- The Sovereign Signal

- Posts

- The First Fed Dissent Since ’93 and the Cracks It Exposed

The First Fed Dissent Since ’93 and the Cracks It Exposed

What if the Fed’s most powerful lever—lower rates—no longer works? Powell’s refusal to cut may say more about fear than strategy... and the 10-Year is screaming it.

Credit to George Gammon, who was the first I saw point this out in yesterday’s YouTube video: for the first time since 1993, two Fed members openly dissented on a policy decision.

Surely there’s been quiet dissent at the Fed since 1993—but to vocalize it? That’s a different story. With Trump calling for rate cuts, two Trump-appointed Fed members just broke ranks… but the real story is why.

The real question is: why now? Why speak up vocally, when quiet internal dissent is always present? Here’s what’s likely happening beneath the surface:

The rate cut lever is breaking.

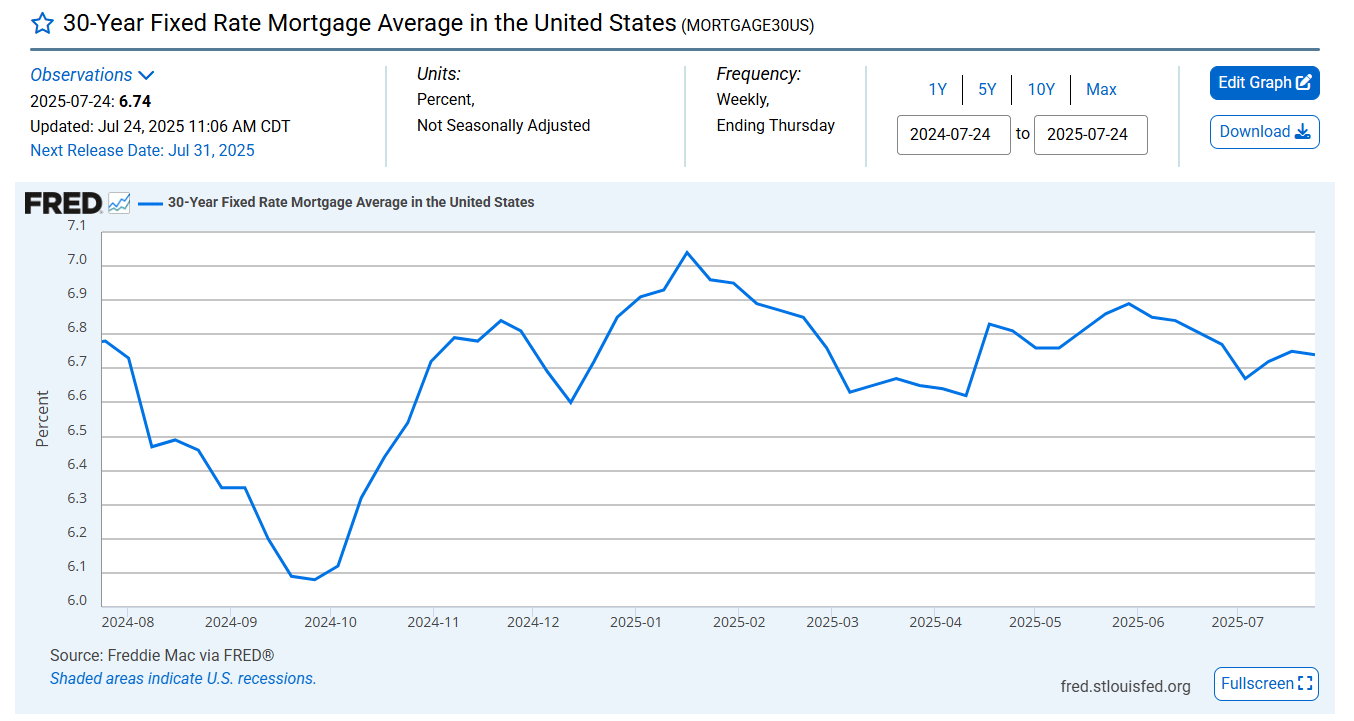

From September 15th, 2024 to December 2024, the Fed cut 100bps… but the 10Y rose by ~63bps and 30Y mortgage rates increased from 6.09% to 6.74%.Powell is losing control of the long end.

Cutting rates now could backfire—triggering yields to rise further and exposing the Fed’s impotence. That’s worse than doing nothing.So these dissents may be a pressure valve.

A trial balloon floated through the Trump-aligned wing of the Fed, gauging how markets react to internal divergence—without Powell officially acting.

In short: This wasn’t just a political signal. It was a smoke signal from the core—the Fed knows the lower-rates lever may no longer work… and that’s the scariest signal of all.

The Fed Cut 100bps. The 10-Year Yield Rose.

Again, from September 15th, 2024 to December 2024, the Fed cut rates by a full 100bps. And yet…

The 10-year yield rose from ~3.646% to 4.356% → a +71 bps move.

The 30-year fixed mortgage rate jumped up from 6.09% to 6.74%.

Let that sink in: 100bps of easing → tighter real-world borrowing. The Fed pulled the lever. And the lever snapped.

Signal | Latest Level | Interpretation | Zone |

|---|---|---|---|

10-Year Swap Spread | –26.1 bps | System still prefers synthetic exposure. Trust eroding at the foundational layer. | 🔴 Red |

Reverse Repos (RRP) | $155.481B | Collateral buffer draining fast. Market more exposed to volatility shocks. | 🟠 Orange |

USD/JPY | 149.74 | Yen weakening again. BoJ pinned defending yields—supercharges carry trade fragility. | 🟡 Yellow |

USD/CHF | 0.8133 | Quiet capital shift toward safety. CHF strength signals underlying preservation flows. | 🟠 Orange |

3-Year SOFR–OIS Spread | 27.3 bps | Term funding stress building. Forward liquidity confidence deteriorating. | 🔴 Red |

SOFR Overnight Rate | 4.36% (3rd day in a row) | Short-term stress plateauing at elevated levels. Suggests sticky background fragility. | 🟡 Yellow |

SLV Borrow Rate | 0.71% (4.7M avail.) | Borrow tension largely subsided but silver price remains higher than where it was when borrow strain began on July 10th. | 🟡 Yellow |

COMEX Silver Registered | 191.54M oz | Leverage rising. Only ~22.6% of OI could fully empty vaults—underscores structural fragility. | 🟠 Orange |

COMEX Silver Volume | 83,085 | Still elevated amid tight borrowing and physical constraints—momentum active. | 🟡 Yellow |

Silver Open Interest | 169,131 | 4.42:1 leverage. Fragile paper-to-metal ratio. Systemic stress point if unwind begins. | 🟠 Orange |

GLD Borrow Rate | 0.43% (5.6M avail.) | Stable for now. No short squeeze—but calm can mask storm in gold's monetary role. | 🟢 Green |

COMEX Gold Registered | 20.92M oz | 47% of OI could drain vaults. Stronger footing than silver—but still thin. | 🟡 Yellow |

COMEX Gold Volume | 252,423 | Active. Institutions remain engaged—suggests alert positioning amid macro signals. | 🟡 Yellow |

Gold Open Interest | 442,545 | 2.11:1 leverage. Lower than silver, but still concentrated. | 🟠 Orange |

UST–JGB Spread | 2.8% | Yield gap near highs. Duration dislocations fueling global risk rotation. | 🟠 Orange |

Japan 30Y Yield | 3.088% | Near 2011–13 highs. BoJ nearing policy limits—adds systemic fragility via yen channel. | 🟠 Orange |

US 30Y Yield | 4.884% | Long-end pressure remains. Quiet repricing of capital continues beneath surface calm. | 🟠 Orange |

SOFR Daily Volume | $2.754 Trillion | Greater and greater loads concentrated in overnight plumbing—any crack could ripple violently. | 🟠 Orange |

Powell’s Real Fear Isn’t Recession—it’s Losing Control

The market isn’t responding to rate cuts the way textbooks promise. That’s not just inconvenient—it’s existentially destabilizing for a central bank built on narrative control.

If Powell cuts again and yields rise again…

It exposes that the Fed has lost grip on the long end. '

It could supercharge the exodus from sovereign debt to hard assets.

It signals to global capital allocators: "This system is no longer responsive."

Which is why Powell may hold the line—even at the cost of a recession. It’s not the downturn he fears. It’s the undeniable confirmation that the lever no longer works—and the illusion of control dies with it.

A System Built on Control Cannot Survive the Loss of It

This isn’t just about basis points. It’s about the illusion of command. And that illusion is eroding—just like the swap spread has been warning (currently at -26.1bps).

Every week the 10-year yield refuses to respond “correctly”…every time mortgage rates rise despite policy shifts…every time real-world borrowing gets harder as rates fall……it validates the deeper truth: the foundation is breaking free from the script.

The Bigger Picture: This Is a Macro-Paradigm Reversal

Dissent inside the Fed → cracks in consensus.

Real-world yield inversion → cracks in credibility.

Bond market insubordination → cracks in monetary transmission.

And in the face of all that? Stocks hit new highs. Retail flows chase memes. Bitcoin pumps.

The entire system is now fueled by speculation on what the Fed will do next, even as the Fed’s actions no longer drive the outcomes. This is how the late-stage illusion behaves before a reality reasserts itself.

When Fundamentals Matter Again, What Will Still Matter?

If rate cuts no longer drive yields…if “guidance” no longer calms volatility…if Treasuries no longer represent safety……then only intrinsic value remains.

Which is why gold and silver are rising beneath the surface noise. They don’t rely on trust. They don’t answer to Powell. They don’t require market belief to hold value. They just are.

The Cracks Aren’t Just in the Fed—They’re in the Foundation

Two open dissents. A 100bps cut that tightened borrowing. The long end defies the Fed.

This isn’t noise—it’s system failure. Gold and silver aren’t reacting—they’re revealing. The game ran on confidence. Confidence is cracking.

Now real value rises—not because the system works, but because it’s breaking. The wise don’t wait for the signal. They become it. That’s why I’ve partnered with HardAssets Alliance.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

When liquidity means trust, and trust is cracking, the wise step out of the simulation and into sovereignty. Secure your foundation—before the next wave hits. Move before the headlines catch up.

Luke Lovett

📲 Cell: 704.497.7324

🌐 Undervalued Assets | Sovereign Signal

📧 Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply