- The Sovereign Signal

- Posts

- 🫀 The Palpitating Heart of the System

🫀 The Palpitating Heart of the System

Where Funding Stress, Collateral Decay, and Silent Panic Converge

In the last few days, we’ve seen the most telling signals of systemic stress since perhaps 2019—hiding in plain sight, buried in data nobody bothers to read:

✅ SOFR, the benchmark cost of overnight funding, didn’t just drift higher.

It blasted through one fresh monthly high after another—jumping from 4.30 to 4.36, then to 4.40, then refusing to retreat and closing pinned at 4.39.

✅ And then, just when the market exhaled, SOFR closed at 4.45%—the most expensive funding in months.

If you think that’s an abstraction, it isn’t.

SOFR is the real price the entire system pays to stay alive for one more night, every night.

When it spikes like this, it means trust in collateral is evaporating in real time.

But it didn’t stop there.

Thanks to George Gammon’s work yesterday, we caught the signal that almost everyone missed:

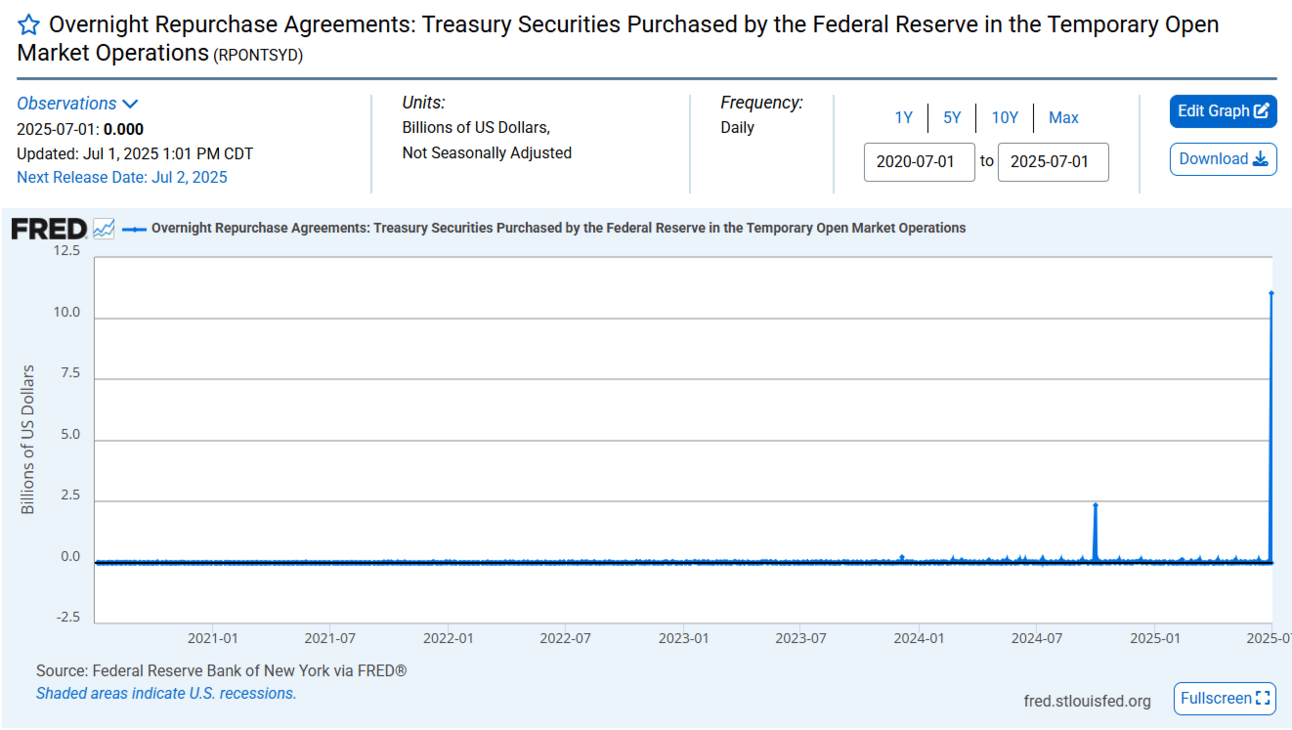

RPONTSYD—the record of emergency overnight Treasury repos conducted directly with the Federal Reserve—just erupted to $11 billion on June 30th.

For the vast majority of the past four years, RPONTSYD was at zero.

Because in healthy markets, nobody needs the Fed’s backstop.

When it jumps, it’s because entire institutions can’t fund themselves privately—no matter what rate they offer.

Alongside the spike in rates, the sheer volume of overnight funding surged to yet another all-time high.

SOFR volume hit 2,946 billion dollars—nearly $3 trillion.

SOFR isn’t an abstraction.

It’s the real, unavoidable cost the system pays to stay solvent overnight.

When SOFR jumps and stays pinned—and when RPONTSYD spikes alongside it—it means trust in collateral chains is evaporating in real time.

