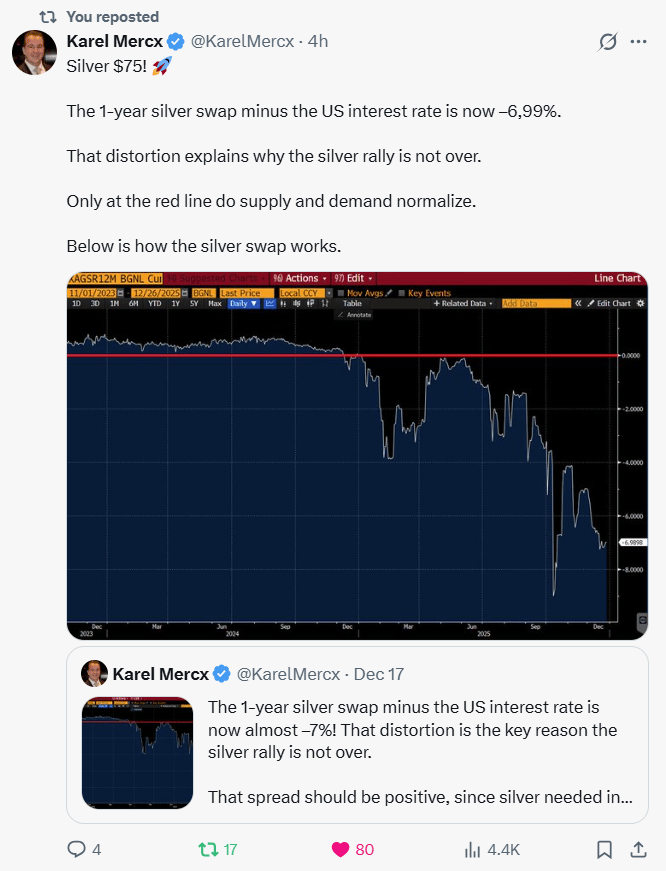

The 1-yr silver swap minus U.S. rates has cratered to ~-7%—a level that should be impossible in a calm market because carrying silver for a year (storage/insurance/financing) normally makes that spread positive.

When near-dated silver is this much pricier than next year’s, it means buyers doubt future deliverability and are yanking bars out of the system today.

That’s not hype; it’s collateral stress.

Until that spread rips back above zero, the path of least resistance is higher—paper will keep chasing physical.

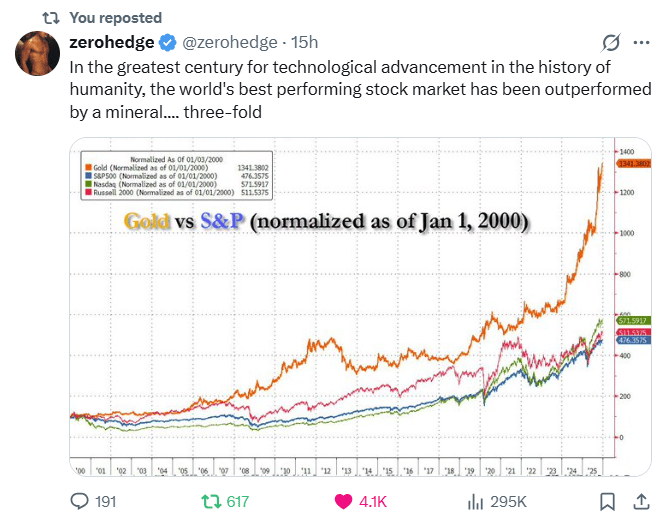

Innovation boomed. Debt boomed harder.

That chart screams a simple truth: in a hyper-levered, QE-on-every-dip world, policy beats productivity—so hard collateral (gold) outruns equity narratives.

If gold did that with zero hype, imagine the beta when silver finishes remonetizing.

#greatestglobaldebtbenderinrecordedhistory #hyperinterconnectedrecordleverage

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply