- The Sovereign Signal

- Posts

- "US Dept of War announces investment of over $2 Billion For A US Smelter to process critical minerals such as Silver" While Chinese Silver Inventories Continue To Decline - Mexico, Largest Silver Producer, Remains at 20% Peak Output, Silver Is Critical Infrastructure for AI Race

"US Dept of War announces investment of over $2 Billion For A US Smelter to process critical minerals such as Silver" While Chinese Silver Inventories Continue To Decline - Mexico, Largest Silver Producer, Remains at 20% Peak Output, Silver Is Critical Infrastructure for AI Race

The greatest global debt bender in history would naturally precede a global scramble for commodities.

The Pentagon taking 40% of a new U.S. silver smelter—the first since the 1970s—means silver just graduated from commodity to strategic material.

This isn’t “industry news”; it’s war-economy positioning.

When the state moves downstream into refining concentrates, you get a price-insensitive buyer, export controls, and a reshoring race that shifts the bottleneck from smelting to ore…

which pushes the scramble into Latin America and anywhere supply can be locked.

…Pentagon takes 40% of a U.S. smelter while SHFE inventories bleed out: that’s sovereigns vacuuming the metal while the West rushes to rebuild refining.

When states turn into price-insensitive buyers and warehouses in Shanghai run dry, you don’t get “pullbacks,” price resolves with parabolic leaps.

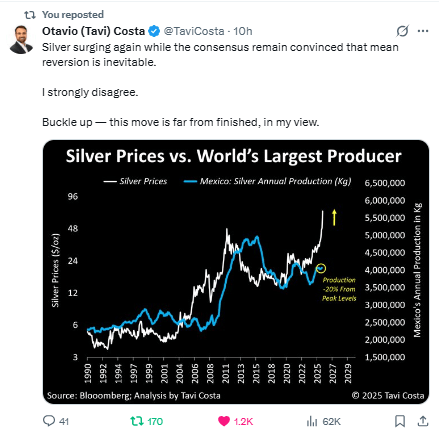

Consensus keeps chanting “mean reversion,” but the supply side is screaming regime shift.

Mexico—the world’s silver workhorse—still ~20% below peak output while SHFE stocks vanish and the U.S. scrambles to onshore a smelter with the Pentagon on the cap table.

That isn’t a spike to fade; it’s a structural choke point meeting sovereign, price-insensitive demand.

Reversion won’t save you when the curve itself is being redrawn.

At first glance, of course this post is about oil.

But silver is absolutely critical to the future of the technological and industrial advance the market is hoping can fix the 330% global debt to GDP.

Software may “eat the world,” but the world eats silver.

AI’s compute stacks, solar throughput, EVs, defense—all of it scales on a physical choke point, and that choke point historically conducts at 6% of the price of gold.

China understood this years ago; the U.S. is only now pivoting to stockpile and re-shore.

When the market finally prices silver as both the energy metal and the compute metal, we won’t be arguing over $70 vs. $80—we’ll be repricing the bandwidth of civilization.

AI league tables miss the real scoreboard: who owns the atoms that feed the algorithms.

Countries “winning” AI without locked-down supply of silver, copper, power, and fabs are renting greatness on margin.

The next decade’s AI edge is a materials/energy moat—compute sovereignty measured in megawatts, wafers, and ounces.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply