- The Sovereign Signal

- Posts

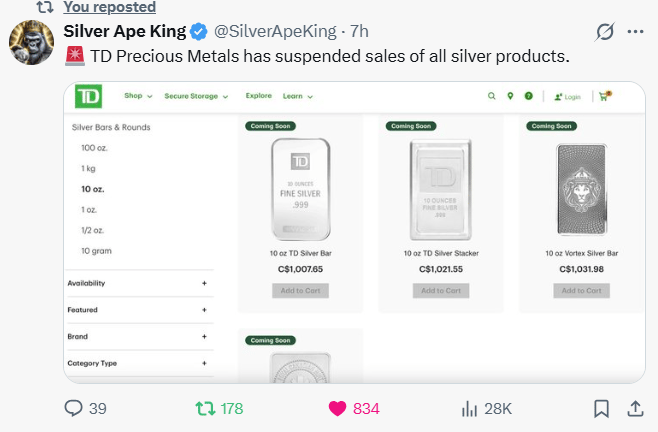

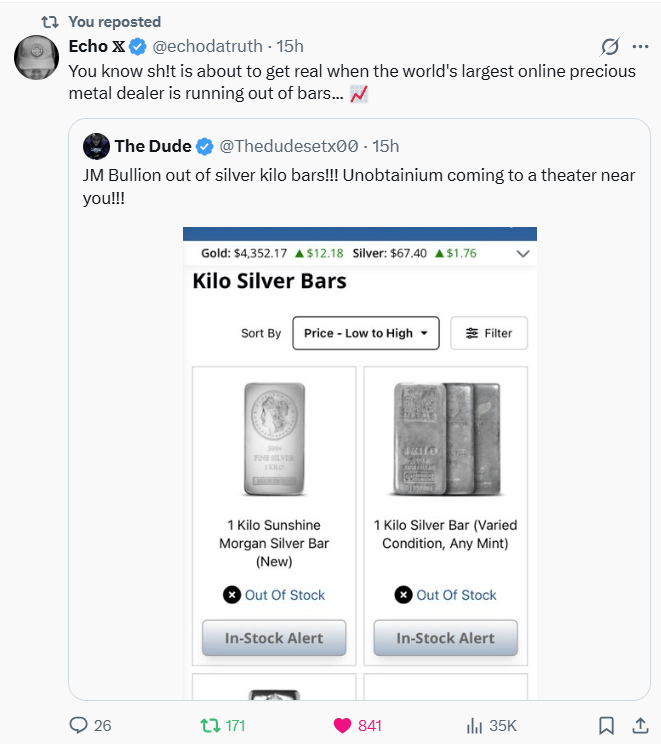

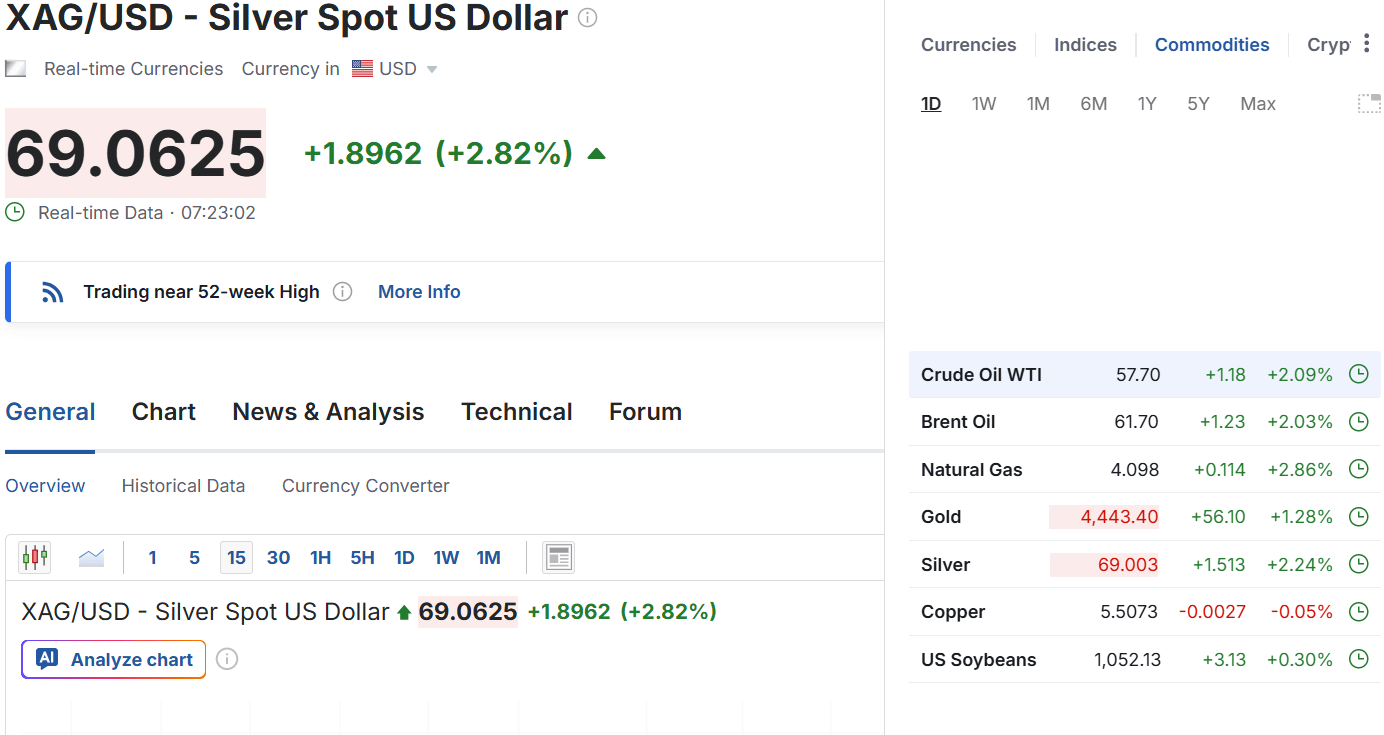

- TD Precious Metals Suspends Sales Of US Physical Silver Products, JM Bullion Runs Out Of Silver Kilo Bars, Silver Rips Past $69 In US While Trading Above $71 In China

TD Precious Metals Suspends Sales Of US Physical Silver Products, JM Bullion Runs Out Of Silver Kilo Bars, Silver Rips Past $69 In US While Trading Above $71 In China

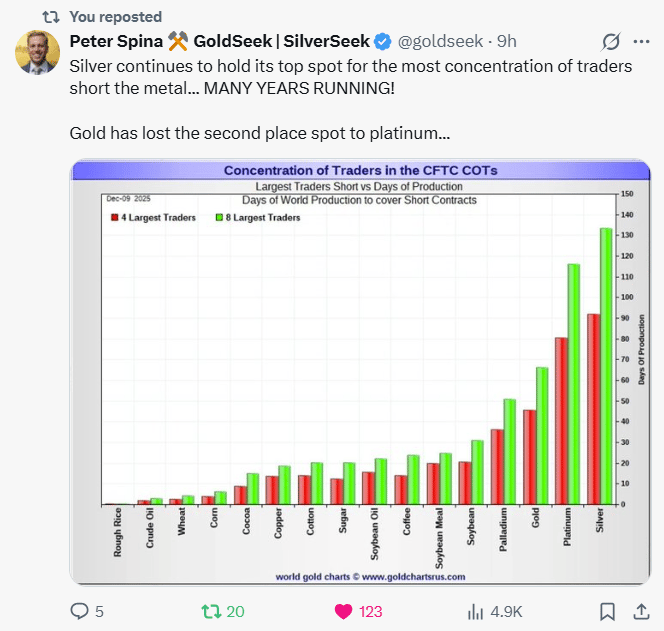

Guess what the most shorted commodity in the world is?

The silver market is catching fire, up above $69 this morning with signs of scarcity of physical silver continuing to increase.

Absolutely nuts—and exactly what a squeeze looks like.

TD shut off silver sales → retail vacuum.

Premiums jump, inventory vanishes, smaller dealers copy-paste “sold out.”

Physical leading, futures chasing.

Asia/SGE hotter than COMEX; backwardation + lease-rate stress = rocket fuel.

Thin liquidity = bigger moves.

Call walls + short gamma = every buy punches harder.

Bottom line: Price ripping + product disappearing = liquidity black hole.

Expect higher premiums, nastier volatility, and another leg up unless supply magically appears.

Add this to the sirens:

JM Bullion out of kilo bars = retail shelves thinning at the biggest shop.

When the warehouse says “no mas,” premiums and panic buy-ons kick in.

Refiners can’t insta-restock if this continues. Lead times stretch, dealers ration, smaller shops mirror “out of stock.”

Translation: We’re sliding from bull market to the edge of a real re-pricing in silver.

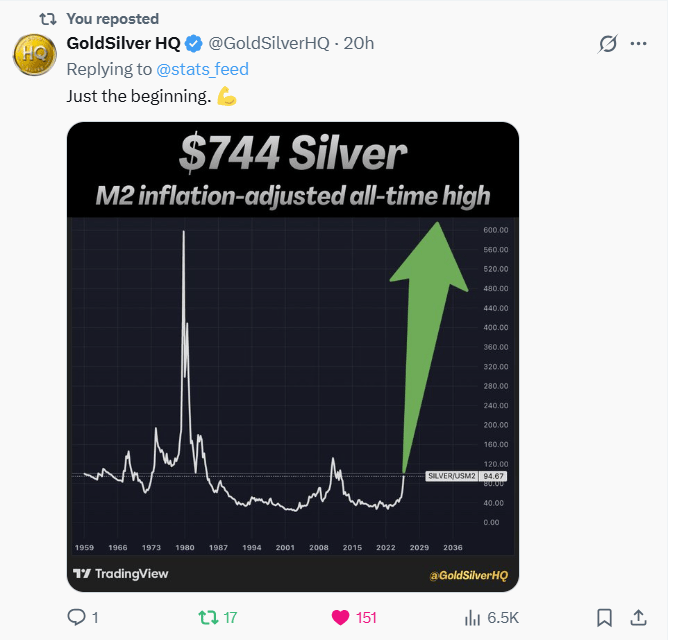

At some point, physical delivery of silver will become the norm.

When it does, we’re probably looking at four digit silver.

Less metal, more FOMO, nastier squeezes.

Silver has the most concentrated shorts on the CFTC board—just a handful of whales sit on dozens of days of world production.

That’s a coiled spring.

When a tight physical market + rising price forces even one whale to cover, it’s a buy-vacuum straight up.

Fewer shorts = thinner offers = vertical candles.

Add Asia premium, lease stress, and ETF call walls, and you’ve got rocket fuel.

Translation: the moonshot setup is real—crowded shorts + scarce metal = violent upside.

Silver’s not “rallying.” It’s getting re-rated.

Scarcity + squeeze:

Deficits, backwardation, Asia premium, inventories bleeding = real-world metal > paper.

Monetary snapback:

Gold’s being re-monetized; silver is the high-beta collateral catching up.

Ratio mean-revert = jet fuel.

Policy gasoline:

Cuts/QE/buybacks/BOJ wobble → more currency, more bid for un=printables.

Positioning flips:

Banks net long, call walls stacked, East bid relentless.

Translation: this isn’t a pop—it’s a label change.

From “industrial input” to scarce collateral. When labels change, prices go vertical.

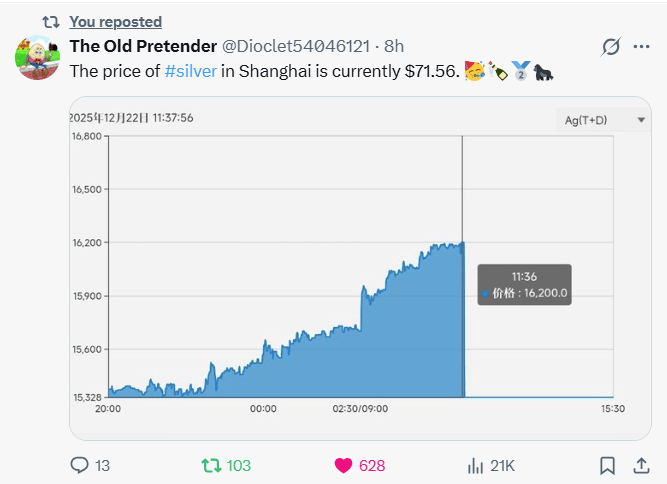

Shanghai at $71.56 = East pulling the rocket.

Big Asia premium → arbitrage hunts metal → Western paper must chase up.

Signals physical tightness and ongoing backwardation pressure.

Adds fuel to the call-wall melt and keeps squeeze dynamics alive.

Translation: price gravity now points East → Up.

Backwardation = bull fuel.

What it is:

Spot price > near-dated futures.

The market is paying more for metal now than later.

Why it matters:

That premium screams immediate scarcity (tight inventories, urgent delivery demand, lending/lease stress).

When holders are rewarded more to sell today than roll, metal quits flowing, squeezing shorts and dealers.

Mechanics:

Shorts needing bars must buy spot; arbitrage that normally sells spot/buys futures can’t scale if physical isn’t there—so the squeeze feeds on itself.

Signal quality:

Persistent backwardation in a monetary metal is rare and tends to precede/confirm up-moves, especially when paired with high lease rates, ETF call walls, and Asian premiums—exactly today’s setup.

Caveat: Backwardation can flicker intraday. I

f it persists (as it has been) while inventories bleed, odds favor higher prices until spot cools or new supply appears.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply