- The Sovereign Signal

- Posts

- The Great Silver Squeeze: China Drags Silver Higher With $2 Premium, Global Backwardation, and the Most Explosive Breakout Setup in Modern Financial History

The Great Silver Squeeze: China Drags Silver Higher With $2 Premium, Global Backwardation, and the Most Explosive Breakout Setup in Modern Financial History

With Chinese silver futures surging to ~$53.12—nearly $2 above COMEX—against acute backwardation and collapsing Shanghai inventories, global money supply jumping $10T in 12 months, miners sitting atop a tiny $0.13T market, silver holding its gains far better than the 1980 and 2011 peaks, and the Fear & Greed Index plunging to “9” even as the S&P is still up 37% from the April low, every major signal is flashing the same message: structural tightness, violent leverage under the surface, and a historic rotation into hard assets already underway.

This. Time. Is. Different.

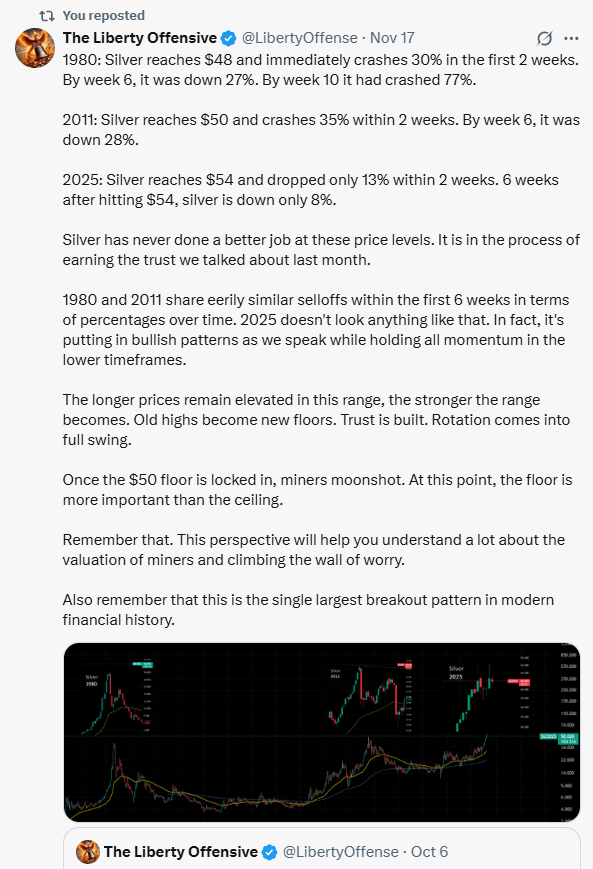

1980 and 2011 were hit-and-run bubbles: silver tagged the highs and then got its face ripped off—down 30–35% in two weeks and ~80% in a few months.

2025 is the opposite story.

Silver hit $54… dropped just 13%… and six weeks later it’s only 8% off the high, building bullish structures while momentum stays intact.

That’s not a blow-off top.

That’s a new floor being poured in real time.

The longer silver grinds sideways up here, the more capital and conviction get locked in.

When that $50 floor is finally accepted, the move in the miners isn’t a spike—it’s a revaluation.

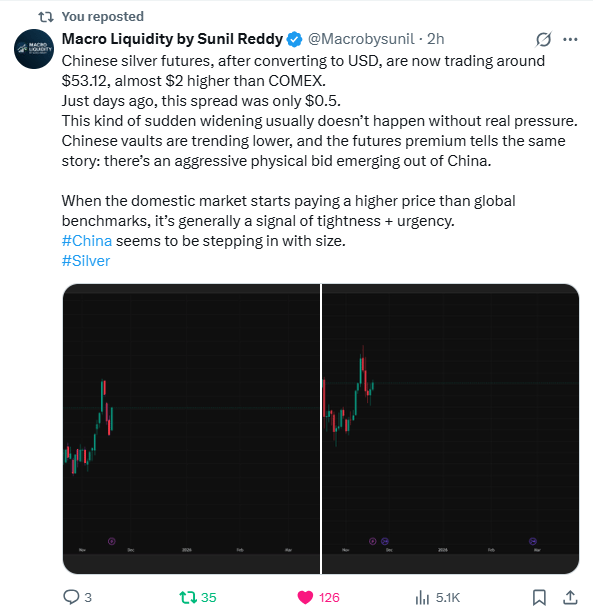

China just quietly grabbed the steering wheel on silver.

Chinese silver futures are now about $53.12, almost $2 ABOVE COMEX, and that gap blew out from just 50¢ a few days ago.

That only happens when someone, somewhere, is so hungry for metal they’re willing to outbid the global benchmark and drag price higher to get it.

Chinese vaults are draining, China is paying up, and that tells you who’s setting the real price: the buyer desperate for physical, not the trader flicking paper contracts in New York.

In a hyper-leveraged world choking on IOUs, the game is simple:

Debt and derivatives control the story.

Whoever controls the marginal ounce controls the narrative.

If China is now that marginal buyer, every short, every underweight portfolio, and every complacent COMEX price is hidden leverage waiting to get repriced—hard—as ton after ton moves East.

China is vacuuming the market.

They’re paying more than COMEX, draining Shanghai vaults, and bidding with urgency — because they see what the West keeps trying to hide with paper:

There’s not enough physical silver left to absorb real demand.

Backwardation proves it.

That only happens when the world wants metal now, not promises later.

And every time Western desks slam price with paper?

They hand China a discount — and China scoops up even more.

The “smashes” don’t fix the shortage.

They accelerate it.

Now combine that with the real killer:

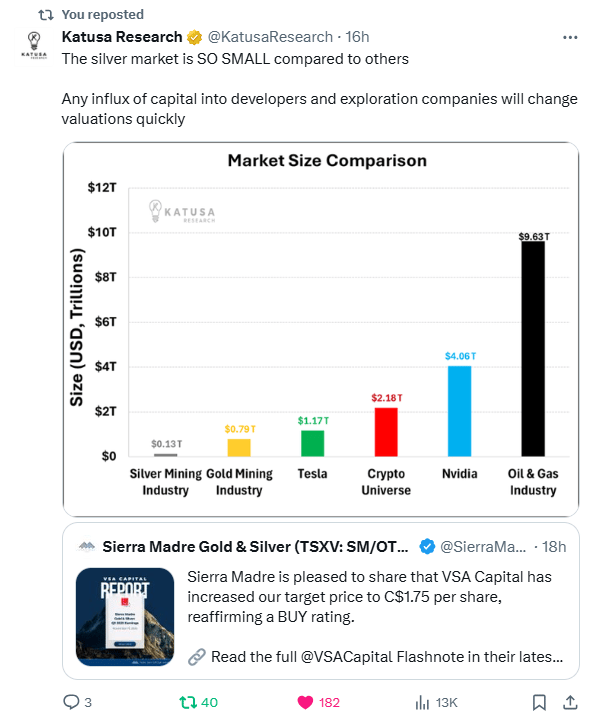

The entire global silver mining industry is worth only $0.13T.

Smaller than a single tech stock.

Smaller than some corporate treasuries.

A market this tiny cannot withstand sovereign-scale buying.

It can barely handle retail FOMO.

So you have:

• China paying premiums

• Physical inventories draining

• Persistent backwardation

• Paper smashes backfiring

• A $130B market cap trying to absorb multi-trillion-dollar global flows

The silver market isn’t “small.” It’s microscopic.

The silver mining industry is $0.13 trillion—a rounding error next to Nvidia ($4T) or Oil & Gas ($9.6T).

The entire global silver-mining industry… smaller than individual tech stocks.

When the world finally wakes up to structural shortages…

When China keeps bidding above COMEX…

When money supply keeps exploding…

All that capital has to squeeze through a $130B doorway.

The asymmetry is outrageous.

Silver isn’t just undervalued.

It’s under-sized for the world that’s coming.

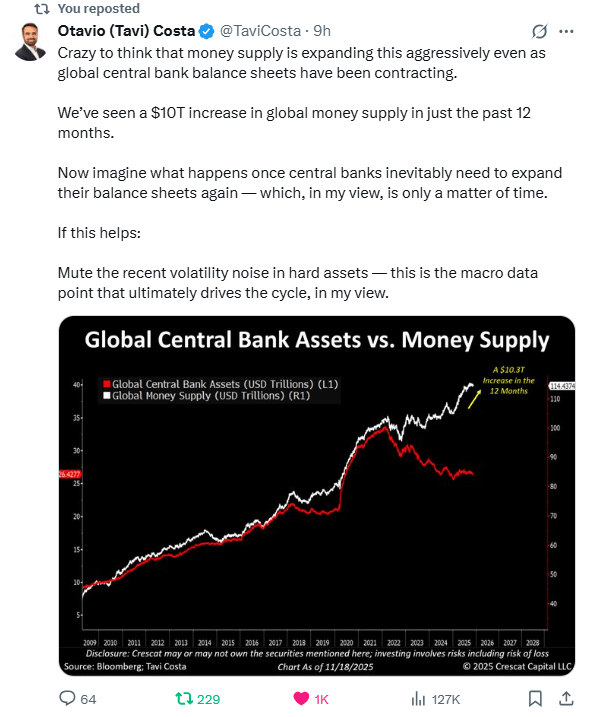

Global money supply just exploded $10 trillion in 12 months — before central banks even turned the printers back on.

The world is piling up more IOUs than ever, but the pool of real stuff — especially silver — is shrinking fast:

China paying above COMEX

COMEX inventories draining

India imports up 530%

Futures spreads blowing out

When fake money multiplies and real collateral disappears, the system only has one way to rebalance:

Hard assets surge.

This $10T chart isn’t “interesting.”

It’s the quiet countdown to when silver stops trading like a commodity…

and starts trading like the collateral the world is suddenly desperate for.

Extreme Fear at 9 while the S&P is barely down is the giveaway:

This isn’t emotion.

It’s leverage screaming.

The system is so over-borrowed, so over-derivative’d, so tightly wound…

…that even a small dip feels like a crisis.

That’s why fear is maxed out with no real crash.

The tower is fragile.

And in the middle of that panic?

Silver got slammed… then ripped back… and is now up almost 3%.

That’s not noise.

That’s the difference between a market built on leverage—

and an asset driven by real demand.

Fear spiked.

Leverage shook.

Silver didn’t flinch.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply