- The Sovereign Signal

- Posts

- THE TRILLION-DOLLAR RESET

THE TRILLION-DOLLAR RESET

When BRICS+ moves to zero-haircut silver, COMEX revises open interest contracts by 33,000, developed-world central banks sit below 10% gold, 40% of professionals hold none, spot silver pulls farther away from futures, developed central banks sitting under 10% gold... only 5% of fund managers seeing $5,000 gold by 2026. Translation. We're EARLY.

If BRICS+ accepts physical silver as zero-haircut repo collateral, the game is over.

That instantly turns silver from “industrial metal” into base-layer money — the same tier as gold.

And when an entire economic bloc treats silver as risk-free collateral, the price can’t stay where it is.

There isn’t enough physical supply in the world to back even a fraction of that demand.

Revaluation isn’t a maybe — it becomes the system’s survival mechanism.

Combine that with what’s already happening:

• SHFE vaults draining 3% in a single day

• Global debt hitting $111 trillion

• Japan’s bond market cracking

• Gold & silver breaking out against Bitcoin

• Energy prices suffocating crypto mining

• Repo markets everywhere hunting for pristine collateral

Everything is pointing toward the same conclusion:

The paper world is failing.

The physical world is being repriced.

COMEX “revisions” aren’t revisions.

They’re warnings.

When a market that normally fixes 200 contracts a day suddenly has 33,000-contract Monday corrections, that isn’t a typo — it’s big players hiding stress.

Delaying trades.

Masking losses.

Buying time.

And every spike lines up with moments when oversight goes dark.

That’s the tell.

Because when the paper market starts bending its own reporting to survive, it means one thing:

The collateral behind the system is cracking.

And when paper cracks, the world runs to the only collateral that doesn’t lie:

Gold and Silver.

This is how every revaluation begins —

not with headlines,

but with the paper market quietly losing control.

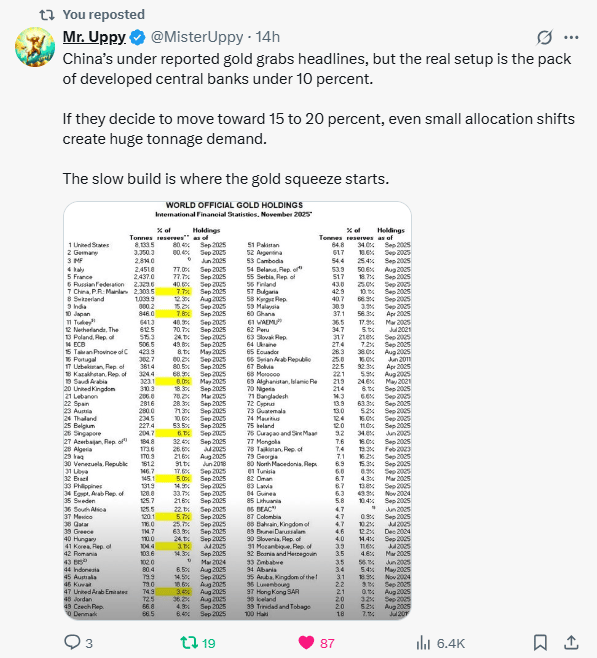

Central banks in the developed world are sitting on tiny gold allocations — under 10%.

If they even drift toward 15–20%, the tonnage required is absurd.

There isn’t enough above-ground, deliverable gold to satisfy that shift without blowing up the entire pricing system.

China hoarding? That’s just the teaser.

The real squeeze begins when the slow, quiet Western banks join the party.

Read between the lines:

When the institutions that set the system all start reaching for the same scarce asset at the same time…

the price doesn’t “rise.”

It revalues.

This is how every sovereign debt cycle ends:

Paper confidence evaporates → real collateral gets marked to reality →

gold and silver reset the system.

That’s the road we’re on.

Professionals don’t own gold because they still think the old system works.

But rate hikes already crushed bank collateral, the RRP is nearly empty, deficits are exploding, and the bond market is showing cracks.

When that happens, policymakers have exactly one tool left: liquidity.

And every time liquidity returns, gold stops following opinions and starts following math.

Only 5% of fund managers think gold breaks $5,000 by 2026.

That’s what disbelief looks like right before a rewrite of the entire collateral stack.

Because when bond collateral fails, the system doesn’t ask for sentiment.

It asks for real assets.

And that’s where this ends:

Massive, permanent revaluation of real collateral — gold and silver.

Not because people “like” them… but because the system needs them.

When the bond market screams for safety, paper beliefs collapse and physical truth takes over.

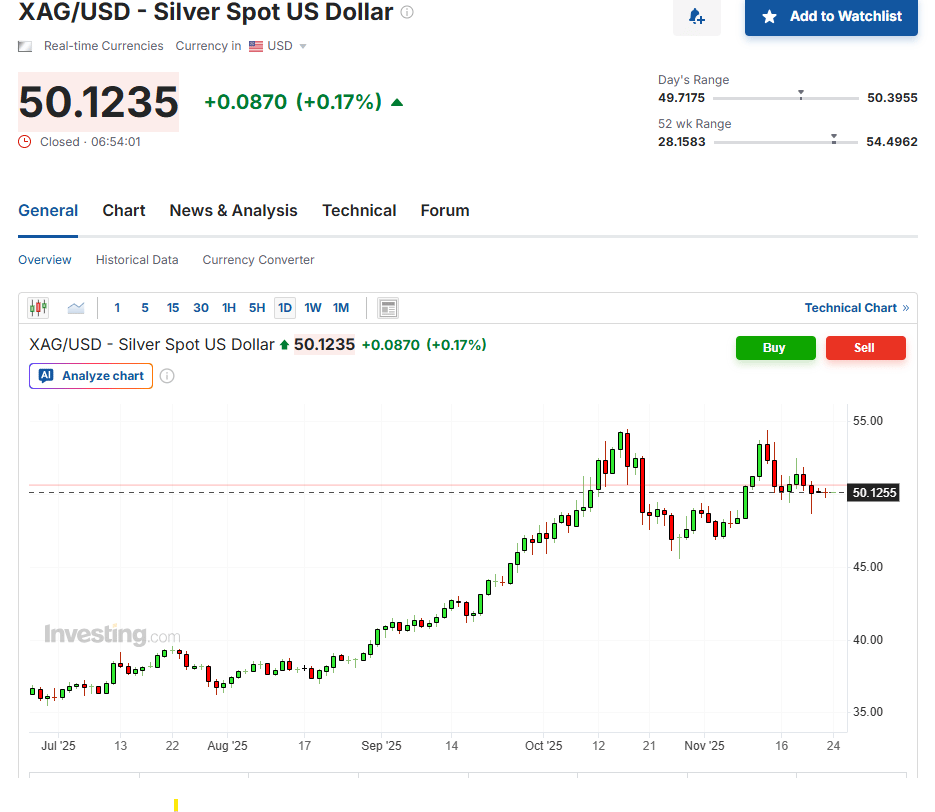

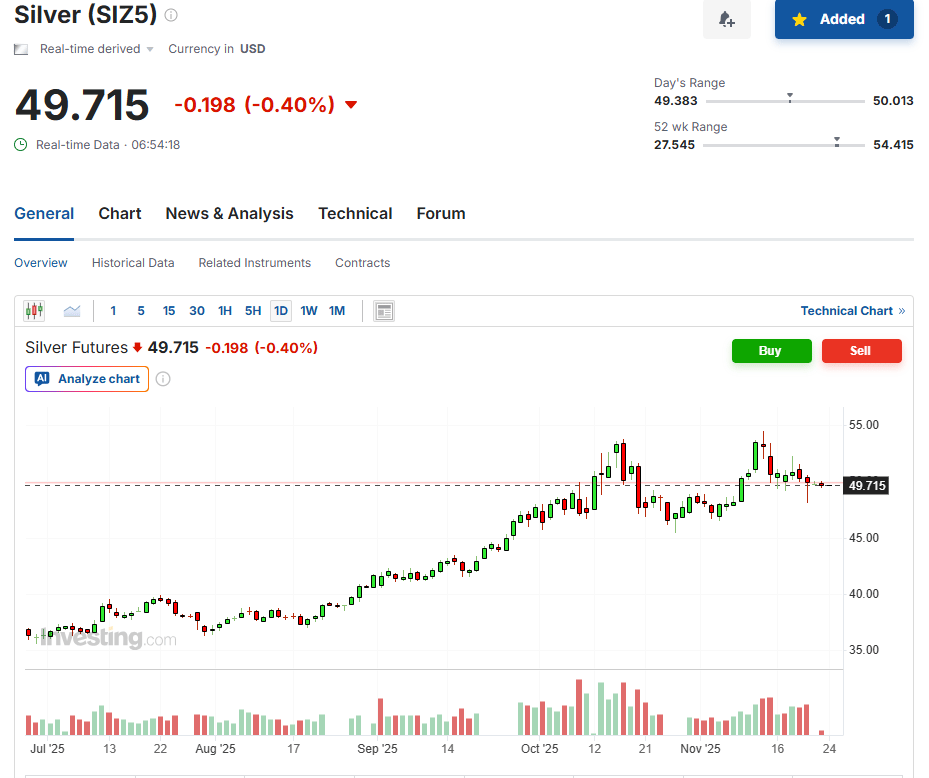

The spot–futures spread widening again is the market whispering the same message louder each week:

Physical silver is tightening.

Paper silver is pretending.

When spot trades meaningfully above futures, it means the immediate real-world demand for actual metal is outpacing the financialized promises written on screens.

That’s not “normal volatility”—that’s a stress fracture in the pricing mechanism.

It tells you:

• Physical buyers are getting urgent.

• Futures shorts are leaning on paper they may not be able to deliver.

• The arb that normally keeps these two locked together is breaking because there isn’t enough metal to close the gap.

When spreads widen in stressed systems, they don’t tighten back quietly. They snap.

And just in case you’re wondering where this ends…

It ends the same place every historic spread dislocation ends:

massive real-world collateral revaluations.

Gold and silver repricing to levels that actually clear physical supply.

The paper system is blinking.

The metal is calling the bluff.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply