- The Sovereign Signal

- Posts

- Liquidity and Collateral 🐉

Liquidity and Collateral 🐉

How the East Has Stockpiled Real Money—While the West Sleeps on a Crumbling Foundation

Imagine you live in a skyscraper built on faith.

Faith that the foundation will never crack.

Faith that no matter how much weight gets piled on top, someone will always pour in more concrete.

Faith that if it all starts to shake, the authorities will do something—anything—to keep it standing.

✅ This is the belief that has defined Western finance for decades:

“There will always be more liquidity.”

More credit.

More buyers.

More bailouts.

More interventions to paper over every excess and every failure.

But here’s what almost no one in the West wants to face:

Every time the system has to flood itself with emergency liquidity, it isn’t proving how strong it is.

It’s proving how close it is to collapse.

And with each intervention, something deeper happens:

✅ The backstops get more sophisticated.

They find clever new ways to paper over the cracks—swap lines, reverse repos, hidden guarantees.

✅ The distortions last longer.

More people convince themselves this is normal.

More wealth gets piled on top of the illusion.

✅ But the structure also becomes more fragile.

Because the longer you deny gravity, the more violent the fall when it finally returns.

And this is the part almost no one in the West is willing to face:

The system isn’t just built on money.

It isn’t even built on debt.

✅ It’s built on two things—LIQUIDITY and COLLATERAL.

Liquidity is the belief that there will always be another buyer.

Another credit line.

Another bid to keep prices from collapsing.

But collateral—that’s the real foundation.

And at the core of collateral, above everything else, sits U.S. Treasuries.

Treasuries are treated as:

Risk-free.

Perfectly liquid.

The final backstop of all other credit.

✅ Every repo agreement.

✅ Every derivatives contract.

✅ Every overnight funding line.

✅ Even the confidence behind your bank deposits—

All of it assumes Treasuries will always be trusted as pristine collateral.

And this is the silent crisis:

As deficits explode,

As buyers quietly step back,

As foreign holders diversify away,

As funding costs spike in the shadows,

✅ The world is waking up to the possibility that Treasuries might not be the untouchable collateral everyone assumed.

This is why we track the signals we track.

Because they are:

The most front-running,

The least susceptible to manipulation

The most organic indicators of what’s happening beneath the surface of Treasury trust.

✅ When swap spreads go negative,

✅ When reverse repo usage goes and stays below $100B

✅ When the price of hard collateral (like gold) quietly makes new all time high after new all time high—

These are not random quirks.

They are early warnings that the foundation itself is starting to shift.

This isn’t about fear.

It’s about understanding the stakes:

If Treasuries are no longer treated as perfect collateral, every other layer built on top of them has to be repriced—at once.

Because when that moment comes, it won’t matter how sophisticated the liquidity backstops are.

It will only matter who already owns something real.

📡 Sovereign Signal Table — July 5, 2025

Signal | Level | Interpretation | Zone |

|---|---|---|---|

10-Year Swap Spread | –26.53 bps | Persistent collateral strain—Treasuries remain deprioritized in funding stack | 🔴 Red |

Reverse Repos | $214.665B | If this dips and stays below $100B, risk of another global market sell off skyrockets. | 🟠 Orange |

USD/JPY | 144.56 | If this dips and stays below 140, look out. | 🟠 Orange |

USD/CHF | 0.7941 | Slight rebound—capital still favoring fiat safe havens over risk assets | 🔴 Red |

SOFR 3Y OIS | 27.2 bps | Fresh rise—short-term funding tension re-intensifying relative to spring baseline | 🔴 Red |

SOFR Overnight Rate | 4.40% | Still elevated, will see on Monday at 8AM ET if it has normalized downward. If it keeps spiking, buckle up. | 🔴 Red |

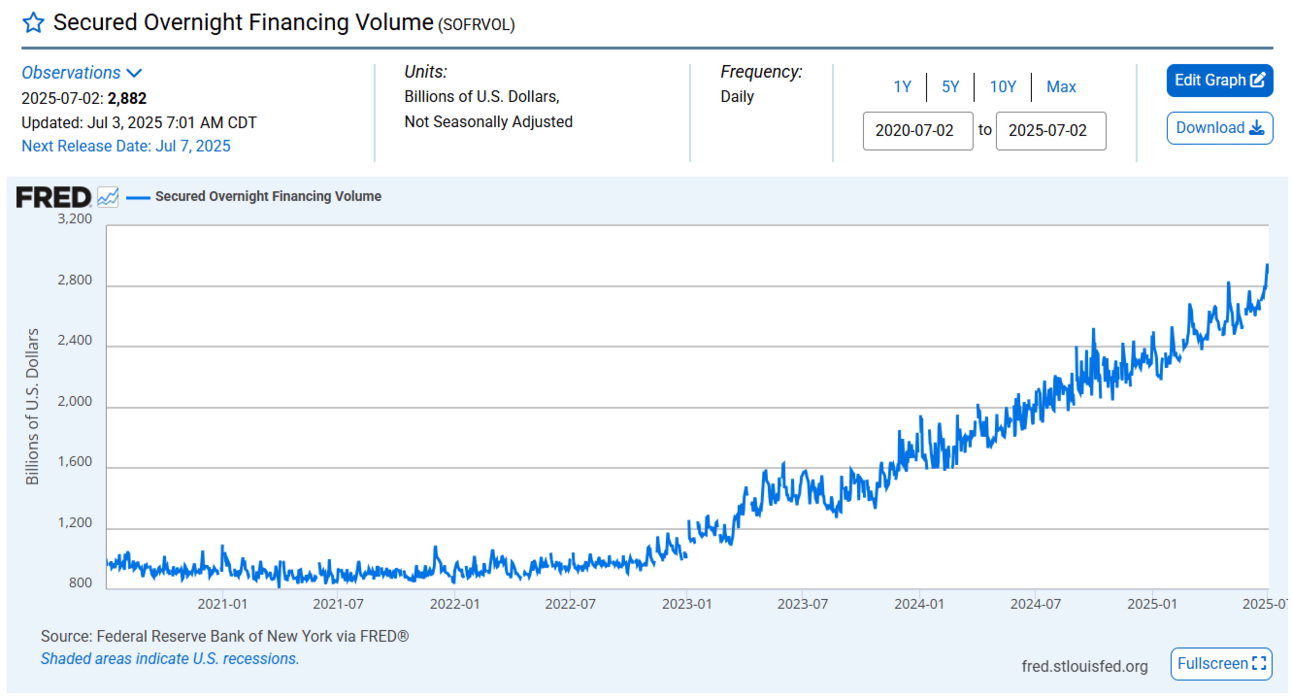

SOFR Overnight Volume | 2,882 | Structural reliance near record highs—liquidity dependency entrenched | 🔴 Red |

Japan–US 10Y Spread | 2.897% | Yield premium unchanged—no sign of policy divergence alleviating USD funding premium | 🟠 Orange |

SLV Borrow Rate | 0.72% | Marginal uptick—short pressure in silver moderately persistent | 🟡 Yellow |

GLD Borrow Rate | 0.73% | Stable—stealth accumulation and hard collateral demand still evident | 🟡 Yellow |

