- The Sovereign Signal

- Posts

- ⚠️ The Liquidity Mirage: Echoes from the Failing Foundation

⚠️ The Liquidity Mirage: Echoes from the Failing Foundation

The illusion of stability masks something deeper: a silent distortion fracturing global trust at the base-layer. These signals aren’t noise—they’re microquakes in the foundation of modern finance, tracking the slow-motion collapse of belief in the very IOUs that built our world.

This isn’t about equities. Or earnings.

It’s about the foundation beneath everything: trust.

And for the past 54 years, that trust has rested on one layer: sovereign debt.

U.S. Treasuries. Japanese Government Bonds. The IOUs that built the modern world.

But that trust is breaking.

Swap spreads are inverting.

Reverse repo balances are low.

SOFR–OIS is flashing deep-curve stress.

This market isn’t stable. It’s in a state of sedated dysfunction, compounding by the day.

The most sophisticated capital in the world isn’t waiting for the mainstream to catch up.

It’s rotating—back to the base-layer humanity trusted for thousands of years:

Gold. Silver. Possession over promises.

They’re not ripping because of hype.

They’re ripping because debt is failing.

The world is drowning in sovereign IOUs:

U.S.: 120% debt-to-GDP

Japan: 250%

Europe: buckling under the same strain

Markets haven’t just been distorted—they’ve grown more and more detached from reality, setting the stage for more and more explosive re-pricings.

Why? Because liquidity was free.

But that liquidity came at a cost: A hollowing-out of the foundation.

Now, with everything built on that debt—credit, stocks, even currencies—

every crack in the base-layer triggers not a crash, not a reset,

but a cycle of Minsky-style convulsions: cascading selloffs, followed by emergency liquidity waves.

Boom. Bust. Bailout.

Over and over—until trust in the foundation fully collapses.

Because nature doesn’t allow imbalance forever. And this imbalance is historic.

These aren’t just red flags. They’re fault lines.

Microquakes beneath the monetary order.

And the smart money? It knows where the ground is still solid.

Gold. Silver. The base-layer that never defaulted. Not a bet.

A return to gravity.

Signal | Latest Level | Interpretation | Zone |

|---|---|---|---|

10-Year Swap Spread | –27.4 bps | Deepening inversion → synthetic swaps preferred over USTs. Persistent distrust in base-layer collateral. | 🔴 Red |

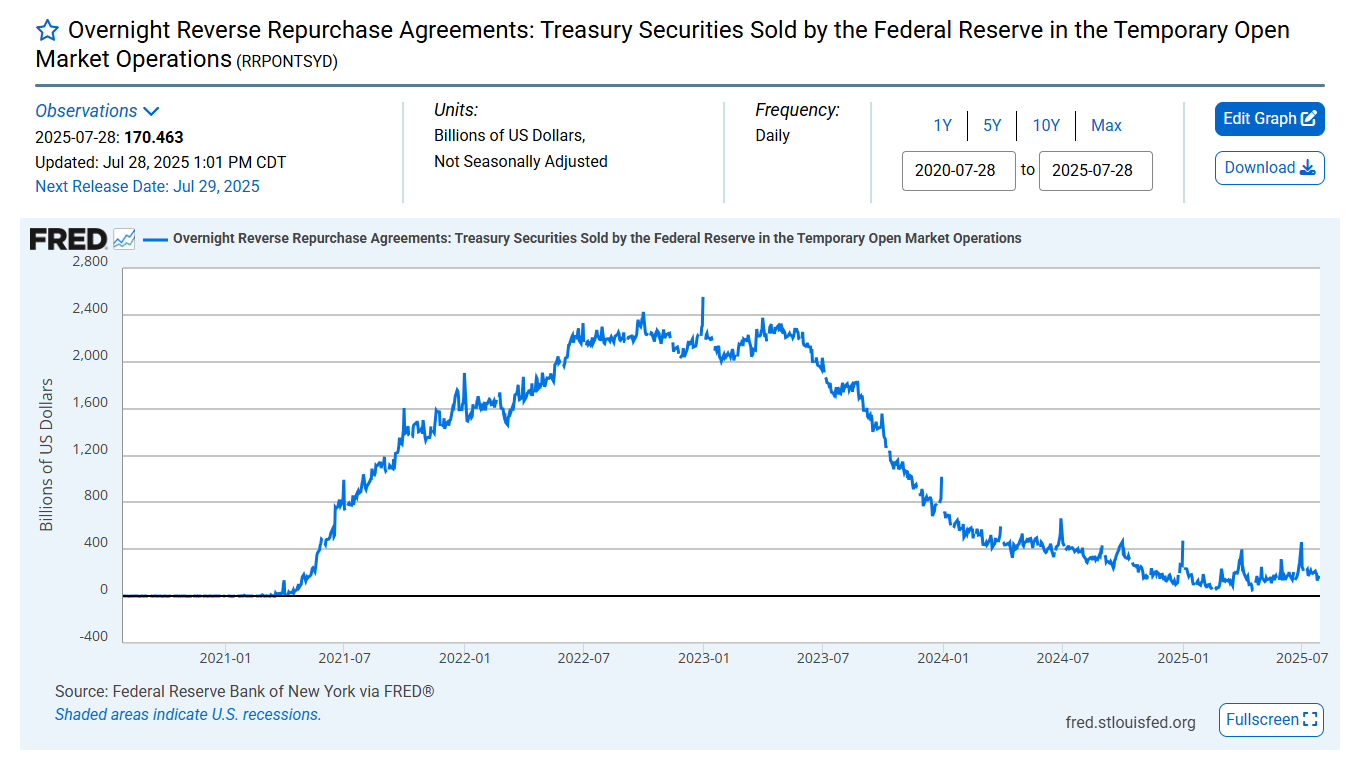

Reverse Repos (RRP) | $170.463B | Watch for break below $100B—this preceded March–April market selloff. | 🟠 Orange |

USD/JPY | 148.52 | Yen weakening again. BoJ must defend yields—can’t support both currency and bonds. | 🟡 Yellow |

USD/CHF | 0.8055 | CHF strengthening = rising global fear. Quiet signal of capital preservation instinct. | 🟠 Orange |

3-Year SOFR–OIS Spread | 27.7 bps | Deep curve stress implies ongoing mispricing of term funding risk. | 🔴 Red |

SOFR Overnight Rate | 4.36% | Jumped +6 bps in a day. Stable for now, but if it keeps rising → liquidity issues ahead. | 🟡 Yellow |

SLV Borrow Rate | 0.81% (6.0M shares available) | Short strain eased—but price still around a 14 year high. Signs of short squeeze likely to resume soon. | 🟡 Yellow |

COMEX Silver Registered | 196.47M oz | Just 22.9% of open interest could fully drain vaults. Thin cushion. | 🟠 Orange |

COMEX Silver Volume | 52,541 | Pulled back from recent highs. Still active in constrained market. | 🟡 Yellow |

COMEX OI (Silver) | 170,893 contracts | ~854M oz of paper vs 196M oz physical. 4.3:1 leverage ratio. | 🟠 Orange |

GLD Borrow Rate | 0.48% (6.1M shares available) | Neutral → no stress yet. Watch for spikes. | 🟢 Green |

COMEX Gold Registered | 20.559M oz | ≈44% of OI could stand and empty the vaults. Better than silver, but fragile. | 🟡 Yellow |

COMEX Gold Volume | 292,064 | High activity → possible trend inflection underway. | 🟡 Yellow |

COMEX OI (Gold) | 453,174 contracts | ~45.3M oz exposure vs 20.6M oz physical. 2.2:1 paper to metal. | 🟠 Orange |

UST–JGB Spread | 2.858% | Extreme divergence → USD funding pressure + cross-border collateral distortion. | 🟠 Orange |

Japan 30Y Yield | 3.057% | Near multi-decade highs. Pressuring BoJ. Could trigger forced intervention/liquidation. | 🟠 Orange |

US 30Y Yield | 4.961% | High cost of capital → refinancing pain, asset repricing pressure. | 🟠 Orange |

SOFR Daily Volume | $2.766 Trillion | Still massive. Markets leaning on overnight funding to stay liquid. | 🟠 Orange |

🩸 Collateral Swap Reversal

10-Year Swap Spread: –27.4bps (🔴 Red)

This is not a fluke.

This is not a blip.

This spread has been buried in the upper negative 20s for months.

In a healthy system, real Treasuries—the so-called risk-free asset—should always be more valuable than synthetic exposure.

But not now.

And not for a long time.

The market is screaming something almost no one is willing to hear:

“We trust the simulation more than the source.”

Think about that.

The foundation of the modern financial system—U.S. Treasuries—is so distorted, so over-leveraged, so disbelieved…

that institutions are actively choosing derivative exposure over the actual bonds.

That’s not yield-seeking. That’s not efficiency.

That’s systemic mistrust baked into market structure.

This isn’t just inverted pricing—it’s inverted belief in the very base-layer of global collateral.

And when the world stops trusting its foundation?

Everything stacked on top—credit, equities, over $1 quadrillion in derivatives—becomes gravitationally unstable.

This isn’t a yield curve anomaly.

It’s the market saying that the base layer of the financial system is cracking.

And the longer this inversion persists, the louder the unspoken message becomes:

“The foundation has failed.

The real safety is no longer debt.

It’s metal.”

🔄 The Drain Beneath the Surface

Reverse Repo: $170.463B (🟠 Orange)

Down from over $2T in 2023.

The last time RRP sustained a break below $100B? February 2024.

What followed? The March–April selloff.

RRP isn’t just a liquidity tool.

It’s the Fed’s shadow fire extinguisher—its quiet buffer for stress.

But it’s drained fast relative to $2T in 2023. And here’s the kicker:

The Fed is buying Treasuries… then lending them back out into RRP.

This is shadow yield curve control—stealth QE.

They’re creating synthetic collateral and injecting it into a trust-starved system.

It looks like stability, but it’s not. It’s base-layer erosion.

Every Treasury that’s bought and flipped in RRP waters down the credibility of the global collateral foundation: U.S. debt.

And yes, it’s inflationary—because it fabricates new pseudo-money without real goods and services behind it.

This isn’t liquidity. It’s illusion. And the smart money sees the rot.

That’s why they’re rotating—from derivatives to deliverables.

From promises to possession.

Gold. Silver. The original extinguishers.

💱 The Schism in the East

USD/JPY: 148.52 (🟡 Yellow) - Japan 30 Year Yield: 3.057% (🟠 Orange)

Japan is the largest foreign holder of U.S. Treasuries.

For decades, its entire system survived by anchoring to U.S. debt.

But that anchor is breaking. JGB yields are surging.

The Bank of Japan must choose: defend the yen or the bond market.

They’re letting the yen devalue to defend JGB yields (a liquidity black hole).

This supercharges the yen carry trade, increasing leverage and fragility across asset classes, and sets up a more explosive unwind for the next time (think late July-early August 2024 flash-crash).

Every pip higher in USD/JPY tightens global USD liquidity.

Every tick higher in the Japan 30-year yield drives U.S. 30-year yields up too—creating a global duration shock.

And when long yields rise, equities feel it first.

The cost of capital spikes. Valuations compress. Risk cracks open.

This is not isolated. JGBs and Treasuries are structurally correlated.

When one wobbles, the other shakes. And if both shake? The whole system reels.

This is not theoretical.

This is the slow-motion disintegration of base-layer trust.

What’s left to anchor the system?

Not debt. Not promises.

Gold. Silver. Possession.

And smart capital is already rotating back—before the news catches up.

📉 The Preservation Instinct

USD/CHF: 0.8055 (🟢 Green)

The Swiss franc just saw the largest reserve surge in 25 years:

from $20B to $88B.

