- The Sovereign Signal

- Posts

- The Weak Link In The Most Interconnected Financial System In History Just Snapped

The Weak Link In The Most Interconnected Financial System In History Just Snapped

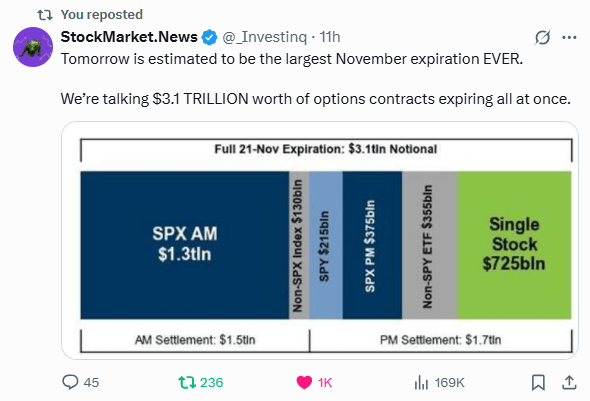

$3.1 TRILLION in options are expiring today. Japan’s bond market is blowing up.The yen is collapsing. Leverage everywhere is unwinding.

Global margin call is in motion.

VIX ripping toward 27 pre-market.

Yen finally starting to reverse after collapsing, at 156.86 at 6:45AM ET.

This is the stress we’ve been warning about for months — Japan as the weak hinge on the most hyper-leveraged, interconnected financial system ever built.

When the Yen finally reverses after a vertical collapse, it isn’t “relief.”

It’s forced buying.

It’s positions blowing out.

It’s margin clerks taking the wheel.

And here’s the punchline:

If this spike burns out quickly, the danger isn’t over — it gets worse.

Because a fast snap-back means:

the unwind hasn’t happened yet.

the leverage is still trapped.

the margin calls are still loading.

And when that unwind finally hits?

It won’t be local.

It cascades across every asset class — equities, bonds, FX, commodities — as forced sellers chase liquidity and the VIX goes feral.

OMG.

People act shocked.

What else did you expect when we stacked the most indebted, hyper-leveraged financial system in human history higher and higher for decades on top of a mountain of artificially cheap liquidity…

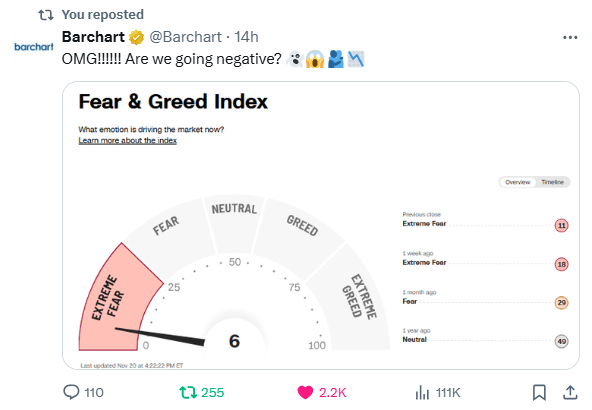

Extreme Fear at 6.

VIX screaming.

Correlations snapping.

Margin calls hitting like falling dominoes.

This is the Minsky era—liquidity collapses that feed on themselves and get bigger each time because the system is more leveraged than it has ever been:

2008 leverage ×

2020 leverage ×

Now? Orders of magnitude larger.

And here’s the punchline:

After the forced unwinds and collateral firesales finish their purge, central banks will have no choice but to unleash the largest wave of easing, balance-sheet expansion, and currency debasement ever recorded.

That’s when commodities go ballistic—in cycles—with gold and silver leading the way.

This is the opening chapter, not the finale.

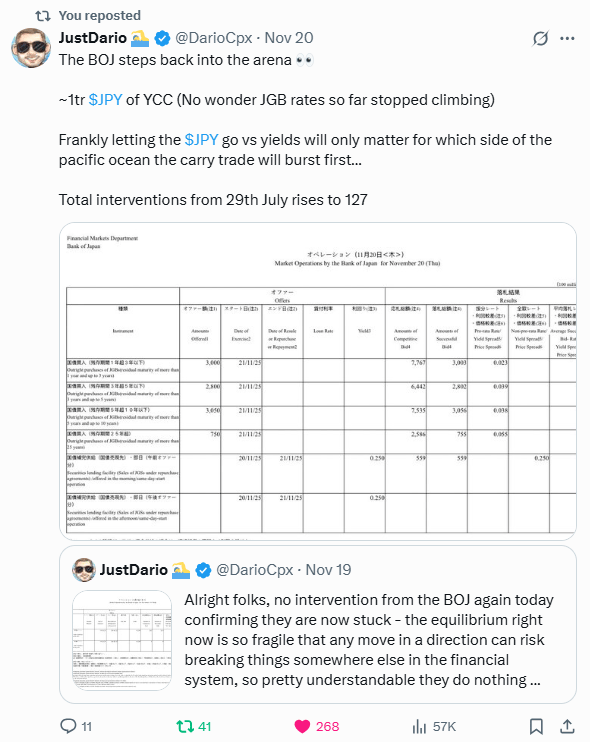

Japan just fired a trillion-yen shot of intervention… and the message couldn’t be louder:

They’re not “managing the system.”

They’re trying to stop it from breaking.

For days, the BOJ was frozen because any move—defend the yen or defend the bond market—risked snapping something somewhere else in the global plumbing.

Now they’ve been forced back in.

~¥1 trillion in YCC support tells you exactly what’s happening:

JGB yields were exploding.

The yen was collapsing.

The carry trade was starting to tremble.

The system hit the edge of what it could handle.

This “intervention” isn’t strength.

It’s triage.

Because when the BOJ steps in this aggressively, it means the equilibrium is so fragile that one wrong twitch could detonate a carry-trade unwind across the Pacific—Japan or the U.S., someone’s funding market blows first.

127 interventions since July isn’t policy.

It’s firefighting.

The implication is simple:

If Japan is forced to use this much ammo just to keep the system upright, the pressure building underneath is far bigger than the public realizes.

And the next time they freeze up again?

The stress will spill out somewhere else.

Harder.

Faster.

Louder.

This is not normal.

This is the sound of global financial architecture creaking.

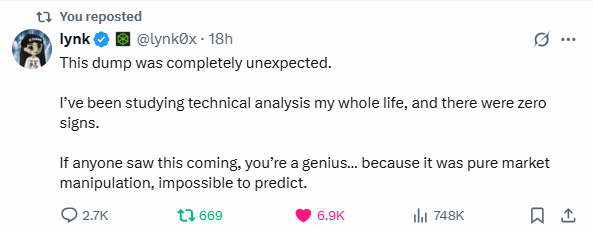

Modern TA-maxis are the high priests of a dead religion.

They stare at charts, worship patterns, and pretend leverage doesn’t exist.

Then one liquidity shock hits, the floor disappears, and they act shocked — as if debt, carry trades, and balance-sheet fragility aren’t the real engines under the market.

The irony is brutally obvious:

the longer fundamentals don’t matter, the more debt stacks, the more leverage builds, and the more violent the snap-back has to be to restore equilibrium.

And every time that snap comes, central banks panic-print to plug the hole… pushing gold and silver higher in wave after wave.

This wasn’t “impossible to predict.”

It was inevitable.

Anyone studying the plumbing instead of the candles saw it coming long before the screens went red.

This is how a Minsky world works — denial, leverage, collapse, debasement, repeat — until hard assets reclaim the throne.

What was once dismissed as ‘gold-bug paranoia’ is now Bloomberg front-page reality.

The same private-equity leverage machine that hollowed out corporate America has quietly tunneled into the retirement and life-insurance system—turning the safety net of the average American into a collateralized yield farm.

When the mainstream finally starts calling this a ‘systemic risk,’ it means the stress is no longer theoretical.

It’s already happening.

$3.1 TRILLION in options are expiring today.

Japan’s bond market is blowing up.

The yen is collapsing.

Leverage everywhere is unwinding.

This isn’t “volatility.”

This is what happens when the most indebted financial system in history hits a stress point.

Everything gets sold to meet margin.

Even gold and silver.

Not because the fundamentals changed — but because traders are drowning and need cash now.

Whether this is a one-day flush or the start of something bigger, the setup doesn’t change:

Forced selling is temporary.

Debt and leverage will keep setting new records.

Gold and silver will be the ones that re-price the highest when the fundamentals finally matter again.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply