- The Sovereign Signal

- Posts

- The "Debasement Trade Phenomena"-SOFR Breaks Above the Fed Window, Repos Hit $50 B — The System’s Fuel Light Is Flashing

The "Debasement Trade Phenomena"-SOFR Breaks Above the Fed Window, Repos Hit $50 B — The System’s Fuel Light Is Flashing

Reserves have drained to 5-year lows, leverage is maxed, and silver’s backwardation is shouting scarcity. This isn’t a “debasement trade”—it’s a collateral regime change: liquidity stress, record gold buying, and algorithmic triggers converging into a single truth—the world is quietly rotating from IOUs to atoms.

Gold isn’t the “debasement trade”—it’s the settlement layer.

Signals that matter:

Central banks keep adding tonnes—watch what the best-funded players do, not what they say.

In the U.S., households are still massively underexposed: ~0.5% of savings in precious metals vs a four-decade average near 2%.

Read between the lines:

When liquidity gets patched with more liquidity, currencies dilute more and more.

This isn’t nostalgia; it’s plumbing. In a market built on leverage, base collateral (gold, monetary silver) becomes the adult in the room.

Bottom line: the conversation shifting back to gold isn’t a trend—it’s a reversion to what’s worked historically.

Low ownership + rising institutional demand + policy that leans on printing = a structural bid for real money.

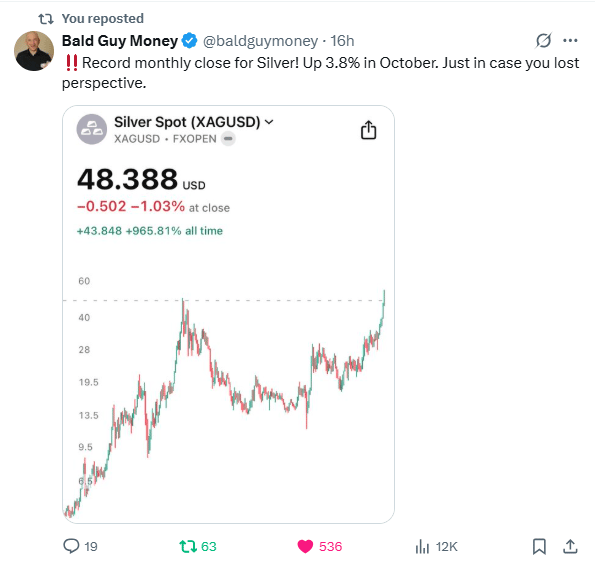

Record monthly close in silver = algorithmic green light.

High-timeframe breakouts:

Most CTAs/quant trend models key off monthly closes.

A new record monthly print upgrades silver from “rally” to trend in those systems → buy signals and position-size increases over the next few sessions/weeks.

Stops & step-ups:

Breakout and Donchian-style models ratchet trailing stops higher, forcing late shorts to cover.

In a thin float, that buy-to-cover = gasoline.

Vol-filters flip:

A strong monthly with contained realized vol lets vol-targeting funds add exposure without breaching risk limits → mechanical demand.

Options feedback loop:

Record close pulls strikes “in the money,” market makers hedge by buying futures, creating a mini-gamma grind higher.

ETF plumbing:

Momentum + headlines = creations in SLV-type products; creations require sourcing metal/claims → flow pressure on scarce inventory.

Leverage angle:

When algos lever up into a small physical pool, paper sizing outruns atoms. That’s how air-pocket rips happen.

Plain English: A record monthly close doesn’t just look good—it reprograms the machines to chase.

In a max-leverage market with tight silver float, that flip can turn steady buying into violent upside bursts.

First the machines, now the metal—again.

Record monthly close = algorithmic green light.

Trend models just flipped silver from “rally” to trend—mechanical buying/short covers get queued.

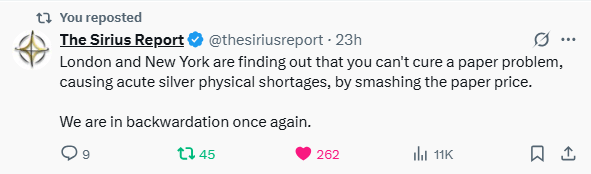

Backwardation is back (we just had it even stronger before the sell off).

Spot > futures means pay me metal now, not a promise later.

You only see repeated backwardation when bars are tight and getting tighter.

LEVERAGE vs. inventory.

Paper stacks are huge; freely available ounces are small.

When quants push and float is thin, each bid moves price more, forcing reflex hedging—feedback loop.

Why now:

Asia paying premiums, factory pull (solar/EV), and funding strain are funneling savings into base-layer collateral.

Each paper smash bleeds more inventory and snaps spot back above futures.

Plain English: The chart told the algos “go,” and the plumbing just repeated “metal is scarce.”

We’ve seen this signal twice in two weeks—trend + tight supply is how quiet grinds become sharp upside bursts.

Signal | Latest Level | Interpretation | Zone |

|---|---|---|---|

10-Year Swap Spread | −17 bps | Deeper negative → swaps richer than cash Treasuries; credit/funding tension intensifies. | 🟠 Orange |

3-Year SOFR–OIS | 27.2 bps | Still elevated mid-tenor stress; risk appetite fragile. | 🔴 Red |

UST–JGB 10-Year | 2.442% | Wide trans-Pacific gap → basis/carry distortions linger. | 🟠 Orange |

Reverse Repos (RRP) | $51.802B | Cash sprinting back to safety (short T-bills) → stress thermometer flashing. | 🔴 Red |

USD/JPY | 154.01 | Carry trade maxed; unwind risk building. | 🔴 Red |

USD/CHF | 0.8045 | Safety bid for “hardest fiat” persists. | 🟠 Orange |

SOFR Overnight | 4.04% | High, but eased a touch; cost of money still bites. | 🟡 Yellow |

SOFR Transaction Volume | $3.098T | Plumbing running hot; leverage heavy. | 🟠 Orange |

SLV Borrow (fee / avail / rebate) | 1.56% / 450K / 2.31% | Availability shrank; demand spike can hit price more quickly. | 🟠 Orange |

COMEX Silver Registered | 164.2M oz | Deliverable pool thin vs. paper flow. | 🔴 Red |

COMEX Silver Volume | 64,053 | Quiet tape → gaps travel farther. | 🟡 Yellow |

COMEX Silver Open Interest | 156,552 | Moderate positioning; room for expansion/snapbacks. | 🟡 Yellow |

GLD Borrow (fee / avail / rebate) | 0.57% / 5.2M / 3.30% | Shorting cost modest; shares available. | 🟡 Yellow |

COMEX Gold Registered | 19.85M oz | Tight deliverable pool keeps basis firm. | 🟠 Orange |

COMEX Gold Volume | 259,051 | Healthy flow; vol can gap on headlines. | 🟡 Yellow |

COMEX Gold Open Interest | 465,521 | Solid participation; funding shocks matter. | 🟠 Orange |

Japan 30-Year JGB | 3.052% | Elevated long end stresses carry/convexity. | 🔴 Red |

US 30-Year UST | 4.669% | Long end tightens conditions; de-risking sensitive. | 🟠 Orange |

When SOFR (what banks pay each other overnight) runs above the Fed’s discount rate, it screams one thing: cash is tight.

Banks would rather pay up in the market than touch the stigma-soaked window. That’s stress.

Why now (plumbing, not headlines):

Reserves are thin and Reverse Repo is drained → fewer spare dollars.

Collateral is scarce → funding desks bid harder and harder for overnight cash.

Leverage stacked high from the easy-money decade → even small shocks jack up funding costs.

What this does:

Funding first, everything else second.

Banks raise lending rates, trim balance sheets, and sell liquid assets to make room.

Volatility accelerates.

When leverage meets pricey funding, routine wiggles become air-pockets as positions are cut.

