- The Sovereign Signal

- Posts

- 🧙♂️ The First to Fall: Japan, Oracle of the Endgame

🧙♂️ The First to Fall: Japan, Oracle of the Endgame

When the oldest disciple of Keynes begins to tremble, the whole temple shakes.

While we typically focus on the structural spread between U.S. and Japanese 10-year yields, today we turn our attention to something even older—and more ominous.

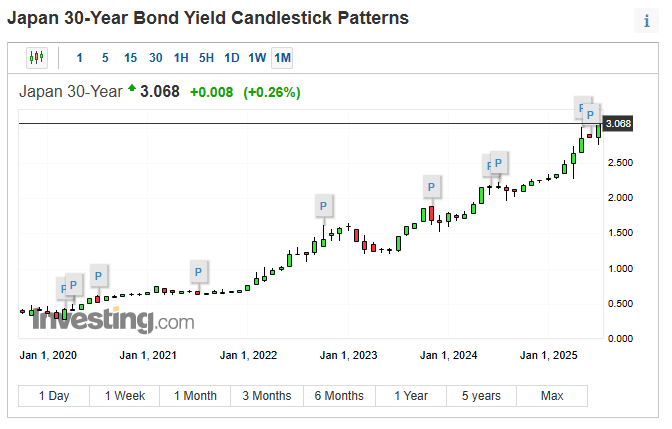

The Japan 30-Year Government Bond yield is now breaking out of a long-term channel and accelerating toward uncharted territory.

When the 30-Year starts to rise aggressively, it’s not reacting to this quarter’s CPI print.

Japan’s yield curve has been under heavy control via Yield Curve Control (YCC) for years—particularly at the short and intermediate maturities.

But the long end—the 30-Year—is harder to suppress without destroying the currency.

When it moves, it often signals that the Bank of Japan is losing control.

It’s a crack in the myth of permanent debt suppression.

It means belief is breaking down at the deepest time horizon in the weak link of the intricately interconnected global financial system.

For decades, Japan has served as the canary in the Keynesian coal mine—an experimental subject in the long game of zero rates, yield curve control, and demographic stagnation.

What begins in Japan has a way of quietly metastasizing into Western markets.

The West’s fiscal future, in many ways, foretold by Japan.

But now, that past is erupting into the present.

🌍 Why This Matters to the Entire World

Japan is the largest foreign holder of U.S. Treasuries.

Rising JGB yields compel Japanese institutions to sell Treasuries to defend their currency or domestic portfolios—exporting rate volatility into U.S. debt markets.

Global Carry Strategies Begin Here. When JGBs yield higher, the whole global yield differential carry trade breaks.

That pressures hedge funds, banks, and FX speculators to unwind dollar trades and reallocate into JPY—causing U.S. liquidity spasms.

The Doom Loop Awaits. If the BOJ tightens to calm the 30Y, the yen collapses.

If it defends the yen, yields go vertical. Either path is contagion.

And the Western world—leveraged to the hilt—is structurally less prepared for either outcome than Japan was.

Signal | Level | Interpretation | Zone |

|---|---|---|---|

10-Year Swap Spread | –28.7 bps | Deep negative spread = systemic collateral rejection; Treasuries losing trust in funding stack | 🔴 Red |

Reverse Repos (RRP) | $219.415B | This has been remarkably stable in recent days, albeit near the lower end of the caution zone. | 🟠 Orange |

USD/JPY | 146.63 | Global liquidity easing back up—tripwire level for global carry trade unwind is under 140 | 🟠 Orange |

USD/CHF | 0.7963 | Swiss franc at historic strength—flight to true safety underway | 🔴 Red |

SOFR 3Y OIS | 25.5 bps | Forward funding concerns persist—risk still priced into the curve | 🟠 Orange |

SOFR Overnight Rate | 4.33% | Nominally stable—back at Fed effective funds rate | 🟢 Green |

SOFR Overnight Volume | 2,814 | Volumes cyclically continue to go higher—this is not good paired with spread stress | 🟠 Orange |

SLV Borrow Rate | 0.71% | No squeeze yet—but short positioning could flip quickly | 🟡 Yellow |

GLD Borrow Rate | 0.59% | Paper gold tension building—early signs of stress in bullion markets | 🟡 Yellow |

COMEX Gold Warehouse | 36,876,794 oz (Registered = 20.2M) | Open interest on COMEX is equivalent to 44.38M ounces of gold. Less than half that is available for physical delivery (registered). | 🟡 Yellow |

Gold/Silver Ratio | 89.73 | Silver still undervalued—capital crowding into gold for trust | 🔴 Red |

10Y UST – JGB Spread | 2.897 | Watch out for a break above 3, towards 3.5% | 🟠 Orange |

🔄 Structural Correlation: When Japan Moves, U.S. Debt Markets Shake

This is not theoretical.

