- The Sovereign Signal

- Posts

- ⚖️ Two Sides of the Same Coin

⚖️ Two Sides of the Same Coin

Japan’s Yield Spiral and the Swiss Franc Surge Are Shaking the World’s Foundation — and Silver Is Where the Pressure Will Escape

Yesterday we saw two signals flash the same message in stereo:

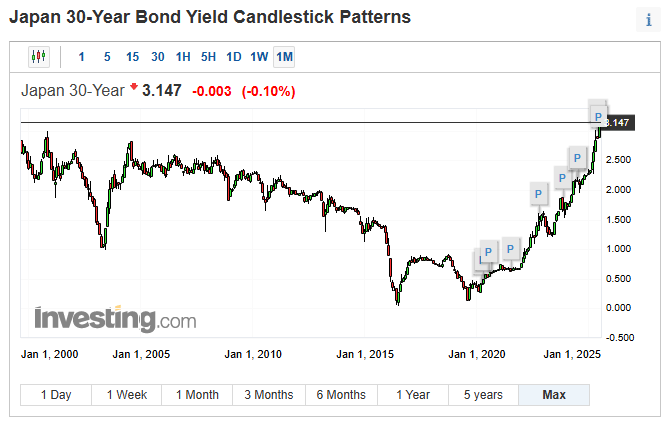

✅ Japan’s 30‑year yield ripping toward all‑time highs, a silent scream that the Bank of Japan is losing its grip on its own debt market.

✅ In the latest IMF data, global reserve managers didn’t just nudge into Swiss francs…

They catapulted:

💥 From $20 billion to $88 billion in recorded holdings —

the largest surge in the 25‑year history of the dataset.

That’s a more than four‑fold explosion in demand for a single currency in a single quarter.

📌 Meanwhile:

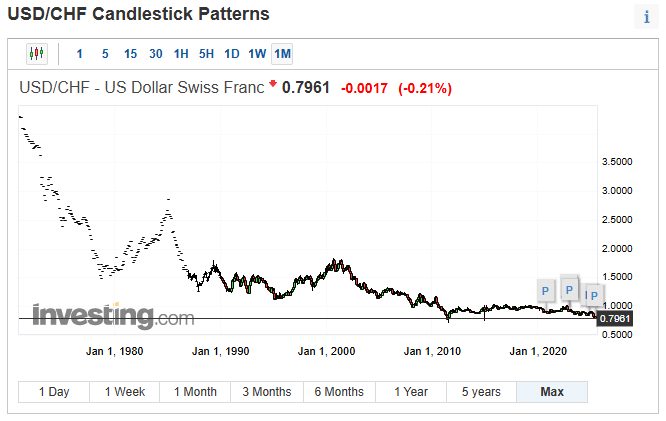

The USD/CHF trades near record lows, signaling relentless capital flows into the franc despite its deeply unfavorable real‑rate differential.

This isn’t ordinary portfolio rebalancing.

It’s the world’s deepest pockets quietly telegraphing a profound loss of confidence in the dollar’s singular role as “pristine collateral” and a rotation into alternate safe havens — even at a cost.

The takeaway:

When a currency with so little yield advantage is being hoarded at this scale, you’re not looking at a trade…

👉 You’re looking at a systemic signal.

👉 A sign the very foundations of the global monetary system are being stress‑tested in real time.

👉 The base layer of the global financial system collateral layer is losing confidence.

US Treasuries and JGBs are supposed to be the rock.

But if the rock wobbles, every derivative, every repo, every overnight loan built on top of it becomes exponentially more fragile.

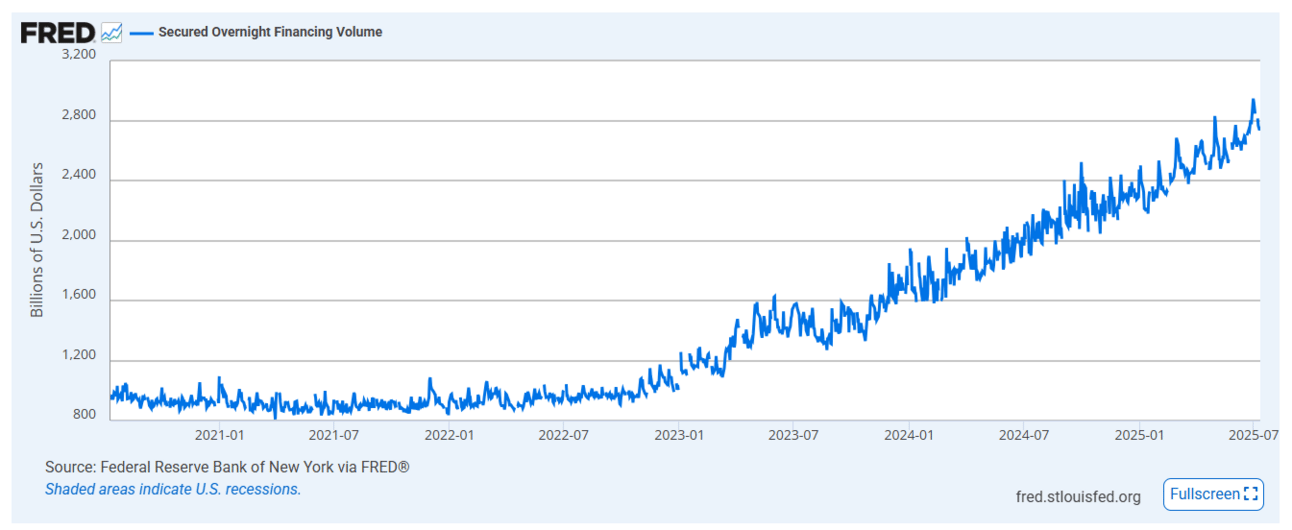

📈 SOFRVOL keeps climbing, proof the system is leaning harder and harder on overnight funding just to keep breathing.

🩹 Reverse repos – the patch to the patch – keep the illusion alive.

But here’s the deeper truth:

💡 We are now in a permanent state of QE through the repo markets.

Every time the Fed props up liquidity with these mechanisms, true price discovery erodes a little more.

And the more intervention required to hold the system together, the greater the eventual reckoning:

⚠️ When price discovery is suppressed long enough, the next liquidity event doesn’t just correct — it crashes.

⚠️ That crash demands even larger liquidity injections and more aggressive monetary support.

⚠️ Which means the next round of currency debasement will be far greater.

We’re not saying that crash is happening tomorrow.

We’re saying this is the Minsky CYCLE we are living through right now —

a cycle where exponentially greater fragility builds in the shadows until it the next major liquidity event.

💣 This is suspended dysfunction.

🥈 And then there’s silver.

Silver’s bid against what is close to a record short position on the COMEX is the pressure valve hissing before the rest of the market can hear it.

While these tectonic plates shift under our feet, silver is doing what real collateral does when synthetic systems fray: it breaks its chains.

Yesterday silver got smacked down intraday, pulling back from its high‑velocity move above $39.

As of this morning, it’s trading at $38.575 — a calm pause in the storm.

But step back and look at the bigger picture:

🔹 Just last week, silver opened at $37.15 and by Friday’s close it printed $38.955.

🔹 That’s nearly a $2 gain in a single week (up from $33.45 since June 1st) — a structural breakout in motion, not a one‑off spike.

Markets don’t go straight up.

They coil, they shake out weak hands, and they consolidate before the next leg.

This pullback isn’t a failure; it’s a healthy reset — a pressure valve adjusting before it hisses louder.

📌 Watch the mechanics beneath the price:

SLV borrow rates keep climbing, now 1.03%, a clear sign that stress is mounting for shorts as more physical is borrowed through SLV at higher rates.

Every uptick in that borrow cost means margin calls are biting and physical is being hunted down.

The tape may show a dip, but the structure shows strength.

Silver is still behaving exactly how it does in the early stages of a squeeze:

✅ Surge → ✅ Pullback/Consolidation → ✅ Next surge.

Keep your eyes on the deeper signals — not just the day‑to‑day chart.

Signal | Latest Level | Interpretation | Zone |

|---|---|---|---|

10-Year Swap Spread | –29.4 bps | Still deeply inverted. Ongoing dislocation in collateral trust. | 🔴 Red |

Reverse Repo (RRP) | $217.841B | Watch out for the $100B tripwire. | 🟠 Orange |

USD/JPY | 147.64 | This will most likely continue to weaken with JGB yields exploding higher. | 🟠 Orange |

USD/CHF | 0.7956 | Pressing near systemic stress thresholds. CHF weakness signals global fragility — Swiss capital no longer fully insulating. | 🔴 Red |

3-Year SOFR–OIS Spread | 26.4 bps | The market is demanding a premium to lend against Treasuries. A 3-year SOFR-OIS spread isn’t about today’s liquidity; it’s about how the market is pricing forward expectations for funding stress and collateral scarcity over the medium term. | 🟠 Orange |

SOFR Overnight Rate | 4.31% | Nominally stable. | 🟢 Green (surface-level only) |

SLV Borrow Rate | 1.03% | Shorts are paying more to source silver, signaling growing squeeze conditions. | 🟠 Orange |

GLD Borrow Rate | 0.55% | Calmer than silver, to be expected. | 🟡 Yellow |

COMEX Gold Inventory | 36,748,662.05 oz (20.2M Registered) | Registered gold remains tight relative to total open interest (453,712 contracts at 100 ounces per contract). Physical cover ratios stay thin. | 🟡 Yellow |

10Y UST – JGB Spread | 2.843% | Slight contraction but still elevated. High U.S. yield premium keeps Japan under pressure. | 🟠 Orange |

SOFR Overnight Volume | 2.754 trillion | Cyclically higher and higher. Market more and more reliant on overnight funding to avoid major liquidity event. | 🟠 Orange |

🌍 Signals in Stereo: Japan’s Bonds, Switzerland’s Francs, and the Fragility of the Base Layer

From $20 billion to $88 billion in recorded holdings — the largest surge in the 25‑year history of the dataset.

That’s over a four‑fold explosion in demand into the Swiss Franc. Here’s why that happened:

✅ Historical Safe Haven:

Switzerland has a long‑standing reputation as a neutral, politically stable, and highly risk‑averse jurisdiction.

In times of war, currency crises, or global shocks, capital historically flees there.

✅ Balance Sheet Conservatism:

Swiss banks and the Swiss National Bank operate with deep caution.

They run some of the strongest capital ratios in the world.

The franc itself has been managed with a mindset of stability over growth.

✅ Legal & Institutional Foundations:

Swiss law, banking secrecy traditions (even after being scaled back), and their strong creditor protections have historically made Switzerland a place where wealth is preserved, not risked.

✅ The Franc’s Role:

When global reserve managers or private investors want to park capital somewhere ultra‑safe — regardless of yield — the Swiss franc is one of the first choices.

That’s exactly what the IMF data shows:

💥 From $20 billion to $88 billion in reserve holdings despite its unfavorable yield.

This is classic behavior: when the foundations of the system wobble, you run to the most conservative corner.

This is the world’s deepest pools of capital quietly telegraphing that they no longer fully trust the dollar’s exclusive role as pristine collateral.

And the ripple effect matters even more when you factor in Japan’s unique position:

🇯🇵 Japan’s 30‑Year Yield Is Ripping — and the Base Layer Is Groaning

Japan isn’t just another economy.

It is the single largest foreign holder of U.S. Treasuries — the very instruments that anchor the global financial system.

When Japan’s 30‑year yield rips past 3% and keeps climbing, it’s not a local issue.

It’s a shockwave through the foundation of the system: sovereign collateral itself.

⚖️ The Choice They’ve Already Made

With USD/JPY at 147, the Bank of Japan will make the obvious decision:

They will defend their bond market, not the yen.

👉 That means unlimited intervention — printing yen to buy their own bonds to keep yields from running away.

👉 And that means letting the yen slide even further.

🔗 Why This Hits the Base Layer

When the BOJ prints yen to defend JGBs, two things happen:

✅ JGBs remain in circulation but only because of artificial demand.

Their price is no longer set by free market participants, but by the central bank’s balance sheet.

✅ The yen weakens as a consequence, forcing capital rotations globally.

Investors holding yen or yen‑based collateral see value erode, and they adjust by shifting into other assets or currencies (like U.S. Treasuries, CHF, or gold/silver).

Here’s the danger:

Treasuries and JGBs are supposed to be the pristine collateral underpinning the entire leverage and funding ecosystem.

Japan has the second‑largest government bond market on earth after the U.S.

But when one of those pillars (JGBs) becomes so heavily manipulated that its true price is unknown, confidence in the entire collateral chain erodes.

👉 Every repo transaction priced off these bonds becomes riskier.

👉 Every derivative, every overnight funding arrangement built atop them becomes more fragile.

👉 Swap spreads distort, SOFR volumes rise, and reverse repos keep the illusion alive — but only just.

So…

Even though the dollar is the primary reserve currency, JGBs sit right beside Treasuries in the global collateral hierarchy.

If JGBs start to wobble:

Japanese institutions likely will sell Treasuries to fund JGB bond purchases.

Repo desks re‑assess the quality of JGB collateral, tightening funding conditions.

A shockwave hits the entire leverage pyramid built on the assumption that both Treasuries and JGBs are rock‑solid.

👉 That’s why we watch JGBs so closely — they’re not just Japan’s problem, they’re a pillar of the same global base layer as Treasuries.

📌 This Is the Bigger Picture

When Switzerland’s franc — despite offering almost no yield — is being hoarded like gold, and Japan is openly monetizing its own debt to keep its bond market from imploding, you’re not looking at random noise in isolated corners of finance.

🇯🇵 Japan is the weak point of the entire global financial system.

For decades it’s been the pressure valve for global liquidity, running negative rates and providing the fuel for the enormous yen carry trade — cheap yen borrowed to chase yield everywhere from U.S. tech stocks to emerging‑market debt.

But beneath that liquidity engine sits the second‑largest sovereign bond market on Earth.

And that market — the JGB market — has been held together by years of aggressive yield‑curve control.

The Bank of Japan has had to buy its own debt in ever‑greater size just to keep long yields from breaking out.

The longer this goes on, the closer we get to a breaking point where Japan will be forced to choose:

⚔️ Defend the yen by selling foreign reserves (including U.S. Treasuries) and tightening liquidity…

or

⚔️ Defend its bond market by printing even more yen and letting the currency slide.

👉 They cannot do both.

And whichever path they choose, the consequences cascade globally:

The yen carry trade — the quiet engine of global liquidity — seizes up.

We saw this in late July-early August 2024.

U.S. Treasuries — the base layer of the global collateral system — come under stress as Japan’s interventions ripple outward.

Every repo, every derivative, every funding market built on those two pillars becomes exponentially more fragile.

This isn’t a local problem.

It’s a systemic fault line. And as that fault line widens, the shockwaves will be felt everywhere.

🥈The Ancient Pressure Valve for a Modern Fragile System 🥈

For over 8 years, Japan ran negative rates—warping the second‑largest bond market on Earth.

That bond market is structurally intertwined with U.S. Treasuries, the base layer of global collateral.

Now, with the yen carry trade pumping liquidity worldwide and Japan’s 30‑year yield ripping toward all‑time highs, the BOJ will be forced into a corner at some point:

👉 Defend the yen and risk blowing up its own debt market…

👉 Or defend its bonds and let the currency slide.

They cannot do both forever.

And every tick higher in JGB yields tightens the noose around the entire financial superstructure—because Treasuries and JGBs are supposed to be the rock upon which every repo, derivative, and overnight funding chain is built.

When that rock wobbles, the pressure has to go somewhere.

💡 That’s why throughout history, when confidence in synthetic systems cracks, capital races to the one thing that can’t be conjured out of thin air:

Silver.

⚖️ The Original Global Money

Before dollars, before Treasuries…

Silver was money.

✅ Used as currency in ancient Mesopotamia

✅ The backbone of the first truly international reserve currency — the Spanish silver dollar

✅ A dual monetary anchor alongside gold for centuries

Silver is the pressure release valve.

When monetary foundations fracture, silver historically moves fastest—because it’s both:

🛠 Industrial lifeblood (indispensable in tech, energy, and defense)

🌐 Monetary metal (a reserve of value trusted for millennia)

🔥 What We’re Seeing Now

Even with silver getting smacked down intraday yesterday, we’re simply seeing a healthy consolidation after last week’s surge from $37.15 to $38.955.

Today’s level around $38.575 is not weakness—it’s re-loading at higher levels.

📌 SLV borrow rates climbing to 1.03% signal shorts are straining to find metal to cover rising margin calls.

📌 Every uptick in that borrow cost is another signal: supply stress is real.

🏦 Position Yourself Before the Next Liquidity Shock

You don’t have to play in opaque OTC markets or hope synthetic instruments deliver.

I can connect you directly with my trusted referral partners—major U.S. precious metals dealers—offering:

✅ Fully insured delivery to your door

✅ Secure storage options in top‑tier vaults

✅ Only practical forms of metal: sovereign coins, rounds, and bars (no risky numismatics or rare collectibles)

✅ Preferred pricing channels I use myself

Gold and silver aren’t theory. They’re your hedge against the dysfunction we’re tracking.

📩 Reply or DM me to get connected.

Luke Lovett

📲 Cell: 704.497.7324

🌐 Undervalued Assets | Sovereign Signal

📧 Email: [email protected]

🔐 Legal Disclaimer 🔐

The content provided herein is for informational and educational purposes only and should not be construed as financial, investment, legal, or tax advice. I am not a licensed financial advisor, investment professional, or attorney. The views expressed are solely those of the author and are not intended to be relied upon for making investment decisions.

While every effort has been made to ensure the accuracy of the information presented, no guarantee is given that all content is free from error, omission, or misinterpretation. Market data, trends, and conditions are subject to rapid change, and past performance is not indicative of future results.

Some views expressed may reference public insights from respected analysts and commentators. Some third-party content may be paraphrased or summarized for educational purposes only, with attribution, and does not imply endorsement or affiliation. All rights remain with the original creators.

Always conduct your own research and consult with a licensed financial advisor or registered investment professional before making any investment decisions. By reading this publication, you agree not to hold the author liable for any losses or damages resulting from the use of this information.

I am not a metals dealer. All orders are processed directly by a licensed precious metals dealer. I do not hold funds, process transactions, or provide personalized investment advice.

Reply