Policy gravity: Persistent SOFR > policy rails corners the Fed into liquidity support (term ops/QE-adjacent tools).

That eases funding but dilutes currency—a tailwind for base-layer collateral (gold & monetary silver) and other duration assets.

Plain English: The engine light is on.

Too much leverage + not enough cash pushes overnight rates above the guardrails.

The system either de-leverages or gets new fuel. Either path reprices risk; the assets that don’t depend on anyone’s promise gain credibility.

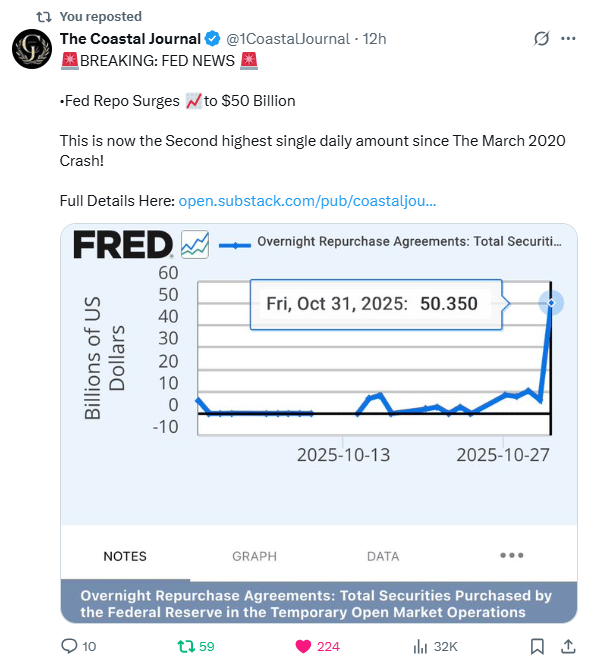

$50B overnight repo isn’t trivia—it’s a flare.

Banks just swapped a mountain of Treasuries for cash before the bell. You only hit that pump when dollars are tight.

Why this is happening now (plumbing, not headlines):

Reserves are thin and the Reverse Repo cushion is drained → fewer spare dollars in the pipes.

Rates stayed high while bond prices fell → balance sheets carry mark-to-market pain.

Leverage stacked up during the easy years → small shocks force big dollar scrambles.

Month-end funding + global carry wobbles (yen, swaps) = rush for overnight liquidity.

What it means:

Funding first, everything else second:

desks raise lending rates, trim risk, and sell the most liquid stuff to make room.

Volatility can gap—forced de-risking turns dips into air-pockets.

The policy box tightens:

persistent repo spikes nudge authorities toward more liquidity tools to cool the pipes.

Bigger picture (we’ve been pounding this for months):

The repo market is the heart of global liquidity. When its heartbeat jumps like this, it’s the system saying: too much leverage, not enough cash.

The fix is simple but not painless—de-leverage or add fuel. Either way, trust migrates toward clean collateral that settles on contact.

This isn’t doom and gloom—it’s diagnosis. The engine light is on. Manage leverage, respect funding, and remember: plumbing moves markets long before headlines do.

Good Lord. The “debasement trade” isn’t a quirky phenomenon. It’s balance-sheet math.

What’s actually happening:

Runaway deficits + rising term premia → sovereign IOUs feel riskier.

Leverage everywhere (ETFs, options, basis trades) → more claims on fewer real cushions.

Plumbing tells (repo spikes, thin reverse repo, negative swap-spread drift) → cash is scarce when it matters.

Float is shrinking (East paying premiums, vault drawdowns) → atoms outrank promises.

So capital rotates: not into “phenomena,” but into the best collateral—assets that settle on contact, don’t depend on anyone’s promise, and can’t be printed.

Translation: This isn’t a vibe shift.

It’s the market de-risking its foundation while the debt machine and leverage keep compounding.

The more we juice the system, the more undervalued pristine collateral becomes. Wake up.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply