- The Sovereign Signal

- Posts

- 🌐 The Great Realignment - Why Gold's Leaving Vaults & Silver’s Leading Signals

🌐 The Great Realignment - Why Gold's Leaving Vaults & Silver’s Leading Signals

Follow the flow of capital—not the noise—and you'll find the future unfolding

🧭 SOVEREIGN SIGNAL DASHBOARD

Indicator | Current Level | Interpretation |

|---|---|---|

Silver Spot | $36.39 | 🚀 Breakout confirmed — highest close since Feb 2012. |

Bank Net Shorts (COT) *Disaggregated - Futures Only -as of June 3rd | 45,706 contracts | 🔻 Second highest net short ever. Positioned similarly to 2016 post-$21 reversal. |

SLV Inflows (Past Week) | $460M | 🟢 Largest inflow in a year. Institutional repositioning confirmed. |

SLV Call Volume (June 6) | All-Time High | 📈 Speculative ignition. Options market confirms directional conviction. |

Gold/Silver Ratio | ~91:1 | 📉 Compression likely. Silver likely to outperform in mean reversion to 70–75. |

COMEX Physical Deliveries (May 2025) | +517% YoY (Gold 100 oz) | ⛓️ Unprecedented physical withdrawal. Paper-market unwind accelerating. |

LBMA Free Float (Est.) | ~7.5M oz | 🧨 Critically tight. Estimated against the 228M oz (from 236M oz) needed to hedge bank shorts. |

🌍 COMEX & LBMA: The Twin Engines of Global Gold & Silver Pricing

The COMEX (New York) and LBMA (London) don’t just facilitate silver trades —

*they collectively determine the global price of gold and silver.

Together, they’ve long defined silver’s price narrative — but now, that narrative is shifting.

COMEX, once a dominantly paper market, is being reclaimed by physical delivery.

LBMA, the largest over-the-counter hub, is seeing its inventories dwindle, shining a spotlight on silver’s true scarcity.

While much of the volume is driven by futures and unallocated contracts,

price discovery still begins here — influencing producers, refiners, industrial buyers, and investors worldwide.

Today, however, that discovery process is under pressure from the physical market:

COMEX has seen rising delivery demand and contract conversions, tightening available float.

LBMA free float has dwindled to levels that raise important questions about available supply vs open interest.

This isn't a breakdown.

It's a rebalancing — as real-world constraints begin to reassert influence over a market long dominated by leverage and paper volume.

As physical delivery gains relevance,

we may be entering a new phase of price discovery —

one where actual supply, demand, and settlement take on renewed significance.

📉 COMEX Inventories: The Reversal Heard Around the World

🪙 GOLD: The Smartest Money Is Moving—Fast

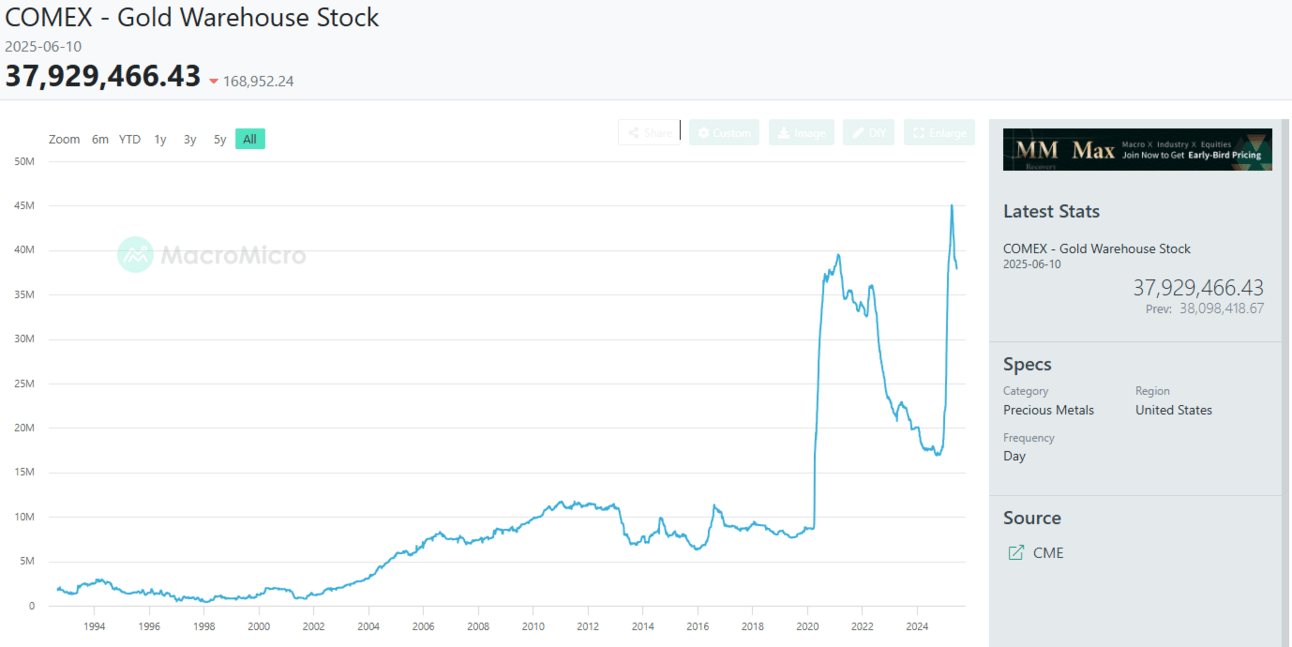

Since November 2024, COMEX gold inventories began a historic vertical climb, rising from ~18M oz to over 45M oz by early April 2025.

📉 But from April to June 2025, inventories have plunged over 8 million ounces, falling to 37.9M oz — the steepest and quickest drop of any recorded since MacroMicro’s COMEX warehouse data began in the early 1990s.

This mirrored the extraordinary inventory surge seen during the 2020 COVID panic — when global liquidity was being fire-hosed into the system.

But the pace of the current reversal is far more rapid and extreme:

📊 2020–2021:

Inventories surged from ~8 million oz (March 2020) to ~39 million oz (February 2021).

The gold stayed put. COMEX became a safehouse — a refuge from London’s fractional metal games.

Over the next 3 years, COMEX inventories slowly drained, reaching ~17M oz by October 2024.

🧠 Why?

Because smart money is moving before the storm.

Earlier this year, LBMA delivery times stretched to 4–8 weeks, a silent alarm that something was broken behind the scenes.

COMEX became the next best option for true physical access/storage…

Now, that gold is disappearing too.

And unlike in 2020, it’s not staying to comfort the market.

It’s vanishing.

🚚 Where Is It Going?

It’s not staying in the financial system.

These are not retail deliveries. These are ~$300,000 100-oz bars.

🔻 Not LBMA — too many claims per bar, not your keys

🔻 Not COMEX — too public, too surveilled

🔐 Likely destinations:

Private vaults in Switzerland, Singapore, UAE, and the Cayman Islands

State storage outside of BIS clearing lanes

Unknown offshore facilities pre-positioned for a parallel system transition

🧠 Who Are They?

These are entities with both motive and means. Think:

Sovereign accumulators (e.g., central banks or state-linked funds not willing to disclose their final destination)

Strategic ultra-HNWIs/family offices with insider geopolitical insight

Large private buyers moving via trusted custodians, likely using proxies to avoid public trace

Why so quiet?

Because you don’t front-run a currency reset.

You prepare for it quietly, then make the switch once the doors lock behind everyone else.

🔍 What Are They Doing With It?

They’re getting their collateral out of the casino.

Not to speculate — to settle the future.

This is metal changing systems, not owners.

You don’t make this move unless you believe that:

Paper markets are a trap

A monetary bifurcation is imminent

You want to be on the right side of Bretton Woods III

Gold is no longer just a store of value.

It’s the ticket to the next system —

the bargaining chip to negotiate a seat at the table for Bretton Woods III.

Those taking delivery aren’t just hedging.

They’re positioning for power —

in a world where fiat loyalty will mean nothing,

but real collateral will mean everything.

Every bar taken off COMEX or out of LBMA isn’t just a trade.

It’s a move on the chessboard of global reset —

quiet, deliberate, irreversible. ♟️🏦🌍

🧮 LBMA SILVER Free Float Estimate: ~7.5M oz

But the COMEX is only half the story.

Because while gold has been flooding out of New York vaults…

London is at risk of being drained of silver.

According to Chris Marcus of Arcadia Economics, a quiet but urgent equation has emerged:

Total LBMA silver holdings: 236M oz

Estimated bank short hedges: 228.5M oz

Remaining “true float”: ~7.5 million ounces

That’s 3 days’ worth of global industrial silver demand.

And it assumes perfect hedging, zero misreporting, and no central bank reclassification.

You know the real world doesn’t work like that.

🧠 What does this mean?

It means the second-largest monetary metal on Earth is skating on a razor-thin float —

and the illusion of liquidity is fading.

In 2021, the LBMA warned that if silver demand stayed elevated, London would run out of deliverable stock in weeks.

That wasn’t a joke.

Now, with multi-year deficits and rising sovereign hoarding, we may have crossed that invisible line —

where scarcity is no longer theoretical.

It’s visible.

It’s verifiable.

It’s now.

This is the phase where retail runs out of time.

🧩 CONCLUSION: THE GREAT RE-PRICING HAS BEGUN

This is restructuring — financial, systemic, and psychological.

The silver market has pierced through its long-suppressed ceiling.

The gold market has become a geopolitical chessboard.

And the two largest pricing engines — COMEX and LBMA — are no longer functioning as business-as-usual mechanisms of leverage and liquidity…

They are exit ramps for those with ears to hear.

💡 What we’re witnessing:

The paper derivatives complex is straining.

Price is no longer just a function of speculative positioning — it's colliding with reality.Physical delivery is surging.

Not because people are panicking — but because those who understand the game are quietly removing their pieces from the board.Inventories are reversing violently.

This is not random. It’s anticipatory. It’s the front-running of a reset.Options and ETF flows confirm conviction.

This is not just a trade. It’s a statement: The world is changing.

🔮 PROBABILITY MATRIX

Scenario | Probability | Signals Supporting It | Interpretation |

|---|---|---|---|

🔼 Silver continues breakout toward $40–42 zone | 🟢 40% Likely | 🔹 All-time high SLV call volume | Institutions are repositioning. Specs are awake. Price action is clean. If silver closes above ~$37.58 on a quarterly basis, this accelerates. |

🔄 Short-term pullback to $34–35.50 before continuation | 🟠 20% Likely | 🔹 COMEX net short positioning elevated (2nd highest ever) | Temporary reversion. If this occurs, it’s a buy-the-dip for those prepared. Not a breakdown — a reload. |

🔻 Surprise price suppression event ("Mr. Slammy") returns | 🟠 15% Possible | 🔹 Options market open interest large | If coordinated suppression occurs, it may be short-lived and less effective than in past years. Physical exit demand may overpower it. |

💥 Systemic liquidity event accelerates gold/silver repricing | 🔴 10% Increasing | 🔹 Gold making all-time highs month after month | This is the "Bretton Woods III" scenario. Low-probability, high-impact. Not yet priced in — but being positioned for. |

🏁 $50+ Silver in next 6–12 months | 🟣 15% Long-Tail | 🔹 Structural supply deficits | This would likely require a macro shock + clear GSR compression trend + breakout above 2011 high. Not imminent — but increasingly plausible. |

🧠 Final Thought

This isn’t a rally. It’s a reshuffling of power.

The COMEX and LBMA are no longer just paper playgrounds — they are the battlegrounds where real collateral is being reclaimed.

Every metric — from SLV inflows to delivery volumes to LBMA float — signals that price is finally being pulled toward truth by the gravity of physical scarcity.

The system isn’t breaking.

It’s being forced to acknowledge reality.

And in that recalibration, silver may not just catch up.

It may lead.

🛡️ Gold and Silver You Can Actually Stack. At Prices That Make Sense.

If you’re looking to move capital into something real — not rare coins or collectibles, but pure investment-grade bullion — I’ve got you covered.

Through direct relationships with top-tier, licensed metals dealers, Sovereign Signal readers get:

📦 Fully insured delivery to your door or vault

⚖️ Dealer-direct pricing on gold and silver bars, rounds, and bullion

📩 Just reply to this report or email [email protected] to get connected.

Luke Lovett

📲 Cell: 704.497.7324

🌐 Undervalued Assets | Sovereign Signal

📧 Email: [email protected]

🔐 Legal Disclaimer 🔐

The content provided herein is for informational and educational purposes only and should not be construed as financial, investment, legal, or tax advice. I am not a licensed financial advisor, investment professional, or attorney. The views expressed are solely those of the author and are not intended to be relied upon for making investment decisions.

While every effort has been made to ensure the accuracy of the information presented, no guarantee is given that all content is free from error, omission, or misinterpretation. Market data, trends, and conditions are subject to rapid change, and past performance is not indicative of future results.

Some views expressed may reference public insights from respected analysts and commentators. Some third-party content may be paraphrased or summarized for educational purposes only, with attribution, and does not imply endorsement or affiliation. All rights remain with the original creators.

Always conduct your own research and consult with a licensed financial advisor or registered investment professional before making any investment decisions. By reading this publication, you agree not to hold the author liable for any losses or damages resulting from the use of this information.

I am not a metals dealer. All orders are processed directly by a licensed precious metals dealer. I do not hold funds, process transactions, or provide personalized investment advice.

Reply