- The Sovereign Signal

- Posts

- Silver - Why This Time Is Different

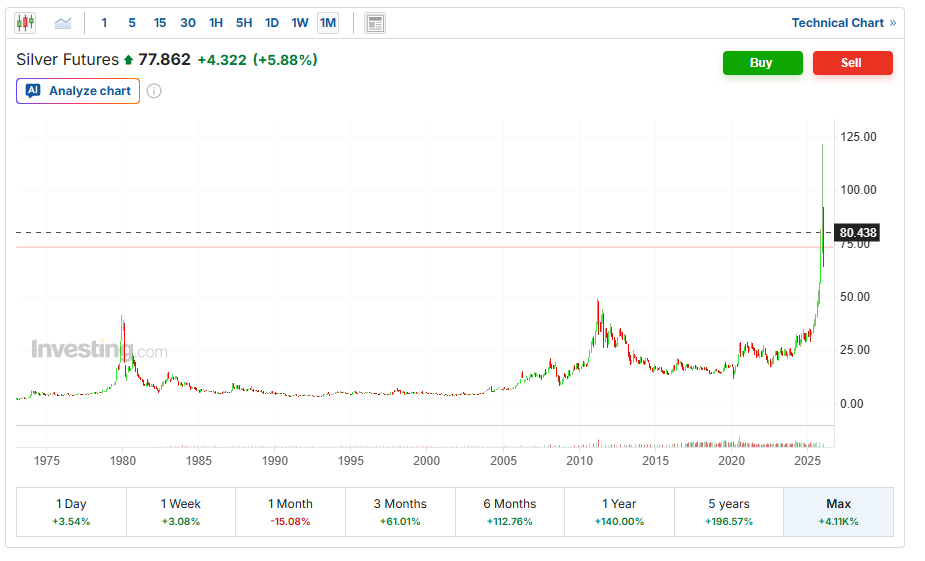

Silver - Why This Time Is Different

From The Hunt Brothers, To Bear Stearns, To Now.

The Hunt Brothers' Silver Saga

Whether you're a seasoned trader who's seen multiple market cycles or a newcomer dipping your toes into the world of commodities, the story of the Hunt brothers and the 1980 silver crash is a timeless thriller.

What happened should be studied in the context of where silver is headed from here.

Think of it as the financial equivalent of a high-stakes poker game where the house suddenly changes the rules mid-hand.

The Run-Up: Why Silver Became a Ticking Time Bomb in the 1970s

Let’s start with the turbulent 1970s…

The global economy was a mess—think runaway inflation (prices rising like a rocket), oil shocks from the Middle East embargoes, and the U.S. dollar losing its shine after President Nixon ditched the gold standard in 1971.

By the late 1970s, silver was trading around $5-6 per ounce, but whispers of shortages and inflation fears started pushing it higher.

Note the macroeconomic backdrop—double-digit U.S. inflation (peaking at 13.5% in 1980) created a perfect storm for commodity bulls.

The Hunts saw this as their golden (or silver) opportunity, fueled by a mix of genuine economic paranoia and raw ambition.

The Players: Meet the Hunt Brothers—Texas Oil Tycoons Turned Silver Barons

Credit to Global Bullion Suppliers for the above image

At the center of this storm were the Hunt brothers: Nelson Bunker Hunt, William Herbert Hunt, and Lamar Hunt.

These weren't your average Joes; they were heirs to one of America's biggest oil fortunes, built by their father H.L. Hunt. Bunker, the ringleader, was a larger-than-life figure—eccentric, conservative, and convinced the world was heading toward economic Armageddon.

He feared communists, inflation, and fiat currency (government-backed money without gold or silver backing). "I buy silver as a hedge against catastrophe," he'd say, but let's be real: This was also about power and profit.

The brothers started small in the early 1970s, quietly accumulating physical silver—actual bars and coins—through discreet deals.

By 1979, they controlled an estimated 200 million ounces, roughly a third of the world's deliverable supply.

But they didn't stop there.

They dove into futures contracts on the Comex (Commodity Exchange in New York), which are essentially bets on future prices.

They leveraged long positions heavily, using margin (borrowed money) to amplify gains, creating massive convexity in their portfolio.

It was exhilarating, almost heroic in their minds, like sticking it to the big banks and governments.

The Run Up

'From 1979 onward, the Hunts ramped up.

They borrowed billions (yes, billions) to buy more futures and physical silver, often through international partners to skirt U.S. regulations.

Prices exploded: From $6 in early 1979 to $50 by January 1980—a 700% surge!

Panic buying ensued as others jumped in, fearing they'd miss out.

Short sellers (those betting on prices falling) got squeezed, forced to buy back at higher prices, fueling the rally further.

It was like a snowball rolling downhill, getting bigger and faster.

The Hunts weren't just investing; they were manipulating supply by demanding physical delivery on their futures contracts, draining vaults.

This created a classic short squeeze, with open interest on Comex spiking and deliverable stocks plummeting.

The brothers' positions were so leveraged that a small price uptick meant massive profits—but the reverse was true too.

The Turning Point: Comex Steps In with "Silver Rule 7"

By January 1980, alarm bells were deafening.

The Comex board—fearing systemic risk (a total market meltdown)—acted decisively.

On January 7, they introduced "Silver Rule 7," an emergency measure.

In simple terms: It banned new long positions (bets on rising prices) bought on margin.

You could still hold existing bets, but no more leveraging debt to pile on.

This shifted from margin trading to cash-only for new buys, effectively hiking position limits and forcing liquidation for over-leveraged players.

Why?

To prevent the Hunts from monopolizing more.

The rule was logically sound: Markets need balance to function; one family's dominance threatened liquidity and fairness.

Emotionally, it felt like betrayal to the bulls—a rigged game where the little guy (ironically, the billionaire "little guys") gets crushed by the establishment.

The Crash: Silver Thursday and the Bitter Aftermath

The rule worked... too well.

Prices peaked at $50.35 on January 18 ("Silver Tuesday"), then started cracking as sellers emerged.

The Hunts, overextended with $1.7 billion in margin calls (demands to pony up cash for losses), couldn't hold.

On March 27, 1980—"Silver Thursday"—panic hit: Prices plummeted from $21 to $10.80 in a single day.

Billions evaporated.

The brothers faced ruin, defaulting on loans and sparking a mini-stock market crash (Dow dropped 5%).

The fallout was brutal.

The Hunts declared bankruptcy in 1988 after lawsuits and fines totaling over $130 million.

Bunker lost his empire, reduced to selling horses.

For the market, it was a wake-up call: The CFTC (Commodity Futures Trading Commission) tightened rules, and silver prices languished for years.

It exposed leverage's double edge: Amplifies wins but devastates losses.

The sequence was airtight: Inflation fears → accumulation → squeeze → intervention → unwind → crash.

Silver's 2011 Rollercoaster: Echoes of 1980, Hidden Bank Dramas, and Why 2026 Is A Whole New Beast

Flash back to the aftermath of the 2008 financial meltdown.

The world was reeling from bank bailouts, housing collapses, and zero-interest-rate policies (ZIRP) from the Fed.

Quantitative easing (QE) flooded markets with cheap money, sparking inflation fears and a hunt for "safe" assets beyond crumbling stocks and bonds.

Silver, the "poor man's gold," shone bright: It's not just a hedge against chaos; over 50% of demand comes from industry—like solar panels, electronics, and medical gear—making it a dual-threat play.

Prices started 2011 around $30 per ounce, already up from $17 in late 2009 thanks to recovering global growth and investor paranoia.(silverinstitute.org)

By early 2011, the rally ignited: Hedge funds, retail traders (emboldened by forums like Reddit precursors), and even sovereign buyers piled in.

The math stacked up: Global mine supply hovered around 800-900 million ounces annually, but demand surged 20%+ from tech booms and coin minting records (U.S. Silver Eagles hit all-time highs).

The peak?

April 28, 2011, when silver touched $49.83 intraday—echoing the Hunts' $50 high, but without a single family's corner.

It was a 160%+ gain from January, driven by short squeezes (short sellers covering at higher prices) and leverage-fueled bets on Comex futures.

Imagine borrowing to buy lottery tickets on a hot streak—the wins feel endless.

Open interest ballooned, with convexity from options amplifying moves, creating a reflexive loop where rising prices scared more shorts into buying.

The Brutal Fall: Margin Hikes, Panic, and 30% Wipes in Days

Starting late April, the CME Group (overseeing Comex) hiked margin requirements five times in a week—demanding more cash upfront for trades, echoing 1980's Silver Rule 7.

Why?

To cool "excessive speculation" amid volatility.

Emotionally, it felt like the rug pull of the century—euphoric bulls turned to desperate sellers overnight.

Prices cratered 30% in five sessions, from $48 to $33 by early May.

A brief rebound to $44 followed, but September's global sell-off (U.S. debt ceiling drama, Eurozone woes) triggered another 40% plunge to $26.

The pain was visceral: Leveraged traders faced margin calls, wiping out accounts.

One trader anecdote from forums: "I went from hero to zero in days—lost my savings betting on the moonshot."

It was textbook: Over-leverage met regulatory intervention, plus macro headwinds like slowing China growth and commodity contagion.

Annual average hit a record $35.12, but the volatility scarred many.

Silver languished below $20 for years after, with silver bulls a laughingstock once again.

The Hidden Drama: Bear Stearns' Silver Short and the Road to Ruin

Now, the part often overlooked—the Bear Stearns connection.

Back in 2008, as the subprime crisis boiled over, Bear Stearns wasn't just sunk by toxic mortgages; whispers (and later lawsuits) point to a massive silver short position that amplified their downfall.

Silver was rallying from $10 to $21 that March, and Bear's shorts (bets on falling prices) were underwater big time—potentially billions in losses as they faced delivery demands.

Analysts like Ted Butler argued the Fed rushed JPMorgan's bailout acquisition (at $2-10/share from $170 highs) partly to contain the short squeeze contagion.

JPM inherited the position, allegedly holding 85%+ of Comex shorts with HSBC.

By 2010-2011, as silver surged, JPM reduced shorts by 30%, but faced CFTC probes and later $1.3B+ fines for manipulation (spoofing trades).

The short exacerbated Bear's leverage woes (33:1 ratio meant a 3% asset drop wiped them out), tying into 2011's squeeze where banks like JPM got burned covering.

Why 2026 Is Different: Deeper Deficits, Debt Doomsday, and Geopolitical Powder Kegs

Too many "Hunt brothers" equivalents:

Institutions (big money pros) are draining vaults broad-based—not just one spot.

Speculators are piling in with bets (like options and futures) that could force even more deliveries.

The numbers are nuts: Comex "registered" silver (the stuff ready for delivery) is below 100 million ounces and dropping fast—like 785,000 ounces a day sometimes.

But demands?

February deliveries already hit 98% of what's expected, and March could need 200-300 million ounces if trends hold.

Unlike 1980's one-family corner or 2011's post-QE speculation, today's drivers are structural and inescapable.

First, the global sovereign debt crisis is a monster:

Total debt hits $346 trillion (310% of GDP), with IMF warnings of 100% by decade's end.

U.S. deficits roar at 7-8% GDP, Japan's at 250%+, Europe's creaking under defense hikes.

It’s like watching a slow-motion train wreck where governments borrow to infinity, risking defaults or inflation bombs.

This fragility boosts silver as "real collateral" in a debt-fueled scramble, far worse than 2011's ceiling debates.

Add silver's sixth consecutive supply deficit: Cumulative shortfalls near 900 million ounces since 2021, with 2026 projecting 67-200 million more.

Mine output peaked in 2016, now flat at 830-850 million ounces, while solar/EV demand explodes (200 million ounces for green tech alone).

China's export curbs fragment supply, draining vaults like Comex (down 25% recently).

No quick fix—new mines can take 10+ years.

Geopolitics amps it: U.S.-China tariffs, Russia-Ukraine fallout, Middle East tensions drive defense/tech needs and safe-haven flows.

Unlike past eras, this isn't stoppable by rule tweaks—it's a global, multi-player squeeze with institutions, nations, and retail all in.

Prices already at $80-120? That's just the warm-up.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply