- The Sovereign Signal

- Posts

- ⚖️The Pressure Valve Is Hissing - Silver's Breakout, Gold’s Reset, and the Endgame No One’s Ready For

⚖️The Pressure Valve Is Hissing - Silver's Breakout, Gold’s Reset, and the Endgame No One’s Ready For

Momentum is no longer a theory—it’s a rupture. As silver detonates decades of distortion, gold prepares to reset the sovereign balance sheet. But those who hold the truth must now hold it wisely—or be taxed by victory itself.

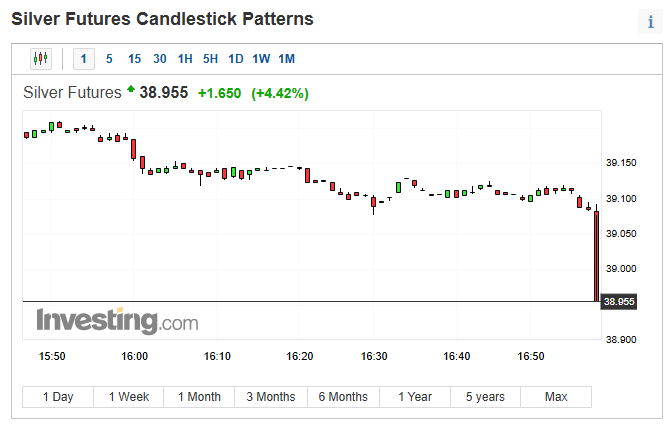

📉 Silent Sabotage or Desperation Signal? The Curious Candle at Close

Yesterday was a landmark day for silver.

The white metal surged from $38.413 to close at $38.955, tacking on +4.42% by the end of the COMEX session.

For most of the final stretch of the day, spot silver held firmly above $39.00, marking the highest level since the early June breakout began.

This is the kind of close that institutional algos tend to validate—and retail rarely understands until it's already gone parabolic.

But right as Globex trading was about to close for the weekend at 5PM ET… a strange thing happened.

A massive red candle appeared on the 1-minute chart, right before the official close.

In a moment when liquidity was drying up, someone—or something—dropped what appears to be a deliberately large sell order, slicing through the tape with no regard for execution cost or logical risk/reward.

For those who’ve watched this market long enough, this was no surprise.

I’ve heard of former Wall Street traders saying they’d be fired for making a trade like that. It’s not just bad execution—it’s either a mistake… or a message.

Whether it's price suppression, a desperate hedge desk puking inventory, or a signal of systemic short stress, this kind of move during illiquid trading hours distorts optics more than reality.

Translation? Don’t be fooled by the candle. The real signal was already sent hours earlier.

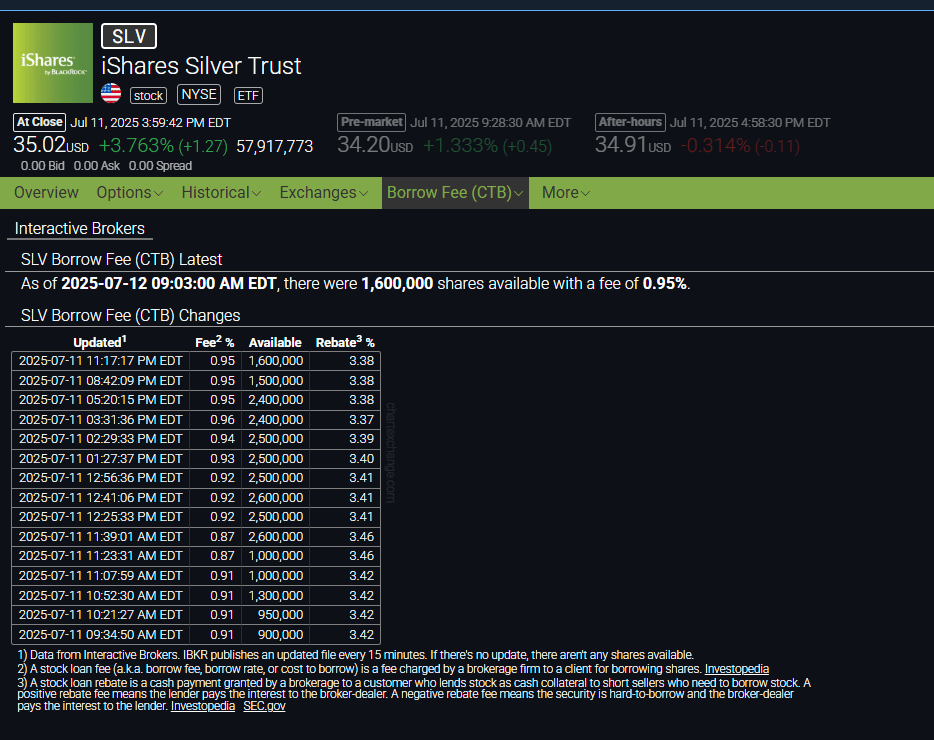

⚠️ The Squeeze Begins: SLV Borrow Rate Spikes from 0.74% to 0.95%

Behind the curtain of spot moves, SLV borrow rates are quietly flashing code orange.

As of last night:

SLV Borrow Fee: 0.95%

Available Shares: 1,600,000

*source - ChartExchange

That’s a significant jump from 0.74% yesterday morning—a move that may not sound like much to the untrained eye… but to those watching short pressure closely, it’s a seismic tremor.

This is how squeezes begin—not with fireworks, but with scrambles for availability.

Institutions trying to maintain synthetic silver shorts via SLV are now bidding up borrow fees as availability tightens.

While still far below the 16.24% all time high from Feb 7th earlier this year, this sudden spike—amid rising price is no coincidence.

The synthetic ceiling is starting to crack.

🪙 Futures Positioning Eases—but Remains Tense

According to the latest COT data:

Managed Money Net Shorts fell by 2,064 contracts to 52,324

While still near historic highs, this slight reduction shows that some funds may be covering—slowly—into strength.

This adds fuel to the thesis that shorts are starting to bleed, and with the SLV borrow rate rising simultaneously, it seems the easy-to-borrow days are numbered.

Signal | Level | Interpretation | Zone |

|---|---|---|---|

10-Year Swap Spread | –30.02 bps | An even deeper print now below 30bps. Ongoing structural distrust in the base layer of the global financial system. | 🔴 Red |

Reverse Repos (RRP) | $181.637B | Steady in the lower edge of the caution zone. Below $100B = critical zone. A breach under $100B would signal imminent liquidity stress | 🟠 Orange |

USD/JPY | 147.42 | Climbing again. More global liquidity running through yen carry trade. Watch out for a break below 140. | 🟠 Orange |

USD/CHF | 0.7966 | Swiss Franc screaming systemic stress signal. Implies global capital flight toward safety. CHF collapse could precede a credit event. | 🔴 Red |

3-Year SOFR OIS | 27.2 bps | Disconnect remains. Forward market still sees dislocation ahead. Latent instability is still embedded in rate expectations. | 🟠 Orange |

SOFR Overnight Rate | 4.31% | Stable, but only on the surface. Masked fragility beneath artificially calm short-term rates. | 🟢 Green |

SLV Borrow Rate | 0.95% | Spiked 21bps yesterday. Watch this go higher to confirm short squeeze is on. | 🟠 Orange |

GLD Borrow Rate | 0.55% | Slightly lower. Subdued—no major stress in gold lending markets yet. | 🟡 Yellow |

COMEX Gold Inventory | 36,779,205.00 (20.2M Registered) | Still implies more paper gold trading than physically deliverable metal. Registered level remains well below open interest. | 🟡 Yellow |

10Y UST – JGB Spread | 2.887% | Watch out for a break above 3% towards 3.5%. | 🟠 Orange |

🏦 From Short Squeeze to Sovereign Reset: Silver Is the Pressure Release Valve

Silver’s recent surge isn’t just a chart pattern—it’s a stress fracture in the illusion.

Because silver isn’t just undervalued.

It’s the most undervalued asset in the entire global financial system.

Even more than gold.

Silver is the pressure release valve for every distortion priced into the system.

Gold is second. Silver is first.

It’s been suppressed for decades—held down by synthetic shorts, fractional reserves, and a derivatives-driven supply illusion.

But when the pressure builds long enough, it doesn’t just leak—it blows.

And right now, SLV borrow rates are rising, physical premiums are creeping in, and COMEX inventories are just beginning to dwindle.

That’s not random—it’s structural.

Because when faith in the system falters, the first to respond is the most mispriced asset.

That’s silver.

Meanwhile, in the deeper background, gold prepares for its role as the sovereign fail-safe—a reset anchor, not a rebellion.

A tool for governments, not just hedge funds.

“Revalue gold to $20,000/oz, and the U.S. Treasury balance sheet goes from $850B to $5T overnight.”

— George Gammon, July 11, 2025

But that’s the institutional release valve.

The policy-level recalibration.

Silver, on the other hand, is raw market truth.

It’s the canary and the earthquake.

The fuse and the fire.

When the dollar system begins to buckle, silver doesn’t ask permission.

It detonates the illusion—because it was the most suppressed.

🔧 Step 1: Mechanics of the Revaluation

How does it work?

It starts with a simple promise:

👉 Uncle Sam says: “Gold is now worth $20,000”

Sounds crazy, right?

But here’s why it makes sense.

At today’s spot price, the U.S. Treasury’s ~260 million ounces of gold are worth around $850 billion.

But at $20,000/oz, that same hoard would be worth:

$5.2 trillion.

That’s right.

With one declaration, Uncle Sam can balloon his balance sheet by nearly $4.4 trillion—without printing a single new ounce of gold.

Now the Treasury holds an asset valued at $5T.

So what’s next?

They issue gold certificates—a legal tool detailed in the Fed's own Financial Accounting Manual for Federal Reserve Banks (Section 2.10)—which the Federal Reserve purchases, placing them on its balance sheet as assets.

Here’s exactly what that section says:

2.10 Gold Certificate Account (110-025)

“The Secretary of the Treasury is authorized to issue gold certificates to the Reserve Banks to monetize gold held by the U.S. Department of the Treasury (Treasury).

At any time, Treasury may reacquire the gold certificates by demonetizing the gold.”

In exchange, the Fed deposits $5T into the Treasury General Account (TGA).

So now:

Fed balance sheet: $5T in new liabilities (TGA deposits), $5T in new gold certificate assets.

Treasury balance sheet: $5T in cash, backed by revalued gold, and… still $37T in debt.

But here’s the trick: the Treasury can now buy back its own debt, shaving the total from $37T to $32T overnight.

📉 Step 2: Shrinking the Debt-to-GDP Ratio—Why It Matters

Is that enough? No.

But it’s the start of a far more strategic game.

Right now, U.S. debt sits around 120% of GDP.

Historically, sovereign crisis thresholds hover around 60–70%.

The revaluation doesn’t eliminate the debt—it shifts the optics and economics of sustainability.

It shifts the debt from a destabilizing situation to a manageable situation.

But there's more.

Because revaluing gold isn't just an accounting trick—it reverberates across global capital flows:

It signals a collapse of trust in fiat collateral.

It shocks the system into recalibration.

It may even preempt or neutralize a currency crisis, by resetting the denominator.

💥 Step 3: The Knock-On Effects—Inflation, Doom Loop & Yield Curve Control

But there’s no free lunch.

Injecting $5 trillion of fresh purchasing power into the system—through maturing Treasuries and gold bugs now flush with Lambo dreams—causes a price shock.

There’s now $5 trillion of new liquidity chasing the same amount of goods and services.

Prices rise.

Interest rates spike.

And suddenly, even with lower debt, the cost of servicing that debt explodes.

This forces the Fed into yield curve control—capping long-term Treasury rates (say at 2.5%) by buying unlimited quantities of bonds (further distorting the free market) to suppress yields.

🧯Enter Yield Curve Control (YCC): The Only Escape Valve

The Fed now has one option to prevent systemic collapse:

🔧 Cap long-term yields.

💰 Buy unlimited Treasuries.

🧨 Print whatever’s required to suppress rates.

This is Yield Curve Control.

They say:

"We won’t let the 10-year rise above 2.5%. If you want to sell, we’ll buy—at that capped yield—no matter what."

The goal?

Stop interest costs from exploding.

The cost?

Monetary expansion on a scale far greater than QE.

🧠 In Summary

Why does gold revaluation force YCC?

Because it creates inflation, which spikes rates, which threatens debt sustainability, which forces the Fed to suppress rates, which requires printing more money, which deepens inflation… which then validates the gold revaluation in the first place.

It’s a self-reinforcing loop.

And that’s why gold and silver don’t just “go up” in this scenario—they become the lifeboats as the ship tilts.

Sound extreme?

QE sounded insane in 2006.

Today, it’s part of the standard playbook.

So why wouldn’t monetizing gold—via Section 2.10—become just another tool?

🤔 Step 4: Could They Really Do This?

Yes.

Legal authority? ✅ Section 2.10 says so.

Balance sheet capacity? ✅ They’ve done it with Treasuries and MBS.

Precedent? ✅ FDR in 1933. Nixon in 1971.

Need? ✅ Systemic debt now outpaces GDP, taxation, and political feasibility.

🪙 Not All Fun and Games for Gold Bugs: The Hidden Cost of Victory

Let’s get something straight.

A revaluation of gold to $20,000/oz would be a generational victory for gold bugs—the validation of decades of ridicule, ignored warnings, and suppressed truth.

But victory doesn’t come without consequences.

Because while your ounce of gold might now be worth roughly 7x what it was, the cost of storing that ounce also just increased by roughly 7x.

If you’re paying 0.5% annually to store your gold now…

At $20,000/oz, that’s no longer a rounding error.

That’s real capital leakage.

The gold is heavier now—not physically, but financially.

And those who aren’t prepared may find themselves forced to sell just to cover carrying costs.

🧠 Read between the lines:

The system never gives without finding a way to take.

The revaluation of truth also exposes new friction points for those who once flew under the radar.

🧰 Solution? Monetize Your Gold Before the System Monetizes You

This is why intelligent gold holders—those who think in real terms—are already shifting toward yield-bearing gold structures, like leasing platforms or gold-backed credit systems.

Because in a world where gold is repriced from barbarous relic to sovereign ballast, the holders who thrive will be those who understand utility, not just price.

Gold is re-entering the system.

But don’t forget: so are you.

🧭From Passive Holder to Sovereign Steward: The Next Move for Gold & Silver Owners

If this revaluation scenario unfolds—and the signs say it’s already beginning—then holding gold and silver is no longer just a hedge…

It’s a position of power.

But power requires strategy.

Because as prices surge, so do storage costs, counterparty risks, and logistical blind spots.

That’s why I’ve partnered with a company that allows you to take the next logical step:

Earning yield on your gold and silver—instead of paying to store it.

That’s right.

Instead of seeing your metal sit idle while you bleed storage fees, you can now monetize your assets in a way that’s secure, conservative, and backed by real-world collateral.

✳️ Here’s What I Can Help With Directly

✅ Earn yield in gold or silver through vetted platforms

✅ Secure, cost-effective storage options in world-class vaults

✅ Fully insured delivery of physical metals straight to your door—no drama, no middlemen

✅ 1-on-1 consultation to match your goals with the right setup

You’ve already done the hard part: waking up.

Now make sure your metals are working for you, not costing you.

If you’d like an introduction, just reach out. I’ll get you personally connected with the right solution, with no pressure—just clarity and options.

📩 DM or email [email protected] to position yourself now.

Luke Lovett

📲 Cell: 704.497.7324

🌐 Undervalued Assets | Sovereign Signal

📧 Email: [email protected]

🔐 Legal Disclaimer 🔐

The content provided herein is for informational and educational purposes only and should not be construed as financial, investment, legal, or tax advice. I am not a licensed financial advisor, investment professional, or attorney. The views expressed are solely those of the author and are not intended to be relied upon for making investment decisions.

While every effort has been made to ensure the accuracy of the information presented, no guarantee is given that all content is free from error, omission, or misinterpretation. Market data, trends, and conditions are subject to rapid change, and past performance is not indicative of future results.

Some views expressed may reference public insights from respected analysts and commentators. Some third-party content may be paraphrased or summarized for educational purposes only, with attribution, and does not imply endorsement or affiliation. All rights remain with the original creators.

Always conduct your own research and consult with a licensed financial advisor or registered investment professional before making any investment decisions. By reading this publication, you agree not to hold the author liable for any losses or damages resulting from the use of this information.

I am not a metals dealer. All orders are processed directly by a licensed precious metals dealer. I do not hold funds, process transactions, or provide personalized investment advice.

Reply