- The Sovereign Signal

- Posts

- 🩸Under the Surface: Silver, Scarcity & the Coming Repricing

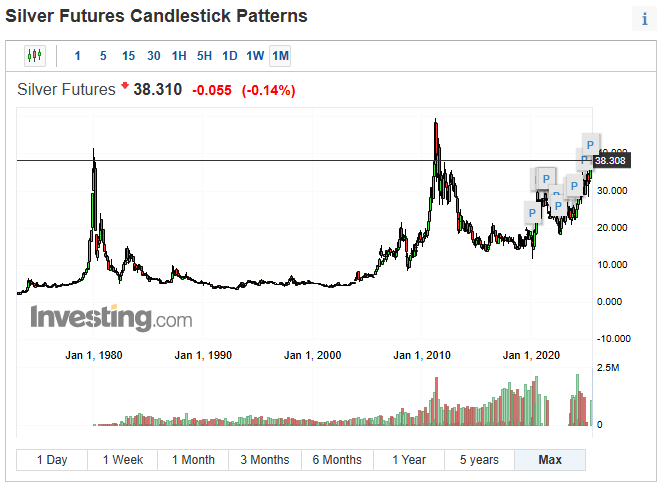

🩸Under the Surface: Silver, Scarcity & the Coming Repricing

How a Silent Battle Between Paper and Physical Is Exposing the Cracks in Global Collateral—and Why Capital Is Quietly Choosing Silver Before the System Can React

Last week, silver danced like nothing was wrong.

It opened at $38.40.

It surged to $39.91.

It closed at $38.365.

📉 Down a mere three cents. Flat.

⚖️ Balanced.

At first glance… uneventful.

But when you look under the surface—you see it:

⚔️ The COMEX Battlefield: A Clash of Giants

Large Speculators: 82,188 contracts long vs 23,521 short → 🟢 +58,667 net long

Commercials: 123,789 contracts short vs 45,357 long → 🔴 ‑78,432 net short

Open Interest: Surging to 210,124 → up +5,809 on the week

This isn’t a market drifting sideways.

This is a market on the edge of rupture—with two of the most powerful forces in global capital locked in a trench war beneath the ticker:

👉 Translation:

That wasn’t a fade. That was a failed takedown.

Price refused to break because this isn’t a market led by tourists.

It’s a battleground between two giants.

🧠 Zoom Out: This Isn’t Just Silver—This Is Systemic

Silver isn’t rising in a vacuum.

It’s the pressure gauge of a monetary system running out of pristine collateral.

Treasury markets are cracking under debt expansion.

JGBs (structurally connected to Treasuries) are heavily strained while the 10 year swap spread is screaming.

Fiat is multiplying—but trust in the base layer of the global financial system (Treasuries & JGBs) is cracking.

And silver? It’s not just a metal.

It’s becoming the escape hatch—the collateral of last resort—the pressure-release valve for a global financial engine that is sputtering.

Every SLV share created…

Every Indian ETF ounce absorbed…

Every COMEX short written without matching physical in hand…

…is a signal that faith is shifting.

This is not balance. It’s a buildup.

This is not quiet. It’s compression. This is not a chart—it’s a countdown.

Signal | Latest Level | Interpretation | Zone |

|---|---|---|---|

10-Year Swap Spread | –26.6 bps | Deep inversion → synthetic swaps are preferred over real USTs. Signals distrust in Treasury liquidity and hidden stress in base-layer collateral. | 🔴 Red |

Reverse Repos (RRP) | $150.509B | Watch for sustained break below $100B; this preceded March-April market sell off. | 🟠 Orange |

USD/JPY | 148.27 | Yen weakening again → with Japanese bond yields rising, they cannot defend both their currency and bond market at the same time. | 🟡 Yellow |

USD/CHF | 0.7992 | Below parity → CHF strength = rising global fear. Quiet signal of capital preservation instinct. | 🟠 Orange |

3-Year SOFR–OIS Spread | 26.3 bps | Dangerously elevated → stress deep in the curve. Implies ongoing mispricing of term funding risk. | 🔴 Red |

SOFR Overnight Rate | 4.3% | Stable for now. Nominally tight, but not acute. | 🟢 Green |

SLV Borrow Rate | .81% (6.3M Shares Available) | Short strain here has subsided but price has risen from $36.6 since then. | 🟡 Yellow |

COMEX Silver Registered | 196.47M oz | Only ~22.9% of total open interest could take delivery and drain entire inventory. Fragile floor. | 🟠 Orange |

COMEX Silver Volume | 74,253 | Elevated → trading action intensifying in a constrained physical environment. | 🟡 Yellow |

COMEX Open Interest (Silver) | 171,406 contracts | Implies 857M oz in paper exposure against 196M oz registered. Extreme leverage ratio. | 🟠 Orange |

GLD Borrow Rate | 0.5% (5M shares available) | Neutral. No stress signal, but bears watching if spikes. | 🟢 Green |

COMEX Gold Registered | 20.559M oz | ~44% of open interest could stand for delivery and drain the vaults. | 🟡 Yellow |

COMEX Gold Volume | 282,014 | Heavy turnover → institutional positioning shifting rapidly. | 🟡 Yellow |

COMEX Open Interest (Gold) | 466,174 contracts | 46.6M oz in exposure vs 20.6M oz available for delivery. Still >2:1 paper to physical ratio. | 🟠 Orange |

UST–JGB Spread | 2.815% | Extreme divergence = pressure on cross-border arbitrage. May drive USD funding tightness. | 🟠 Orange |

Japan 30-Year Yield | 3.02% | Near multi-decade high → straining BoJ’s YCC regime. May trigger forced intervention or collateral liquidation. | 🟠 Orange |

US 30-Year Yield | 4.916% | Elevated cost of capital → equity pressure, refinancing stress. | 🟠 Orange |

SOFRVOL (Daily Volume) | $2.725T | High throughput → indicates elevated overnight funding needs for markets to remain liquid. | 🟠 Orange |

The Battle Beneath: Privates vs. Gatekeepers

What we’re witnessing on the COMEX is not just positioning.

It’s philosophy vs. preservation.

It’s belief vs. burden.

It’s the sovereign rise of private capital against the entrenched architecture of synthetic control.

Let’s make it clear:

🏹 Who Are the Large Speculators?

These aren’t hobbyists.

These are professional opportunists—the bloodhounds of global capital.

Hedge funds scanning for asymmetry.

CTAs and systematic funds wired to chase trend breakouts.

Prop trading desks exploiting arbitrage and momentum.

Algorithmic platforms watching every uptick in borrow stress, every downtick in COMEX inventory.

They aren’t hedging. They’re hunting.

And they are long because they sense something primal:

The system is strained.

The collateral layer is cracking.

They see the stress in SLV borrow rates and share availability.

They see India—a land of bars and bangles—shifting into ETFs.

They see silver in a structural deficit for the 5th year in a row.

They see that just 22% of longs standing for delivery would drain COMEX inventories.

They see Russia announcing they’re adding silver to their state reserves last fall and launching a domestic gold exchange by year end.

They know exactly what that means. So they lean in. Hard.

🛡Who Are the Commercials?

The gatekeepers.

Swap dealers—many of them affiliated with major bullion banks—issuing futures contracts against metal that often hasn’t arrived yet.

Refiners managing flow risk.

Industrial hedgers trying to secure margins on a commodity that powers everything from solar panels to semiconductors.

They are not “short” because they hate silver.

They are “short” because they are the system.

But here’s the catch:

In normal markets, the commercials win.

They have the float, the network, the data, the collateral.

But these aren’t normal markets.

🔄 The Great Inversion

What happens when:

The private speculators are long because they see opportunity.

The commercials are short because they must maintain the status quo.

A speculative insurgency from private capital—leveraged, focused, and committed—pressing against a risk-managed, over-leveraged, systemically obligated counterparty who cannot afford for silver to surge.

The specs are long because they believe this ends differently.

The commercials are short because they cannot allow it to end differently.

🧬 The Second-Order Signal: When Paper Confirms What the Vault Can’t

At this point, you’d expect the vaults to speak louder than the screens.

But instead, we’re seeing the opposite:

💻 ETF flows are doing what refiners and COMEX can’t.

📉 Borrow rates are screaming what spot price won't say.

📦 Registered silver is declining—while price is near a 14 year high.

And then came the whisper from the East:

Indian silver ETF holdings climbed to 38.6 million oz exiting 2024—a nearly threefold jump from the prior year.

Let that land:

A culture known for its love of bars and bangles just pivoted into paper.

That’s not speculation. That’s institutional improvisation.

Because when physical is hard to source and shipping bars across borders becomes impractical, the world’s capital doesn’t stop wanting silver—it just changes rails.

It reroutes into ETFs.

Into proxies. Into any available claim on the real.

📌 The Core Truth: This Is Not About Price. It’s About Priority.

Let’s strip it down.

At $40 an ounce, every single ounce of silver in every ETF worldwide—India, SLV, PSLV, all of it—adds up to roughly $40 billion.

Meanwhile, the U.S. adds $4.5 billion in debt every single day.

In less than 10 trading days, Washington prints enough to buy the entire global ETF silver float.

That’s a flashing red warning that the monetary system is cannibalizing its own collateral layer.

That’s why hedge funds are leaning long, sensing the fracture.

That’s why SLV borrow was choking—because no one wants to lend silver they might need back.

That’s why India is flooding into silver ETFs—not because they trust paper, but because the bars are delayed, scarce, or priced out.

They’re not choosing claims over coins—they’re adapting under pressure in a market where the real thing is no longer readily available.

When a culture built on physical silver turns to paper, it’s not a preference—it’s a warning.

This isn’t just positioning. It’s not even speculation.

Smart money is front-running increasing scarcity of pristine collateral and taking advantage of the most asymmetric opportunity.

Silver isn’t just a commodity—it’s the original sovereign asset.

It’s the most electrically conductive element on Earth, and the first metal humanity ever called money.

Long before fiat. Long before gold was minted into coins.

Silver was the thread that stitched together the East and West across the Silk Road—the first true global reserve currency, trusted by emperors, kings, and merchants alike.

And now, in a world drowning in digital promises and synthetic debt, this ancient metal—this elemental truth—is in structural deficit for the fifth year in a row.

🧠 Reading the Pressure Valve

Silver is now acting as a thermodynamic gauge for the global monetary system:

When debt as the foundation starts malfunctioning…

When the 10 year swap spread remains deeply inverted for months…

When 3 Year SOFR-OIS widens and telegraphs mid term funding stress…

When the weak point of the hyper-interconnected global financial system (Japan) starts to stumble…

…silver doesn’t just spike. It awakens.

And when the real metal becomes harder to source—delayed, limited, or priced at a premium—the pressure migrates into ETFs. Into SLV. Into COMEX futures. Into proxies.

🥇🥈 Bottom Line – The Signals Are Loud Now

Silver has spoken quietly for years. But now, the pressure is too loud to ignore.

The vaults are thinning. The proxies are tightening. The market is signaling.

This isn’t just about price—it’s about priority.

And when capital starts front-running collateral scarcity, history is already in motion.

That's why I help people rotate into gold and silver through HardAssets Alliance—a platform that bridges sovereign-grade metals with world-class simplicity:

✨ Best pricing, no middlemen. Real-time execution with global wholesalers competing for your order.

✅ Fully allocated ownership. Your metal. Your name. Delivery anytime or vault-secured across five global locations.

🛡️ 100% insured. Every ounce fully covered by Lloyd’s of London—no added cost.

🏰 Institutional security. Biometric access, daily audits, and zero pooling.

If you’re ready to explore what real collateral looks like—before the next squeeze makes the choice for you—I’d be honored to help you set up a fully allocated position.

📩 Reach out directly.

Luke Lovett

📲 Cell: 704.497.7324

🌐 Undervalued Assets | Sovereign Signal

📧 Email: [email protected]

🔐 Legal Disclaimer 🔐

The content provided herein is for informational and educational purposes only and should not be construed as financial, investment, legal, or tax advice. I am not a licensed financial advisor, investment professional, or attorney. The views expressed are solely those of the author and are not intended to be relied upon for making investment decisions.

While every effort has been made to ensure the accuracy of the information presented, no guarantee is given that all content is free from error, omission, or misinterpretation. Market data, trends, and conditions are subject to rapid change, and past performance is not indicative of future results.

Some views expressed may reference public insights from respected analysts and commentators. Some third-party content may be paraphrased or summarized for educational purposes only, with attribution, and does not imply endorsement or affiliation. All rights remain with the original creators.

Always conduct your own research and consult with a licensed financial advisor or registered investment professional before making any investment decisions. By reading this publication, you agree not to hold the author liable for any losses or damages resulting from the use of this information.

I am not a metals dealer. All orders are processed directly by a licensed precious metals dealer. I do not hold funds, process transactions, or provide personalized investment advice.

Reply