- The Sovereign Signal

- Posts

- 🌌 The Final Convergence -When Trust Breaks, Value Reveals Itself

🌌 The Final Convergence -When Trust Breaks, Value Reveals Itself

From commercial bank shorts to sovereign reallocation, from silent liquidity fractures to war-fueled repricing — the system isn’t just wobbling. It’s transforming. This isn’t the beginning of collapse. It’s the return of what’s real.

📡 SIGNALS SNAPSHOT - Where We Are Now

Signal | Status | Interpretation |

|---|---|---|

🟡 Gold Price | $3,452 (ATH close) | Systemic breakout. Safe haven confirmed. |

🥈 Silver Price | $36.328 | Highest weekly close since February 2012. Structural regime shift confirmed, volatility tethered to 13-year resistance breach. |

🏦 Bank Silver Net Shorts | 49,099 contracts | Near all-time record. Flashpoint setup. |

VIX | +15.54% daily surge (to 20.82) | Volatility ignited. Risk-off rotation accelerating. Optionality bid returns. |

🌀 Reverse Repo Balance | $168.645B | Systemic tripwire (consecutive daily closes <$100B) |

📉 Bond Yield Divergence | Curve reinversions, stress | Trust in fiat long-dated debt breaking. |

💥 Oil Spike | Active | War premium, inflation risk. |

🌍 ECB Reserve Shift | Gold > Euro | Structural reset in monetary hierarchy. |

🧨 The Paper Volcano: Near-Record Bank Shorts & the Silver Fuse

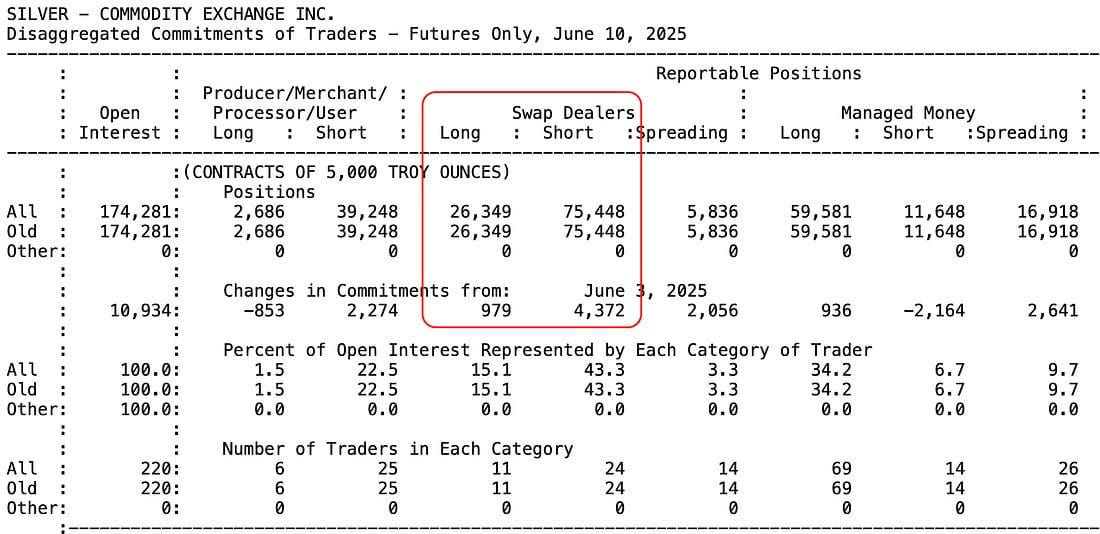

As of the latest CFTC COT report (June 10, 2025), swap dealers are now net short 49,099 contracts on COMEX silver.

That figure isn’t arbitrary.

👉 It places them within just 510 contracts of their all-time record net short position set in July 2016 (49,609 contracts).

But unlike 2016, this time they’re sitting atop a stack of:

🔥 Kinetic war in the Middle East

🏦 RRP draining toward systemic stress thresholds

🌏 Sovereign de-dollarization and gold reallocation

🧲 Non-speculative accumulation in the face of credit risk and collateral decay

This isn’t a speculative blow-off.

This is a reversion to natural law under geopolitical duress.

Credit to Chris Marcus/Arcadia Economics

🎯 Anatomy of the Trap

Let’s look closer:

Swap Dealers

Long: 26,349

Short: 75,448

Net short: 49,099

Managed Money (hedge funds)

Long: 59,581

Short: 11,648

Calm, not euphoric — no signs of bubble behavior

Open Interest: 174,281 contracts

High, but not parabolic — suggests strategic positioning, not frenzy

What does this structure reveal?

A compressed coil of suppressed energy — where the most powerful market participants are desperately trying to contain a rising tide.

Not because they think silver won’t rise…

…but because they can’t afford to let it rise.

When the net short position of the paper silver gatekeepers approaches historical extremes, it’s not a coincidence.

It’s a red flag — the kind that historically signals:

A correction or a face-melting squeeze

A volatility spike or a crack in confidence

📉 And in this macro moment — with reverse repos falling, VIX surging, and cross-border liquidity thinning — even a small external shock could light the fuse.

If just 5–10% of those 49,099 short contracts are forced to cover under pressure?

It’s not just a breakout.

It’s a detonation of trust in the system.

This time, silver’s surge won’t be speculation.

It will be revelation.

⚠️ Liquidity Echoes: VIX Screams, RRP Whispers

On the surface, Friday’s VIX surge of +15.54% (to 20.82) looks like a fear reaction to Middle East escalation.

But if you listen closer, the real warning wasn’t Friday’s scream—it’s the quiet whisper from the most critical corner of the financial system:

💧 Reverse Repo Facility (RRP) is at $168.645 billion — hovering around what seasoned observers now recognize as the plumbing fault line: $100B.

This is how systemic stress first shows up — not in price, but in plumbing.

🧠 RRP is the Canary. VIX is the Echo.

RRP tells us when money-market funds and institutions no longer have enough safe places to park capital — or when that capital is being sucked into the real economy or leveraged elsewhere.

VIX tells us when the surface starts to crack — after the pressure has already built underneath.

Right now, we’re seeing both stir in tandem:

Signal | Current Reading | Interpretation |

|---|---|---|

🧊 RRP | $168.645B | Silent drain in collateral reserves. |

🔥 VIX | 20.82 (+15.54%) | Early-stage volatility pressure emerging. |

But what matters most is not just where these levels are — it’s where they’re headed.

🕳️ The Last Two Times The Plumbing Broke

Let’s rewind to the most recent two liquidity ruptures that mainstream financial media still misunderstands…

📍 September 2019 – The Quiet Collapse Before the Crash

Overnight repo rates spiked to 10%, revealing a sudden and violent shortage of safe collateral.

Our financial institutions could no longer get cheap overnight funding — the liquidity dam cracked wide open.

The Federal Reserve responded with over $1 trillion in emergency injections over the following 6 months to suppress the funding panic.

The world thinks COVID caused the crash.

But in truth?

The fire had already started in the pipes.

💥 When pristine collateral vanishes, the system loses its heartbeat.

📍 February 2025 – The Modern Echo

Reverse Repo Facility (RRP) breached below $100B for consecutive business days — a level not seen since the facility started getting much usage in 2021.

This was a silent alarm that institutions were no longer able to offload liquidity safely.

The trust layer between the Fed and the system was deteriorating.Within weeks:

Volatility spiked

A rolling asset selloff began

Gold surged as capital fled to intrinsic value

🛰️ Liquidity Stress Always Starts Quietly

Both ruptures — 2019 and 2025 — share the same silent fingerprint:

Collateral stress before asset repricing.

But while 2019’s fracture led to $1T+ in liquidity backstops, this time…

🔒 The Fed is struggling to manage “inflation” (the ever expanding money supply).

That means no easy bailout, and no deep liquidity injections to restore trust without greater short to mid-term consequences for the economy.

You’re not watching the start of a market correction.

You’re watching the system run out of safe exits.

📉 Bond Swap Spread Inversion - When the Bedrock Breaks

Forget the yield curve. The real fracture is showing up in the foundation itself:

🔻 The 10-Year Swap Spread — the difference between the 10-year Treasury yield and the 10-year interest rate swap — remains deeply negative at -27.36 basis points.

Why this matters:

In a functional market, the swap spread should be positive, since swaps carry counterparty risk, while Treasuries are "risk-free" government debt.

But a negative swap spread means Treasuries are trading as if they’re riskier than private-sector derivatives — a complete inversion of natural financial logic.

📌 This is not a technicality. It’s a warning:

The very instruments meant to anchor global trust are now misfiring at the core.

The swap spread inversion screams that:

The plumbing between credit, collateral, and pricing is broken.

Demand for real collateral is displacing synthetic structures.

The market is beginning to treat sovereign debt as less pristine than it claims.

Which brings us to the next domino…

🏛 ECB Reserve Shift - Gold Surpasses the Euro

The European Central Bank just confirmed what the market has been whispering:

🌍 Gold is now the world’s second-largest reserve asset — eclipsing the euro.

USD = 46%

Gold = 20%

Euro = 16%

Other = 18%

This isn’t just symbolic — it’s systemic.

At the same time sovereign bond spreads are breaking basic market logic (swap spreads inverting), central banks are replacing malfunctioning debt instruments with timeless stores of trust.

📌 The takeaway:

When institutions that built the fiat order begin exiting it from within — the revaluation has already begun.

And they’re not rebalancing into tech stocks or real estate…

They’re rebalancing into gold — the asset that doesn’t default, doesn’t require swaps, and doesn’t rely on trust to hold value.

🛢 Oil - The Geopolitical Pressure Valve for the Collateral Crisis

At first glance, oil’s recent price action — spiking to 77.62 and closing at 72.98 amid escalating Iran-Israel tension — appears to be war premium.

But step back and a deeper pattern emerges:

As trust in sovereign bonds deteriorates (via swap spreads),

And gold reasserts its place as collateral (via reserve data),

Oil becomes the volatility valve that absorbs the geopolitical blowback.

Here’s why:

Energy underpins all real production and trade — it's the physical backing of fiat currency, even if unstated.

As fiat collateral weakens, oil reprices to reflect rising systemic entropy.

Supply chain stress, naval chokepoints, and political realignments all flow through oil.

🧠 What this means:

Oil is no longer just an inflation input — it is becoming a barometer for the desynchronization between monetary theory and geopolitical reality.

In other words:

Bonds are malfunctioning.

Gold is ascending quietly.

Oil is adjusting violently.

🔍 Who Gains When Oil Surges & Fear Rises?

✅ U.S. Energy Sector

Elevated oil prices rescue distressed shale firms and energy-backed debt markets.

LNG exports gain pricing power vs. Russian supply.

Margins surge for U.S.-based producers — boosting sectoral equity performance.

✅ Geopolitical Strategists

Higher oil = strategic pain for adversaries:

China, heavily energy-dependent

Europe, still exposed to global supply routes

Iran, now inflated economically and politically — giving U.S./Israel a tighter lever

✅ Central Banks in a Bind

Inflation via energy gives plausible deniability

This helps justify rate pauses, or slow pivots, while preserving the appearance of control.

✅ Sovereigns Repositioning Reserves

Spiking oil = falling real yields.

Which = rising gold demand.

The ECB’s recent reserve allocation (gold > euro) is part of this global shift toward intrinsic-value collateral.

🧭 The Signals Align

Across asset classes, central bank behavior, and volatility indicators, the message is unmistakable:

Silver’s structure mirrors historic pressure points — but this time, it's surrounded by geopolitical ignition and unprecedented base layer malfunction.

Reverse repos continue to whisper of systemic fragility, even before price-based fear catches up.

The VIX has begun its echo, signaling risk-on retreat and optionality repricing.

Bond market mechanics are breaking logic, with swap spreads inverting and trust in long-duration fiat debt evaporating.

Gold is no longer the contrarian bet — it’s stealthily becoming the new base layer. The ECB just told us as much.

Oil spiked not just because of war… but because the system needed a pressure valve release.

📌 This is not noise. It’s choreography.

A slow-motion reconfiguration of the global collateral hierarchy.

Bonds are failing. Gold is ascending. Silver is cracking its constraints.

And in this fragile rearrangement, only those anchored in reality will remain standing.

⚔️ Return to Substance. Anchor in the Real.

When the world wavers —

When volatility howls and headlines blur —

The wise don’t chase noise.

They return to weight.

Not the illusions of pixels or promises,

But the enduring truth of form, density, and gravity.

Gold and silver are not just assets.

They are ancestral trust, forged in fire, immune to lies.

📡 As a Sovereign Signal reader, you already feel it:

This isn’t just a market cycle.

It’s a monetary metamorphosis — and you were born for this moment.

You’re not running from collapse.

You’re stepping into alignment.

⚖️ Access direct-dealer pricing

📦 Get fully insured delivery to your doorstep or vault

🪨 Hold what endures when systems reset

If you're ready to exit the illusion — and step into sovereign truth —

📩 reply to this message or email:

This isn’t about panic.

This is about positioning your soul and your savings where gravity still holds.

Because when the illusions dissolve,

Only the real remains.

With strength and grace,

Luke Lovett

📲 Cell: 704.497.7324

🌐 Undervalued Assets | Sovereign Signal

📧 Email: [email protected]

🔐 Legal Disclaimer 🔐

The content provided herein is for informational and educational purposes only and should not be construed as financial, investment, legal, or tax advice. I am not a licensed financial advisor, investment professional, or attorney. The views expressed are solely those of the author and are not intended to be relied upon for making investment decisions.

While every effort has been made to ensure the accuracy of the information presented, no guarantee is given that all content is free from error, omission, or misinterpretation. Market data, trends, and conditions are subject to rapid change, and past performance is not indicative of future results.

Some views expressed may reference public insights from respected analysts and commentators. Some third-party content may be paraphrased or summarized for educational purposes only, with attribution, and does not imply endorsement or affiliation. All rights remain with the original creators.

Always conduct your own research and consult with a licensed financial advisor or registered investment professional before making any investment decisions. By reading this publication, you agree not to hold the author liable for any losses or damages resulting from the use of this information.

I am not a metals dealer. All orders are processed directly by a licensed precious metals dealer. I do not hold funds, process transactions, or provide personalized investment advice.

Reply