- The Sovereign Signal

- Posts

- The System’s Running on Borrowed Breath

The System’s Running on Borrowed Breath

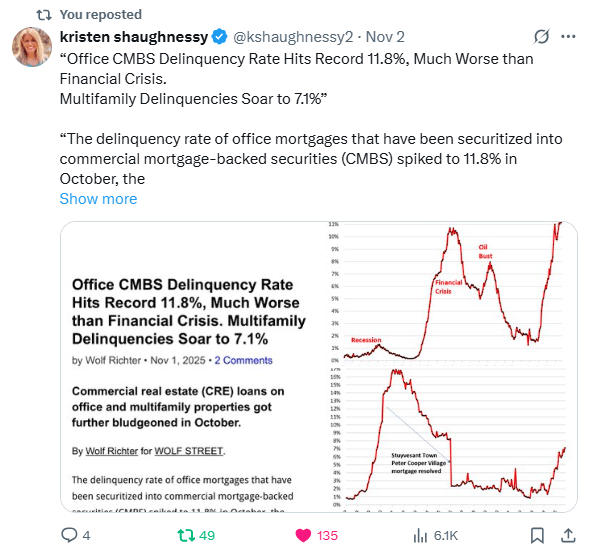

Paul Tudor Jones says today’s setup is “more explosive than 1999” — and the data agrees:• $22.3 T Treasury issuance YTD (SIFMA) → liquidity vacuum.• $395 B bank unrealized losses (FDIC Q2 2025) → fragile balance sheets.• 11.8 % office CMBS delinquencies (Wolf Street) → credit stress climbing.• Global debt = 235 % of GDP (IMF 2025) → debt-on-debt gravity.• Zombie firms surging (Bloomberg) → refinancing cliff.• Silver vaults bleeding bars (Sunil Reddy) → physical metal reclaiming price discovery.Leverage towers built on cheap money are wobbling as real funding thins. Truth is repricing fiction — and only what settles now (gold, silver, cash flow) still breathes.

Markets feel like they’re wired to explode because the whole system is running on borrowed breath.

Everyone’s stacked leverage on leverage—options on options, debt on debt—chasing one more turn of yield. Every dollar has ten claims on it. That’s why tiny moves shake the earth now.

Meanwhile, the cash cushion’s gone thin. QT drained it, Treasury sucked it up, and deposits ran to money markets. So when funding tightens, forced selling trumps fundamentals.

You’ve got a handful of giants propping up the indexes, algos programmed to chase momentum, and volatility wound tight like a spring. One spark—and it all moves together.

This isn’t doom—it’s design. The old easy-money decade built a tall tower of leverage that now has to balance on real funding. When liquidity’s scarce, truth matters again.

Simple translation: the game’s rigged toward what can settle without promises—gold, silver, cash-in-hand reality.

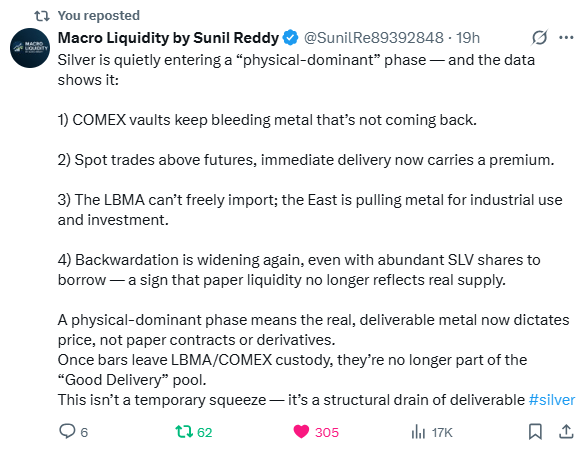

Silver’s tell: the paper game is losing to the metal.

What the tape says:

Vaults keep bleeding bars, spot > futures (backwardation), and the East is pulling metal for factories and savings.

Even with plenty of SLV shares to borrow, that doesn’t create new bars—price is being set by what can ship today, not promises tomorrow.

LEVERAGE (why it bites):

Paper claims (futures, swaps, leases) can multiply faster than real ounces.

When funding tightens and deliveries rise, those claims must settle against a shrinking pool.

Each missing bar forces buy-backs/rolls—that’s how quiet grinds become air-pocket squeezes.

Why now:

Higher rates exposed weak balance sheets, QT thinned cash cushions, and global buyers want settlement-grade collateral.

Industrial pull (solar/EV) quietly ratchets baseline demand.

Implication (simple):

In a physical-dominant phase, atoms set price.

Under-owned + tight float + mechanical trend buying = asymmetric upside that doesn’t need a storyline, just delivery.

Watch: backwardation persistence, vault draw pace, Asia premiums, and ETF creations. When those march together, the market isn’t debating—it’s collecting.

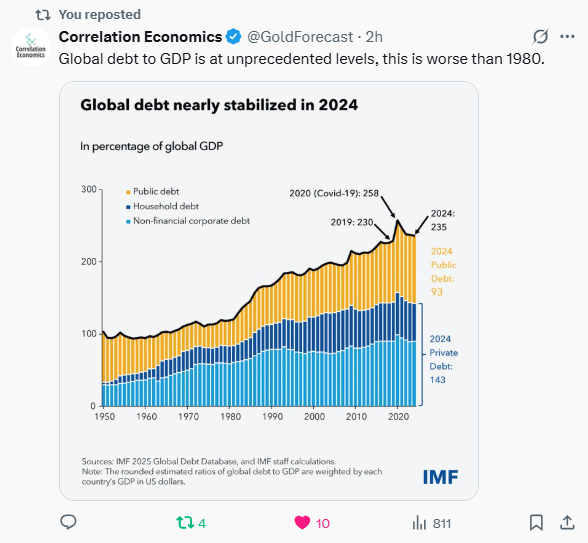

What this chart really says

Debt didn’t just grow; it stacked leverage on top of leverage.

Governments borrowed more, companies borrowed cheap, households chased prices—then that debt became collateral to borrow again.

That’s why tiny rate moves now swing whole markets: every dollar has multiple claims on it.

Why now

A decade of near-zero rates built tall towers of debt.

Rates rose; the interest bill showed up.

QT and heavy Treasury issuance thin the cash cushion dealers use to absorb shocks.

Result: funding gets jumpy, assets get yanked, and valuations drift farther from paychecks.

Translation (simple): When the bill for yesterday’s easy money arrives, the system needs either more fuel (liquidity) or less weight (de-leverage).

Until that balance is restored, anything that settles clean—real collateral, real cash flow—earns a premium.

Constructive lens

This isn’t doom; it’s a reset back toward truth over narrative.

In a max-leverage world, credibility (real collateral) compounds faster than hype (short term yield/AI bubble chasing).

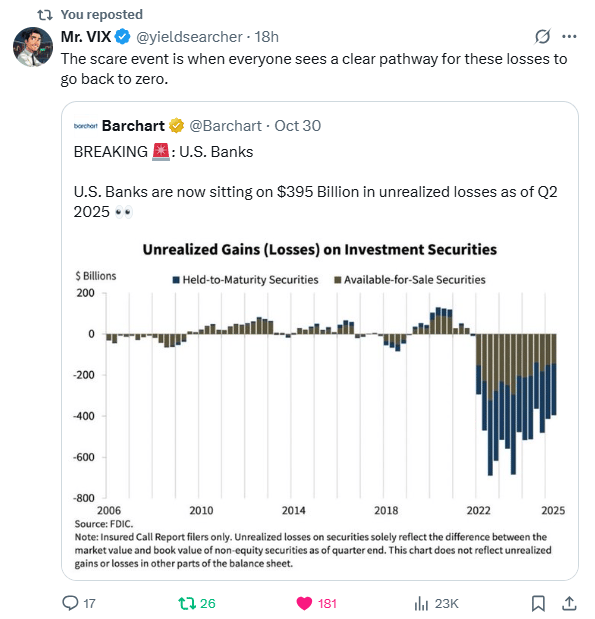

What this really means

Banks are sitting on ~$395B in paper losses because they bought lots of long bonds when rates were low.

Rates jumped → bond prices fell → the hole appears. That’s not an accounting trick; it’s duration + leverage:

Leverage:

Banks fund themselves with short, cheap money (deposits/wholesale) to buy longer, higher-yielding assets.

When funding costs rise and prices drop, the small equity slice absorbs the hit.

Why now:

A decade of easy money encouraged bigger balance sheets.

Then QT + heavy Treasury issuance thinned cash in the pipes, rates stayed high, and SOFR/repo flare-ups made dollars pricier.

The cushion shrank right as marks went south.

Implications

Thin cash + big paper losses =

tighter lending and faster de-risking when volatility flickers.

Forced sellers move first; fundamentals follow.

In that scramble, assets that settle clean (gold/silver) gain credibility because they’re not someone’s IOU.

Constructive path (not doom, mechanics):

There are only three exits:

Yields fall (policy/liquidity eases) → losses shrink.

Time + earnings refill capital (hold to maturity, retain profits).

De-lever (raise capital, sell assets, hedge) → smaller, safer balance sheets.

Bottom line: We built a tall tower on cheap money. Now funding is tight, so leverage bites.

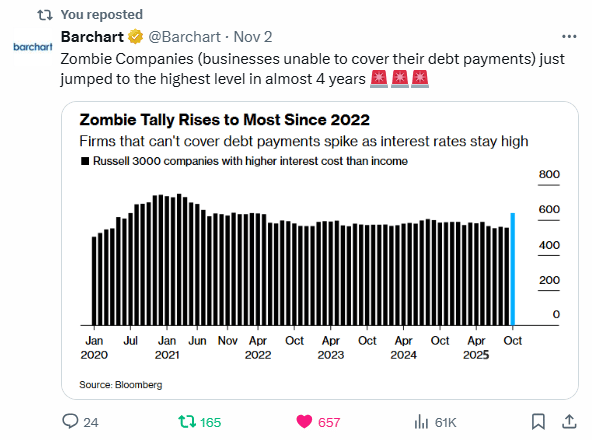

Zombies don’t die from debt. They die when the refills stop.

LEVERAGE 101:

For a decade, weak companies borrowed cheap to stay alive.

That debt rolled and rolled. Now rates are higher and liquidity is thinner, so the interest bill > income. That’s a zombie—living off credit, not cash flow.

Why now:

QT + heavy Treasury issuance drained the cushion.

Funding costs jumped (SOFR/repo flares), and lenders want real collateral. Rollover risk turned into pay-me-now risk.

What follows:

• Cuts (capex, hiring, marketing) to make payments.

• Spread widening as credit sniffs weakness.

• Forced selling when covenants bite—small shocks become air-pockets because leverage multiplies every move.Constructive read:

This is the purge that re-prices risk back to reality.

Strong cash flows, clean balance sheets, and base collateral (gold/silver) gain share as capital leaves the walking dead.

Simple translation: When easy money sputters, fundamentals outruns narrative. Own what can breathe without a lender.

Office/Multifamily delinquencies spiking = leverage meeting reality

Why now:

Rents softened, vacancies rose, and the refi wall arrived with much higher rates.

Income down, interest up → debt service fails. QT + heavy Treasury issuance thin dealer cash, so lenders won’t stretch.

LEVERAGE explained:

CRE was built on short/float debt, interest-only periods, and high LTVs. Small hits to rent or value blow up DSCR.

In CMBS, one building’s pain gets amplified through tranches—losses move up the stack fast.

What it means (simple):

More special servicing / extensions, then selective foreclosures.

Cap rates reset higher → prices lower → equity wiped before bonds.

Credit spreads widen; weak borrowers sell what they can, not what they want.

Constructive read:

This is the cleansing.

Strong sponsors with cash and real cash flow will buy prime assets at honest yields. Portfolios sized to liquidity, not vibes, win.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply