- The Sovereign Signal

- Posts

- The Great Repricing Begins

The Great Repricing Begins

The entire global financial system is built on our bond market. That base layer is cracking—and it’s forcing the market to reach for real, non-rehypothecatable assets. This is how the largest debt super-cycle in history mutates into the largest commodities super-cycle in history.

Over the past year and a half, as global debt continues it’s astronomical rise and central banks worldwide have quietly dumped Treasuries, one trend has stood in total contrast to the decaying paper system:

👉 Unprecedented demand for physical gold.

But it’s not just about price. It’s about location.

Since January 2025:

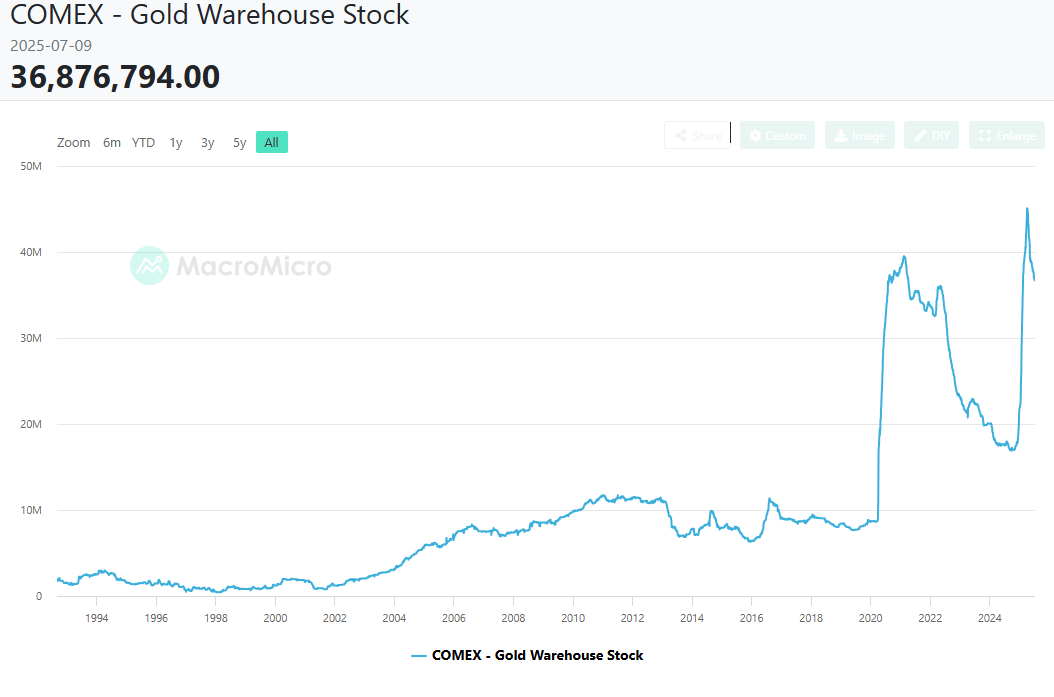

🔥 COMEX gold inventories surged from 22M oz → 45M oz (before sharply reversing), the second-largest increase on record (only rivaled by 2020)

🩸 LBMA delivery times stretched from 2 business days to 4–8 weeks

📉 Reverse repos cratered under $100B in February—right after gold began fleeing London

GLD Borrow rate went as high as 8.57% in February

📉 Global equity markets sold off hard in March and April

This isn't some fluke.

They’re the signals that front ran that last global market sell off.

The LBMA delay wasn’t a logistical hiccup—it was a paper gold system buckling under increased demand for physical…

When it takes 4–8 weeks to deliver what previously took a few days and the GLD borrow rate goes parabolic the question is obvious:

📌 How much gold was really there in the first place?

If you were sitting on billions of dollars in Treasuries or leveraged derivative positions, what would you do if you suddenly realized the most important collateral in the system was cracking?

You’d demand physical gold, fast. Not ETF shares. Not unallocated London contracts. Not promises.

That’s what the “smart money” is doing.

They’ve seen what’s coming:

The U.S. Treasury market is malfunctioning more and more.

The yen is unraveling, and with it, Japan’s bond market—the weak point in the intricately interconnected Keynesian web.

The 30Y Japanese Government Bond (JGB) just surged to 3.07%, nearing its May high of 3.196%—a level not seen in over 25 years.

And at the same time?

Basel III says: “No more trusting paper.”

Which leads us to the inevitable solution:

🔗 The New System: Gold & Commodities on The Blockchain

We’re eventually headed toward a hybrid system where:

🔗 Blockchain prevents rehypothecation

📦 Commodities (led by gold and silver) are the base layer

💰 Fiat is layered on top of real assets—not the other way around

And just like that—paper gold’s days are numbered.

London (LBMA) can no longer keep up.

That’s why gold is flowing to New York and Shanghai.

That’s why delivery times ballooned.

That’s why COMEX inventories surged.

This is not a speculative theory.

It’s already happening.

Signal | Level | Interpretation | Zone |

|---|---|---|---|

10-Year Swap Spread | –29.05 bps | Still deeply negative—synthetic hedging favored over sovereign collateral. Signals systemic distrust in U.S. debt as base layer. | 🔴 Red |

Reverse Repos (RRP) | $227.273B | Liquidity pool remains critically low. Collateral scarcity intensifying. Fed’s balance sheet buffer nearly exhausted. | 🟠 Orange |

USD/JPY | 146.35 | Yen strength creeping back. Any drop below 145 risks triggering FX interventions and carry trade unwinds. | 🟠 Orange |

USD/CHF | 0.795 | Swiss franc approaching historic extremes. Global capital seeking shelter in the last trust-based fiat. | 🔴 Red |

SOFR 3Y OIS | 27.1 bps | Forward rate markets still pricing structural pressure. Suggests market expecting longer-term dislocation in funding stack. | 🟠 Orange |

SOFR Overnight Rate | 4.34% | Headline stability masks subterranean stress. Swap and OIS divergence tells the real story. | 🟡 Yellow |

SLV Borrow Rate | 0.68% | Slight softening—not yet a squeeze. Shorts still confident, but spread to GLD borrow rate narrowing. | 🟡 Yellow |

GLD Borrow Rate | 0.61% | Creeping upward. Early signal of physical market tension. Watching for spikes or divergence from SLV. | 🟡 Yellow |

COMEX Gold Warehouse | 36,876,794 oz (Registered: 20.2M oz) | Registered = total available for delivery. No hidden reserves. COMEX gold is fully spoken for. No room for games. | 🟡 Yellow |

Gold/Silver Ratio | 90.58 | Silver remains heavily undervalued relative to gold. Capital crowding into gold as trust asset. GSR nearing alert threshold. | 🔴 Red |

10Y UST – JGB Spread | 2.846% | Spread narrowing slightly. Still elevated—Tokyo’s long-end volatility bleeding into U.S. curve risk. Japan remains the fault line. | 🟠 Orange |

🧨 The Lower Rates Lever Is Malfunctioning

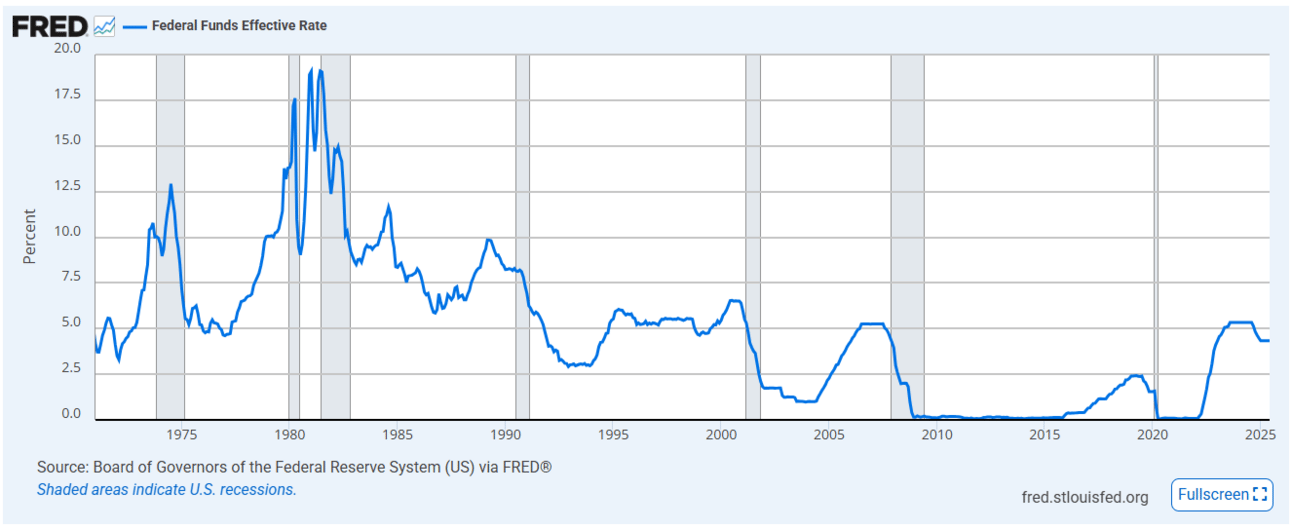

Since the U.S. abandoned the gold standard in 1971, we haven’t had a truly organic business cycle.

Every recession since has followed the same script:

👉 Growth slows

👉 Markets wobble

👉 The Fed cuts rates to stimulate demand

👉 Cheap debt fuels another cycle—until the next downturn

It worked… until it didn’t.

Because this lever has a dark side:

📉 Each rate cut demands more debt to generate less growth.

📉 Each expansion becomes more dependent on artificial liquidity.

📉 And eventually, the system becomes so fragile that lowering rates makes things worse.

We may have reached that point.

⚠️ The 2024–2025 Warning Shot

Let’s connect the dots:

📉 Sep 2024: Fed cuts rates by 50 bps

📉 Oct 2024: Cuts another 25 bps

📉 Nov 2024: Another 25 bps

👉 Total: 100 bps in rate cuts

But instead of yields falling… they rose.

📈 10-year Treasury yield at Sep 2024 open: 3.928%

📈 By Jan 2025: spiked to 4.792%

📈 Today: still elevated at 4.348%

That’s the benchmark for every mortgage, auto loan, and business credit line in the country.

So even as the Fed lowered rates to ease borrowing conditions, the real cost of borrowing tightened.

🤯 This Is a Systemic Malfunction

Why did this happen?

Because the bond market no longer trusts the lever.

If the Fed cuts into inflation or fiscal recklessness, the bond market rebels.

If buyers lose faith in U.S. debt, yields don’t follow the Fed—they reflect fear.

And when the 10-year breaks from the Fed Funds Rate, the Fed loses control.

We used to ask, “Will the Fed cut rates to save us?”

Now the real question is:

“Will cutting rates even work anymore?”

🔑 A New Lever Will Be Needed

The lower-rates lever is malfunctioning because the base layer—Treasuries—is malfunctioning.

If trust in Treasuries collapses, the system must anchor itself to something real.

Gold. Silver. Commodities.

The market is already front-running that transition—bit by bit, quietly—but unmistakably.

🌊 The Super-Cycle Repricing: From Currency Deluge to Commodity Resurrection

Since abandoning the gold standard in 1971, the modern financial system has relied on one trick: when growth falters, cut rates and flood the system with liquidity.

But we’re now seeing the limits of that playbook.

In late 2024, the Fed cut rates three times—100bps in total.

Yet the 10-year Treasury yield, the benchmark for borrowing costs across the economy, rose from 3.928% in September to 4.792% by January 2025.

As of today, it still sits at 4.348%— well above where it was before the cuts.

This is what it looks like when the lower-rates lever breaks.

When the base layer of global finance—U.S. Treasuries—starts to fracture.

And when the foundation is cracking, the rest of the structure becomes dangerously unstable.

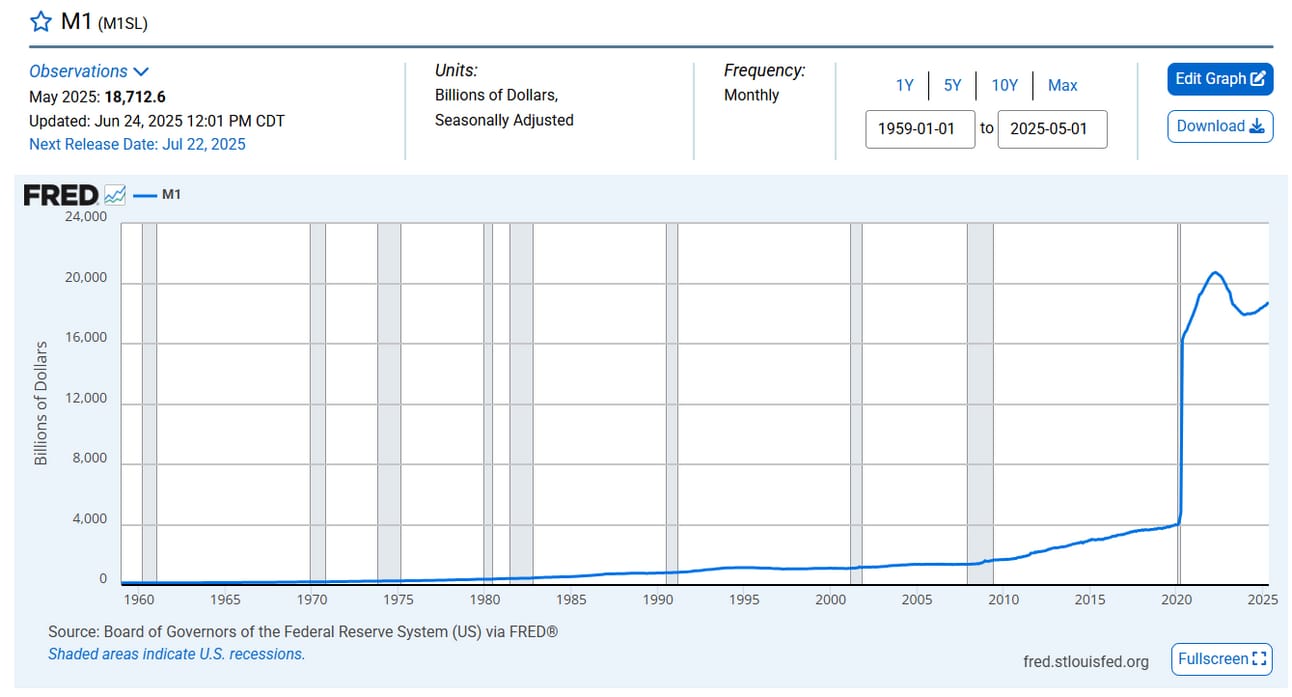

Look at the chart of M1 Money Supply—which includes basic checkings and savings balances—not hedge fund leverage or shadow banking.

Even here, you see the system unraveling:

📈 M1 exploded from ~$4 trillion to over $20 trillion between 2020–2022

📉 It has only marginally retreated to $18.7 trillion as of May 2025

This is not a functioning cycle—it’s a systemic imbalance propped up by pure monetary inflation.

And keep in mind:

👉 M1 is only checkable money.

👉 It excludes the stock market (≈$50–60 trillion)

👉 It excludes the derivatives market—which at over $1 quadrillion in notional value, is the largest and most leveraged construct ever created.

That derivatives market is a giant illusion of stability.

It functions only because of two assumptions:

Overnight liquidity will always be there

Collateral (like U.S. Treasuries) will always be trusted

So when the collateral buckles—like we saw when 10Y yields surged despite rate cuts—the entire structure begins to groan.

The truth is this:

The global financial system has evolved into a vast, reflexive casino where infinite liquidity is assumed—and where the real economy is the afterthought.

💥 The only way to restore equilibrium is to re-anchor the system to intrinsic value.

💥 That means massively repricing gold, silver, and commodities—the assets that can’t be printed, faked, or rehypothecated without limit.

Just like the largest debt super-cycle in history has inflated valuations beyond reason…

It logically follows that the largest commodity super-cycle in history must emerge to correct it.

🔎 Reading Between the Lines: The Exodus, the Squeeze, and the Signal

The most revealing signs don’t shout.

They whisper—in fractures, in delays, in strange anomalies that “shouldn’t” happen in a well-oiled system.

And in Q1 of 2025, the gold market started whispering so loudly you’d have to be willfully blind not to hear it.

Let’s break it down.

🛑 1. The COMEX Surge That Shouldn’t Happen

In just three months, COMEX gold inventories doubled:

📈 From 22 million ounces → 45 million ounces

That’s the second-largest surge on record—only rivaled by the 2020 COVID panic, when the system nearly locked up.

But why would COMEX suddenly get flushed with gold?

Because gold was fleeing London.

→ Investors were pulling bars out of the LBMA, a signal of collapsing trust in rehypothecated gold.

And what did London do to keep the illusion alive?

⏳ 2. LBMA Delivery Times Blew Out

⏱️ From 2 business days → 4–8 weeks

Let’s be honest: that’s a de facto default.

If you go to redeem an ETF or a warehouse receipt and it takes nearly two months to get your metal—you no longer own gold, you own a promise.

These delays didn’t come from a shipping glitch or the logistical difficulties of delivery.

They came from not having the metal available on demand—because it had been lent, leased, and layered far beyond anything physical.

The market sensed that risk.

And they got their gold out of there.

🧨 3. Reverse Repos Cratered

📉 In February 2025, the Fed’s reverse repo facility—once holding nearly $2.5 trillion—dropped and stayed below $100B for the first time in years.

That’s not just a data point.

That’s the core collateral backstop of the system evaporating.

And it happened right after the COMEX surge and LBMA breakdown.

Translation:

→ Capital was scrambling for trusted collateral

→ Gold, the original base layer, was quietly reasserting itself

📈 4. GLD Borrow Rate Spiked to 8.57%

That is an insane level.

Not normal.

Not marginal.

That’s “get me gold at any cost” territory.

The most likely explanation?

→ Desperate sourcing from London

→ As physical gold vanished from LBMA vaults, authorized participants borrowed GLD shares to settle obligations—at extreme cost

In other words, GLD became a lifeboat when the ship under it was taking on water.

🧩 The Pattern: A Crisis of Faith in Paper Gold

When you string this together:

A massive physical movement of gold

A collapse in delivery trust

A collateral crunch across repo markets

A GLD sourcing scramble at 8.57% borrow costs

You’re looking at a systemic stress test—and gold passed.

But more importantly, you're witnessing the beginning of the end of fractional gold markets.

The days of rehypothecated paper gold propping up an ever more distorted pricing structure are numbered.

Because when push comes to shove, the market doesn't want contracts.

It wants metal.

🪙 Preferred Access 🪙

The base layer is breaking.

Japan—the most interest-rate-dependent sovereign in the world—is flashing red. Its 30-year yield just surged to the highest level in decades.

Why does it matter?

Because Japan isn’t just imploding in isolation.

They’re the largest foreign holder of U.S. Treasuries.

And when their yields spike, they face a brutal choice:

🟣 Defend the yen—or

🟠 Defend their bonds.

They can’t do both.

And when that pressure spills over, it hits our bond market—our collateral base.

That’s why the 10-year swap spread has been negative for months.

It’s not noise—it’s the market rejecting paper promises.

🔻 Sovereign debt is being downgraded.

🔻 Trust is quietly evaporating.

🔻 Real collateral is being hoarded.

Gold is already being repriced in anticipation.

Not as a trade.

As admission to the next cycle.

That’s why I built Sovereign Signal access to real bullion that transcends counterparty trust:

📦 Fully insured delivery — to your vault, your doorstep, or wherever you store peace of mind

⚖️ Straightforward pricing — real bars, real rounds, real ounces in your hand

📩 Just reply to this report or email [email protected] to secure access.

Because in a world of decaying trust, gold isn’t a hedge—it’s the key.

Luke Lovett

📲 Cell: 704.497.7324

🌐 Undervalued Assets | Sovereign Signal

📧 Email: [email protected]

🔐 Legal Disclaimer 🔐

The content provided herein is for informational and educational purposes only and should not be construed as financial, investment, legal, or tax advice. I am not a licensed financial advisor, investment professional, or attorney. The views expressed are solely those of the author and are not intended to be relied upon for making investment decisions.

While every effort has been made to ensure the accuracy of the information presented, no guarantee is given that all content is free from error, omission, or misinterpretation. Market data, trends, and conditions are subject to rapid change, and past performance is not indicative of future results.

Some views expressed may reference public insights from respected analysts and commentators. Some third-party content may be paraphrased or summarized for educational purposes only, with attribution, and does not imply endorsement or affiliation. All rights remain with the original creators.

Always conduct your own research and consult with a licensed financial advisor or registered investment professional before making any investment decisions. By reading this publication, you agree not to hold the author liable for any losses or damages resulting from the use of this information.

I am not a metals dealer. All orders are processed directly by a licensed precious metals dealer. I do not hold funds, process transactions, or provide personalized investment advice.

Reply