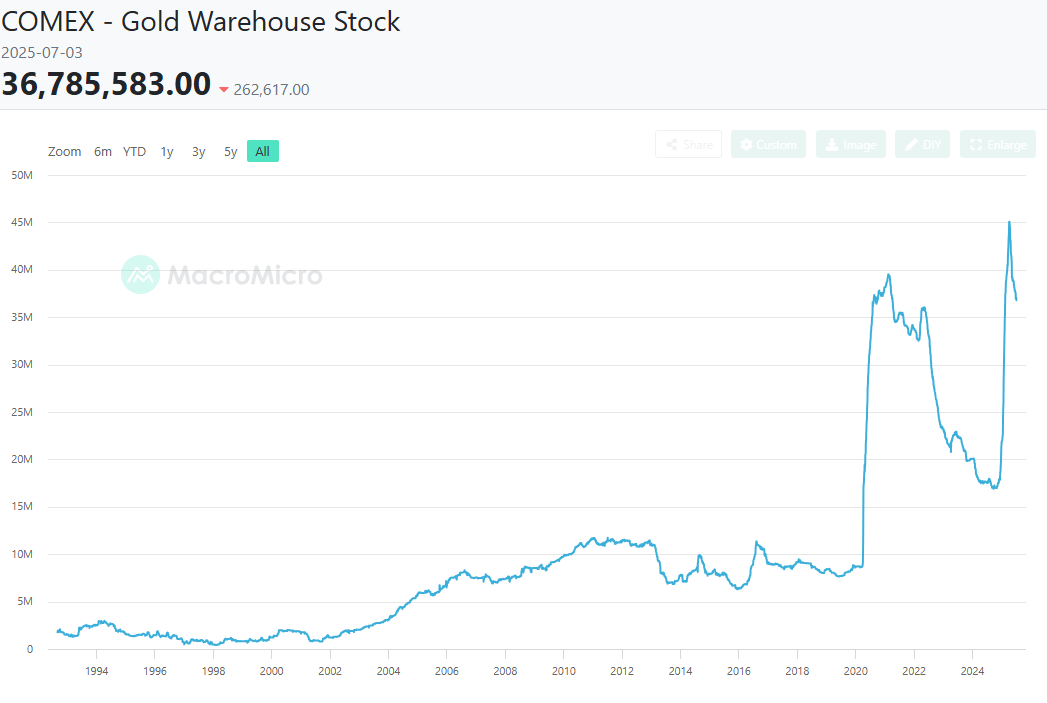

COMEX Gold Warehouse | 36,785,583 oz | Inventories tightening further—underappreciated systemic pressure building | 🟡 Yellow |

Gold/Silver Ratio | 90.12 | Silver bid reviving post-record ratio—structural repricing impulse taking shape | 🔴 Red |

🏯 The Quiet Strategy Behind the Illusion

If you think this ends when Treasuries lose their halo, you’re missing the larger story.

While the West has spent two decades inventing ever more sophisticated ways to paper over cracks, the world’s second largest economy has been methodically preparing for the day the illusions can’t be propped up anymore.

They understood something simple but profound:

✅ When trust in the ultimate collateral evaporates, the system doesn’t calmly migrate to another paper promise.

✅ It reverts to whatever everyone believes cannot default—no matter how many liquidity injections fail.

🥇 The Largest Hoard the West Pretends Doesn’t Exist

Officially, China claims to hold around 2,200 tons of gold.

But many credible researchers—commodity analysts, former central bank insiders, and veterans of China’s state-owned enterprises—believe the real figure could be 10,000 to 20,000 tons.

They didn’t build this hoard as a trade.

They didn’t buy it because they were afraid of volatility.

✅ They bought it because they know what happens when Treasuries stop functioning as perfect collateral.

Here’s what almost no one in the West wants to admit:

As these distortions grow, more and more serious capital will quietly look for something else to pledge.

Something else to trust.

Something else to hold the system together when debt and synthetic liquidity stop working.

That something else is gold.

This is why China kept buying.

Not to speculate.

Not to trade.

✅ But to be ready for the day when everyone realizes Treasuries are not unbreakable.

Because when that moment comes, there won’t be a polite announcement on the front page of the Wall Street Journal.

There won’t be an orderly transition to a new fiat reserve currency.

There will simply be a massive, sudden rotation of capital into whatever everyone still trusts to settle value without counterparty permission.

And when that happens, ask yourself:

Who will hold the cards?

✅ The nations that spent decades assuming debt was real wealth?

✅ Or the nation that quietly built the largest reserve of hard money in modern history—perhaps more gold than the entire West combined?

🏛️ The Belief Holding Up the Entire System

No matter how clever the tools look—

No matter how many swap lines, repos, or bailouts are thrown at the cracks—

✅ Everything still depends on one belief:

Liquidity is infinite and U.S. Treasuries are the single untouchable base layer of the entire financial system.

And when that belief breaks, it’s not just bond yields that move:

✅ Every other price built on that collateral has to be repriced—instantly.

🛰️ Why These Are the Signals That Matter

Most people look at the stock market and think they’re seeing the health of the system.

But the truth is, the market is just the last domino to fall.

✅ The real health of the system is visible in how liquidity and collateral behave—long before stocks start moving.

This is why we track these signals.

Because they are the most direct, unfiltered indicators of whether the foundation is holding together…or quietly fracturing.

Let’s break it down in simple terms:

🟥 10-Year Swap Spread

✅ What it is:

The difference between the yield on Treasuries and the cost of swapping fixed for floating rates.