📡 Sovereign Signal Table — July 2, 2025

Signal | Level | Interpretation | Zone |

|---|---|---|---|

10-Year Swap Spread | –26.7 bps | Collateral strain remains entrenched—marginal deterioration after brief easing | 🔴 Red |

Reverse Repos | $245.53B | Volatility itself is the problem. If this climbs too high, collateral stress is acute. If it falls too low, it means there are no available Treasuries to pledge. Either extreme reveals how fragile the collateral plumbing has become. | 🟡 Yellow |

USD/JPY | 144.06 | Modest rebound—yen pressure still elevated but partial stabilization | 🟠 Orange |

USD/CHF | 0.7928 | Another multi-year low—persistent capital flight into Swiss safety | 🔴 Red |

SOFR 3Y OIS | 28.5 bps | Fresh spike—renewed funding tension and creeping fragility | 🟠 Orange |

SOFR Overnight Rate | 4.45% | Another jump—highest reading in over a month, confirming strain at the heart of liquidity plumbing | 🔴 Red |

SOFR Overnight Volume | 2,946 | New all-time high—systemic reliance on overnight funding keeps escalating | 🔴 Red |

Japan–US 10Y Spread | 2.84% | Stable—USD yield premium still intact but yen moves are unsettling | 🟡 Yellow |

SLV Borrow Rate | 0.71% | Slight easing—short squeeze tension momentarily cooling | 🟡 Yellow |

GLD Borrow Rate | 0.75% | Normalized after yesterday’s panic bid—latent stress still lurking | 🟡 Yellow |

COMEX Gold Warehouse | 37,048,200 oz | No change—tight registered inventories remain a quiet tail risk | 🟡 Yellow |

Gold/Silver Ratio | 93.02 | Extreme undervaluation of silver relative to gold persists | 🔴 Red |

🌐 1️⃣ Negative 10-Year Swap Spread (−26.7 bps)

This is one of the cleanest signals that the market no longer fully trusts Treasuries as pristine collateral.

A deeply negative swap spread means:

Banks and dealers prefer swaps—synthetic funding contracts—over physical Treasuries.

The collateral that’s supposed to be the “safest” in the system is now seen as less desirable.

Why is this so dangerous?

Because every layer of leverage—repos, derivatives, secured lending—assumes that Treasuries can clear the system without friction.

The more negative this spread, the more that assumption unravels.

👉 When trust in the collateral base erodes, it feeds instability everywhere else.

💥 2️⃣ SOFR Overnight Rate Surge

This is where the heartbeat of liquidity started palpitating:

June 24: 4.30%

June 25: 4.36%

June 26: 4.40%

June 27: 4.39%

June 30: 4.45%

This is not random drift.

It’s an accelerating pattern:

a sustained bid for overnight dollars, getting progressively more expensive in a matter of days.

What does this mean in plain English?

Funding desks—who must roll trillions each night—are either:

1️⃣ Losing confidence in counterparty solvency, or

2️⃣ Struggling to source acceptable collateral, or

3️⃣ Both.

This is exactly how the September 2019 repo crisis began:

a quiet squeeze, suddenly spiking into panic.

📈 3️⃣ SOFRVOL Hits Yet Another All-Time High

On June 30, SOFR overnight volume exploded to 2,946—a fresh record.

This is crucial:

Volume surged at the same time rates spiked.

Translation:

More players were forced to scramble for overnight funding.

The scramble was so intense, they accepted sharply higher rates to avoid default.

This is a sign of a liquidity pool not deepening, but thrashing violently under stress.

🏦 4️⃣ RPONTSYD Spikes to $11 Billion

RPONTSYD (“Overnight Repurchase Agreements: Treasury Securities Purchased by the Fed”) quietly jumped to $11.025B—its highest reading in weeks.

This is the Fed stepping in to buy Treasuries overnight to stabilize collateral flows.

It’s the plumbing equivalent of:

"If we don’t step in, dealers can’t fund themselves and the pipes burst."

This is often a last-resort tool to calm overnight funding panic.

When you see it rising alongside SOFR, it means the Fed is already patching leaks in the system.

🔄 5️⃣ SOFR 3Y OIS Creep Higher (28.5 bps)

This jump in the 3-year SOFR OIS spread is a longer-term signal:

Dealers are pricing even more persistent stress—not just overnight volatility.

If overnight SOFR is the pulse, 3Y OIS is the longer-term blood pressure.

It tells you that the belief in perpetual liquidity is beginning to crack.

When this spread pushes toward and above 30 bps, it signals funding stress has stopped being “transitory.”

🏦 6️⃣ Reverse Repo Volatility: The Collateral Warning Light

While most people were watching equity indexes tick higher, the Reverse Repo Facility was lurching in massive swings—visible right on your chart.

Context:

For most of late 2024, usage gradually dwindled—reflecting relative calm.

But in early 2025, something changed.

In February, balances fell and stayed under $100 billion for most of the month—

👉 This was the most important early warning of all.

👉 It preceded the March–April global market sell-off more accurately than any other indicator.

Why does that matter?

Because this facility is where the Fed lends Treasuries to dealers who can’t source them anywhere else.

✅ When balances crater to near zero, it doesn’t mean everything is fine.

It means there are no trusted, available Treasuries left to lend out.

✅ And when balances suddenly explode higher—as they did in June—it signals acute collateral hoarding and funding dysfunction.

This is why both extremes are dangerous:

Low readings = dry pipelines.

High readings = panic borrowing.

What’s most important is the volatility.

You don’t see a stable system produce swings from $50 billion to $500 billion over mere weeks.

You don’t see a stable collateral system repeatedly vanish and reappear.

The bigger picture:

Every time this number swings, it’s flashing a signal that Treasuries as collateral—the base layer of the entire global leverage machine—are under stress.

And February proved it:

When balances disappeared below $100 billion for weeks, it set the stage for the violent repricing that followed.

This volatility is not random.

It’s the market whispering:

“Trust is brittle. Funding is brittle. Collateral is brittle.”

And in this environment, all it takes is one more shock to turn volatility into paralysis.

🧠 Putting It All Together

These signals are not separate—they are all fragments of the same, unfolding story:

The sustained, deeply negative 10 year swap spread reveals that Treasuries—the supposed ultimate collateral—are quietly being deprioritized by the very institutions that once called them “risk-free.”

SOFR’s relentless climb—breaking one monthly high after another—shows the entire system is now competing for overnight funding just to keep the machinery running.

All-time high SOFR volume confirms this isn’t a small corner of the market in distress. It’s systemic stress that has become impossible to disguise.

RPONTSYD erupting to $11 billion tells you some players could no longer fund themselves in private markets—so they slipped through the back door to get emergency cash straight from the Fed.

3Y OIS jumping again proves this tension isn’t a month-end accounting quirk. It’s seeping deeper into the medium-term cost of liquidity—where real conviction lives.

The GLD borrow rate briefly doubling to 1.53% was perhaps the cleanest glimpse behind the curtain: one major player moved aggressively to secure physical gold collateral at any price—then vanished, leaving barely a ripple. That kind of behavior doesn’t happen in calm markets. It happens when trust in synthetic collateral starts to flicker.

Put simply:

We are watching the system probe the edges of what synthetic liquidity—and synthetic belief—can withstand.

Every intervention, every backstop buys another month or quarter of calm.

But each of those fixes compounds the fragility that will eventually force a collective repricing of collateral, credit, and ultimately money itself.

What looks stable today is only stable if you don’t look under the surface.

And if you do?

You’ll see the early cracks widening in real time.

🪙 Preferred Access 🪙

When a system elevates debt to the status of collateral, it becomes a monument to synthetic trust—propped up by the assumption that someone, somewhere, will always step in to keep it from collapsing.

But as we’ve seen this week—when overnight rates spike, reverse repo volatility surges, and gold borrow costs briefly double—confidence can evaporate almost instantly.

That moment is not theoretical.

It’s the moment capital remembers what’s real.

Gold and silver have always been the final collateral of last resort.

Not a derivative.

Not a promise.

Just elemental value—immune to balance sheet games.

The signals flashing across funding markets right now are not random noise.

They’re a prelude to a repricing of everything that rests on confidence alone.

If you’re ready to secure sovereign-grade bullion—verifiable metal that remains yours regardless of what the system does next—I’ve built the bridge.

Through trusted, licensed relationships, Sovereign Signal readers can access:

📦 Fully insured delivery — to your vault, your doorstep, or wherever you store peace of mind.

⚖️ Straightforward pricing — real bars, real rounds, real metal that doesn’t depend on anyone else’s solvency.

📩 Just reply to this report or email [email protected] to get connected.

Luke Lovett

📲 Cell: 704.497.7324

🌐 Undervalued Assets | Sovereign Signal

📧 Email: [email protected]

🔐 Legal Disclaimer 🔐

The content provided herein is for informational and educational purposes only and should not be construed as financial, investment, legal, or tax advice. I am not a licensed financial advisor, investment professional, or attorney. The views expressed are solely those of the author and are not intended to be relied upon for making investment decisions.

While every effort has been made to ensure the accuracy of the information presented, no guarantee is given that all content is free from error, omission, or misinterpretation. Market data, trends, and conditions are subject to rapid change, and past performance is not indicative of future results.

Some views expressed may reference public insights from respected analysts and commentators. Some third-party content may be paraphrased or summarized for educational purposes only, with attribution, and does not imply endorsement or affiliation. All rights remain with the original creators.

Always conduct your own research and consult with a licensed financial advisor or registered investment professional before making any investment decisions. By reading this publication, you agree not to hold the author liable for any losses or damages resulting from the use of this information.

I am not a metals dealer. All orders are processed directly by a licensed precious metals dealer. I do not hold funds, process transactions, or provide personalized investment advice.

Reply