A 4x explosion in demand—despite deeply negative real rates.

This isn’t about yield.

It’s about trust.

Capital is fleeing complexity.

Not in panic—but with purpose.

When the world’s most conservative allocators quadruple into the franc,

they’re not chasing alpha.

They’re chasing survival.

The franc, like gold and silver, is absorbing disbelief—quietly.

And that silence is the real signal.

🚨 Term Funding Dislocation

3-Year SOFR–OIS Spread: 27.7bps (🔴 Red)

This is not a surface-level tremor—it’s deep-curve mispricing.

Banks are demanding a premium to lend into the future because they don’t trust the future.

These aren’t retail investors or reactive funds.

These are the risk architects of the modern system—institutions with real-time visibility into counterparty health, collateral flow, and liquidity plumbing.

And when the spread widens (and stays there) on term funding, it’s not a guess.

It’s a signal. A signal that something deeper is breaking.

That’s not a sign of confidence. It’s the anatomy of invisible dysfunction.

🔥 The Lit Fuse

SOFR Overnight Rate: 4.36% (🟡 Yellow)

+6bps jump in a day

SOFR doesn’t jump 6bps overnight unless something’s misfiring.

This is the base rate for trillions in overnight liquidity.

And yes—this flare might subside quickly.

But this is exactly where the cracks began in 2019.

Before COVID. Before lockdowns.

When the overnight rate suddenly spiked to 10%…

And the Fed quietly injected $1 trillion to keep the system from seizing.

That wasn’t stimulus. It was emergency triage.

What we’re seeing now? A smaller spark—so far.

But from the same wiring. It’s a fuse. And it’s sparking again.

🔐 Ready to Rotate?

This isn’t about hype. It’s not about chasing returns.

It’s about front-running increasing structural dysfunction.

Because when the base-layer of the financial system fractures, everything built on top—stocks, bonds, currencies—becomes unstable.

Smart money isn’t guessing. It’s repositioning.

From leverage… to gravity.

From paper… to possession.

That’s why they’re turning to physical gold and silver.

Not ETFs. Not derivatives. But real metal—stored, insured, deliverable.

HardAssets Alliance gives you what the elite already know to secure:

✨ Best pricing, no middlemen. Real-time execution as global wholesalers compete for your order.

✅ Fully allocated ownership. Your name. Your metal. Delivery anytime or vaulted across five global jurisdictions.

🛡️ 100% insured. Every ounce is fully covered by Lloyd’s of London—at no added cost.

🏰 Institutional security. Biometric access. Daily audits. Zero pooling.

Because in a system this distorted, you don’t want exposure.

You want ownership.

📍 Store globally.

📦 Take delivery any time.

⚠️ Shield your wealth from paper illusions.

Join the capital that sees the fault lines before the headlines.

Secure your base-layer—before the next repricing wave hits.

Luke Lovett

📲 Cell: 704.497.7324

🌐 Undervalued Assets | Sovereign Signal

📧 Email: [email protected]

Legal Disclaimer

The content provided herein is for informational and educational purposes only and should not be construed as financial, investment, legal, or tax advice. I am not a licensed financial advisor, investment professional, or attorney. The views expressed are solely those of the author and are not intended to be relied upon for making investment decisions.

While every effort has been made to ensure the accuracy of the information presented, no guarantee is given that all content is free from error, omission, or misinterpretation. Market data, trends, and conditions are subject to rapid change, and past performance is not indicative of future results.

Some views expressed may reference public insights from respected analysts and commentators. Some third-party content may be paraphrased or summarized for educational purposes only, with attribution, and does not imply endorsement or affiliation. All rights remain with the original creators.

Always conduct your own research and consult with a licensed financial advisor or registered investment professional before making any investment decisions. By reading this publication, you agree not to hold the author liable for any losses or damages resulting from the use of this information.

I am not a metals dealer. All orders are processed directly by a licensed precious metals dealer. I do not hold funds, process transactions, or provide personalized investment advice.

Reply