It’s balance sheet math.

Japan is the largest foreign holder of U.S. Treasuries.

When the JPY weakens and domestic yields rise, Japanese institutions face a dilemma:

Do they defend their currency by selling Treasuries and repatriating cash?

Or do they defend their bond market by letting the yen collapse?

They can’t do both.

And when the BOJ’s grip weakens at the long end (like it is now), they are forced into action.

This is the doom loop:

📈 Japanese yields rise

💸 Japanese sell Treasuries to restore FX and portfolio balance

🇺🇸 U.S. Treasury yields spike from foreign selling

🌪️ U.S. markets wobble → risk-off → global liquidity tightens

🔁 Japan gets hit again via weaker exports and capital flight

🌀 Rinse and repeat

🧱 Everything Rests on U.S. Debt Markets

The U.S. Treasury market is the collateral base of the world.

Every repo line, shadow credit facility, and bank balance sheet is anchored to it.

If the U.S. long end sells off too fast? 🧨 Funding markets blow out.

If Japan is the first to dump? 🧨 Swap spreads and reverse repos react instantly.

If FX-hedging becomes too costly? 🧨 Liquidity evaporates from key nodes of the system.

"The world does not rest on Atlas’ shoulders. It rests on U.S. Treasury duration—and Atlas is watching Japan."

🔭 So when the Japan 30-Year bolts higher quickly—like it just did—

that’s not just a local yield spike.

That’s a signal from the deepest layer of belief in sovereign solvency.

And since Japan’s balance sheet holds $1 trillion+ in Treasuries, the correlation is more than directional—

it’s causal.

Japan doesn’t just mirror the fragility of the U.S. system.

It triggers it.

If the old man stirs too violently, the whole house begins to tremble.

🕊 The Butterfly in Tokyo: Why Japan’s Bond Market Shapes the World

You’ve heard the saying: “When Japan sneezes, the rest of the world catches a cold.”

It’s not poetic exaggeration—it’s a macro reality.

Because in today’s financial system, Japan sits at the foundation of global liquidity plumbing.

🧠 Why? Let’s break it down

Japan has trillions in domestic savings, some of the lowest yields in the developed world, and a massive pile of U.S. Treasuries.

Japanese institutions—pension funds, insurers, banks—have long funded their obligations by borrowing cheap yen and parking that capital abroad.

This is called the yen carry trade:

Multiply this by hundreds of billions, and you have a global flow engine that props up U.S. debt markets and dampens global volatility.

🔥 But what happens when Japan’s yields start rising?

Suddenly, that carry trade starts to unravel.

If Japanese long-term bonds (like the 30-year JGB) start offering higher yields…

Japanese capital stops flowing outward.

In fact, capital starts flowing home—reversing the carry trade.

💣 The Impact?

U.S. Treasuries sell off.

Fewer buyers from Japan → More supply risk in the U.S. → Higher yields.

Dollar funding tightens.

As Japanese institutions unwind dollar positions, liquidity in U.S. markets dries up.

FX markets convulse.

Massive buying of yen to cover positions leads to JPY strength and USD weakness, often triggering forced selling elsewhere.

Hedge funds get squeezed.

The entire global macro community, levered long dollars or U.S. bonds, gets caught offside.

📉 That’s why a spike in Japan’s 30-year yield isn’t just a Japanese story—it’s a global liquidity tripwire.

🕳 Why It’s So Fragile

Japan is the only major sovereign still trying to suppress long-term yields despite:

Rising inflation,

A falling currency,

And soaring debt.

That makes Japan the weakest structural link in the global debt chain.

When the pressure becomes too much and the BOJ is forced to let go of the long end, everything connected to it—especially U.S. Treasuries—feels the shock.

🧭 Bottom Line

Japan is not a sideshow. It’s the quiet cornerstone.

When Japanese yields move, they shake the scaffolding of global finance.

And when the long end of the JGB curve starts to buck like it is now, you don’t wait around.

You prepare.

🔁 The Doom Loop: Japan’s No-Win Scenario and the West’s Blind Spot

It’s not just a bond chart.

It’s a warning.

Japan has reached a point where every path forward leads to structural pain.

And because Japan sits at the fulcrum of the global financial system, that pain doesn’t stay contained.

Let’s walk through it.

⚖️ The Two Paths Japan Can Take

1. Tighten Monetary Policy to Calm Bonds

If the BOJ raises rates or cuts back bond purchases to calm the surge in the 30-year yield…

It signals the end of easy money.

And what happens next?

💣 The yen collapses.

Why? Because Japan’s government debt is so massive, and growth so tepid, that any real tightening quickly chokes the system.

And a weak yen causes ripple effects:

Imports become unaffordable.

Inflation spikes.

Capital flees Japanese assets.

Confidence evaporates.

2. Defend the Yen

The BOJ could instead intervene to strengthen the yen—buying yen, selling USD.

But doing so means they must let go of yield curve control (YCC).

In plain English: Japanese bond yields go vertical.

And that’s the true trigger:

Rising JGB yields destroy the global carry trade.

Japanese capital stops flowing into U.S. Treasuries.

Global bond markets sell off.

FX volatility erupts.

🧨 Why It’s a Doom Loop

Defend the currency, and your debt market explodes.

Defend the debt market, and your currency implodes.

There’s no safe way out.

That’s the loop.

And every tick higher in the Japan 30-year yield is one step closer to the trigger point.

🌍 The West Is Even Less Prepared

Here’s the part no one wants to admit:

The Western world is more fragile—**more indebted, more divided, and more addicted to low rates—**than Japan ever was.

Japan has a unified population and a culture of domestic savings.

The U.S. has political gridlock, retirement shortfalls, and a financial system built on leverage.

When this loop snaps, it won’t just be a Japanese crisis.

It will be a global repricing event—with the U.S. Treasury market at the center of the blast radius.

🧭 What You Can Do

Watch Japan’s 30-year like a hawk.

It’s the tell. The fuse. The future.

Hold gold and silver.

Real money. No counterparty. No loop.

Stay liquid and flexible.

The next few months may be the most important of the decade.

🪙 Preferred Access 🪙

The system is fragmenting from the edge—and the pressure is building at the core.

Japan is the oldest node in the fiat web.

The sovereign most addicted to low rates… is now the one showing the earliest signs of convulsion.

And when Japan shakes, the entire Western structure trembles.

Why?

Because Japan doesn’t just own its own dysfunction—it owns ours too.

They’re the largest foreign holder of U.S. Treasuries.

When their yields spike, they must choose:

🟣 Defend their currency, or

🟠 Defend their bonds.

They can’t do both.

And when the dam breaks, it won’t just be a Japanese problem—it’ll be a collateral problem for the entire world.

We’re watching this unfold right now through the 10-year swap spread, which has been deeply negative for months.

That’s not just a chart anomaly—it’s a mirror:

📉 Banks are backing away from government debt.

📉 Synthetic hedges are being prioritized over real bonds.

📉 Trust is quietly exiting the system—long before headlines catch up.

Why? Because under Basel III, and even with the SLR relief…

➡️ Capital is still punished for trusting promises.

➡️ Only real collateral gets rewarded.

That’s why gold isn’t just a hedge anymore.

It’s a requirement for participation in the next cycle.

And silver? It’s the signal beneath the signal—

A volatile but vital accelerant to the revaluation ahead.

If the system resets at the table of real value—

Those who hold real weight will write the terms.

That’s why I’ve built Sovereign Signal access to non-CUSIP, sovereign-grade bullion that transcends counterparty dependence:

📦 Fully insured delivery — to your vault, your doorstep, or wherever you store peace of mind

⚖️ Straightforward pricing — real bars, real rounds, real ounces in your hand

📩 Just reply to this report or email [email protected] to secure access.

Because in a world of decaying trust, gold isn’t just insurance—it’s admission.

Luke Lovett

📲 Cell: 704.497.7324

🌐 Undervalued Assets | Sovereign Signal

📧 Email: [email protected]

🔐 Legal Disclaimer 🔐

The content provided herein is for informational and educational purposes only and should not be construed as financial, investment, legal, or tax advice. I am not a licensed financial advisor, investment professional, or attorney. The views expressed are solely those of the author and are not intended to be relied upon for making investment decisions.

While every effort has been made to ensure the accuracy of the information presented, no guarantee is given that all content is free from error, omission, or misinterpretation. Market data, trends, and conditions are subject to rapid change, and past performance is not indicative of future results.

Some views expressed may reference public insights from respected analysts and commentators. Some third-party content may be paraphrased or summarized for educational purposes only, with attribution, and does not imply endorsement or affiliation. All rights remain with the original creators.

Always conduct your own research and consult with a licensed financial advisor or registered investment professional before making any investment decisions. By reading this publication, you agree not to hold the author liable for any losses or damages resulting from the use of this information.

I am not a metals dealer. All orders are processed directly by a licensed precious metals dealer. I do not hold funds, process transactions, or provide personalized investment advice.

Reply