✅ Why it matters:

When this spread goes negative—and stays negative—it’s a sign the market doesn’t trust Treasuries as perfect collateral.

It’s like seeing cracks in the basement walls of your house.

For months, this spread has been deeply negative.

Translation:

Treasuries are already malfunctioning as the base layer collateral.

🟥 Reverse Repos

✅ What it is:

A way for banks to park cash at the Fed overnight in exchange for collateral (mostly Treasuries).

✅ Why it matters:

When reverse repo balances drop below $100 billion and stay there for days, it means the system is running out of trusted collateral.

This is exactly what happened in February—and it triggered a global selloff.

When you see this drain, watch out.

🟢 USD/JPY

✅ What it is:

The exchange rate between the U.S. dollar and the Japanese yen.

✅ Why it matters:

This is the most important currency indicator of global liquidity because Japanese institutions are the biggest providers of dollar funding.

When the yen strengthens against the dollar, it means liquidity is tightening.

Think of it as a flashing warning light that credit is about to get harder to find.

⚪ USD/CHF

✅ What it is:

The dollar vs. the Swiss franc.

✅ Why it matters:

When money gets scared, it runs to Swiss francs.

When you see the dollar falling against the franc, it’s a sign capital is quietly hiding in “safe haven” currencies.

This tells you trust is evaporating.

🟡 SOFR 3-Year OIS

✅ What it is:

A measure of where markets think short-term funding costs will be three years from now.

✅ Why it matters:

When this spikes, it means the market expects liquidity stress to persist, not just blip temporarily.

It’s like a long-range weather forecast for funding strain.

🔴 SOFR Overnight Rate

✅ What it is:

The cost to borrow overnight, right now.

✅ Why it matters:

When this rate surges, it means banks are suddenly desperate for cash.

It’s the closest thing to a heart monitor for the system.

🔴 SOFR Overnight Volume

✅ What it is:

How much money is moving every single night in the short-term funding market where banks lend to each other, secured by collateral like Treasuries.

✅ Why it matters:

When this volume keeps climbing, it means the entire financial system is becoming more dependent on overnight borrowing just to keep functioning.

Look at the chart:

Even when funding stress temporarily cools, the next wave always exceeds the last one.

✅ This isn’t random—it’s a sign of structural addiction.

Why this is dangerous:

The higher this goes, the more fragile the system becomes.

Because the more you rely on short-term funding to stay alive, the more catastrophic it becomes if that funding ever stops.

It’s like running your entire business on a credit card and watching the balance go up every month.

Translation:

SOFR Overnight Volume isn’t just high.

It keeps going higher, in relentless cycles.

And that tells you the system isn’t healing—it’s quietly getting more dependent on emergency liquidity to survive.

🟢 Japan–US 10-Year Spread

✅ What it is:

The difference between Japanese and U.S. 10-year yields.

✅ Why it matters:

When the spread is wide, it keeps pressure on the dollar-yen carry trade.

This affects how much cheap funding is available globally.

⚡ SLV Borrow Rate

✅ What it is:

How much it costs to borrow silver from the largest silver ETF in the world.

✅ Why it matters:

When this rate spikes, it signals stress in physical silver markets.

It’s a clue that trust in paper collateral is breaking down, and people are rushing for hard assets.

⚡ GLD Borrow Rate

✅ What it is:

Same as above—but for gold.

✅ Why it matters:

A rising borrow rate shows strong demand to borrow and deliver physical gold.

This often precedes re-pricing of gold as collateral.

🟡 COMEX Gold Warehouse Stocks

✅ What it is:

The total physical gold sitting in the COMEX warehouses in New York.

This is the metal that backs futures contracts—and in theory, could be delivered to settle obligations.

✅ Why it matters:

When these inventories fall, it means more players are pulling gold out of the system.

Less gold in the warehouse = less collateral available to back paper claims.

It’s like everyone quietly withdrawing cash from the bank while pretending nothing is happening.

Look at the chart above:

In early to mid 2020, inventories exploded upward as bullion rushed into the exchange.

Over the next 3 years, gold was steadily drained—a multi-year exodus of physical metal.

In the past year, stocks surged again—but have already started to slide lower.

✅ This is not normal.

✅ It shows the system is under stress: first hoarding metal, then bleeding it out to cover delivery demands.

Important distinction:

Not all this gold is truly “deliverable.”

There are two categories:

1️⃣ Registered:

Gold that is actively designated for delivery against contracts.

This is the true collateral backing the futures market.

2️⃣ Eligible:

Gold that sits in the warehouse but belongs to private holders.

It can potentially be moved into registered—but owners must choose to reclassify it.

In practice:

Much of what’s counted as “inventory” is not available to settle obligations.

✅ When stress spikes, eligible holders often withdraw, not reclassify.

Translation:

This chart isn’t just about quantity—it’s about trust.

When inventories are volatile, it signals that major players don’t want to leave their collateral inside the system.

They’d rather take delivery or store it elsewhere.

✅ That’s the real message:

The more unpredictable liquidity becomes, the less confidence there is in synthetic paper claims.

Bottom line:

When you see COMEX warehouse stocks dropping while funding stress rises,

it’s not random noise.

It’s a clear sign that smart money is moving to own real collateral—outside the system—before everyone else realizes why.

🧭 The Bottom Line

These signals matter because they are the real dashboard of the system’s health.

✅ They show where liquidity is truly flowing or drying up.

✅ They show which collateral is losing trust.

✅ They show where the next crack is most likely to appear.

Most people won’t see the signs until the headlines scream about a crisis.

But by then, the smart money has already moved.

This is why we track them:

Because when the foundation finally shifts,

✅ It won’t be stocks that move first.

It will be the hidden plumbing—the signals that show exactly where trust is failing.

And if you understand them,

You have a chance to move before the crowd.

🌟 My Mission

I’m not here to write sensational headlines.

I’m not here to predict every tick in the markets.

✅ I’m here because I believe Western capital is sleepwalking into the largest repricing of trust in living memory.

For decades, we built prosperity on the assumption that Treasuries would always be sacred.

That liquidity would always be infinite.

That someone else, somewhere, would always take the risk off our hands.

Meanwhile, other nations prepared for the day when that illusion finally cracks.

My mission is simple:

✅ To help the West wake up in time to secure real value before the exit doors are too crowded to fit through.

✅ To build a bridge from synthetic wealth to tangible reserves.

✅ To get as many smart people as possible positioned on the right side of history.

This is why I track the signals.

This is why I write these reports.

And this is why I offer access to real metal—so you don’t have to wonder whether your collateral will be there when it matters most.

If you’ve felt, even quietly, that something fundamental is about to change…

You’re not alone.

And you’re not early.

✅ You’re right on time.

🪙 Preferred Access 🪙

The signals flashing across funding markets right now are not random noise.

They’re a prelude to a repricing of everything that rests on confidence alone.

If you’re ready to secure sovereign-grade bullion—verifiable metal that remains yours regardless of what the system does next—I’ve built the bridge.

Through trusted, licensed relationships, Sovereign Signal readers can access:

📦 Fully insured delivery — to your vault, your doorstep, or wherever you store peace of mind.

⚖️ Straightforward pricing — real bars, real rounds, real metal that doesn’t depend on anyone else’s solvency.

📩 Just reply to this report or email [email protected] to get connected.

Luke Lovett

📲 Cell: 704.497.7324

🌐 Undervalued Assets | Sovereign Signal

📧 Email: [email protected]

🔐 Legal Disclaimer 🔐

The content provided herein is for informational and educational purposes only and should not be construed as financial, investment, legal, or tax advice. I am not a licensed financial advisor, investment professional, or attorney. The views expressed are solely those of the author and are not intended to be relied upon for making investment decisions.

While every effort has been made to ensure the accuracy of the information presented, no guarantee is given that all content is free from error, omission, or misinterpretation. Market data, trends, and conditions are subject to rapid change, and past performance is not indicative of future results.

Some views expressed may reference public insights from respected analysts and commentators. Some third-party content may be paraphrased or summarized for educational purposes only, with attribution, and does not imply endorsement or affiliation. All rights remain with the original creators.

Always conduct your own research and consult with a licensed financial advisor or registered investment professional before making any investment decisions. By reading this publication, you agree not to hold the author liable for any losses or damages resulting from the use of this information.

I am not a metals dealer. All orders are processed directly by a licensed precious metals dealer. I do not hold funds, process transactions, or provide personalized investment advice.

Reply