- The Sovereign Signal

- Posts

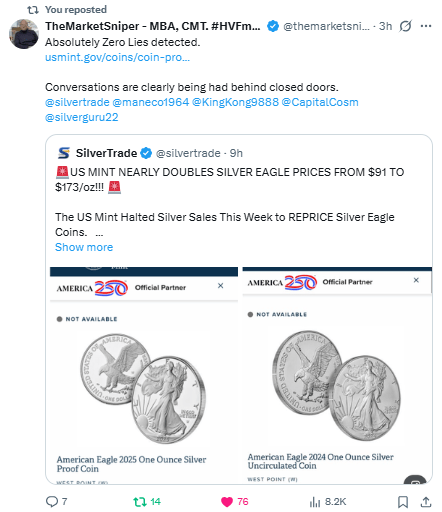

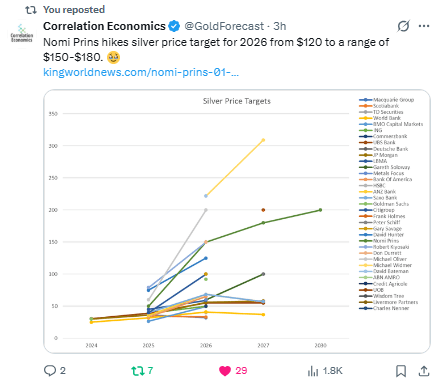

- US Mint Nearly Doubles Silver Eagle Prices From $91 to $173 Per Ounce While Customers Trying To Buy Precious Metals From Dealers Are Told By Their Banks That The Wires Cannot Be Completed

US Mint Nearly Doubles Silver Eagle Prices From $91 to $173 Per Ounce While Customers Trying To Buy Precious Metals From Dealers Are Told By Their Banks That The Wires Cannot Be Completed

This is what we've been warning about. The metal that our world is built on is getting ready to go "unobtanium"

What’s unfolding isn’t a single headline—it’s a systemic shift hiding in plain sight.

The U.S. Mint just nearly doubled the price of Silver Eagles - massive implications.

One of the largest US precious metals dealers (Apmex) slapped on a $10,000 minimum order threshold this week.

Retail investors are reporting blocked bank wires to metal dealers.

And this all happens just before a long market holiday, when liquidity is thin and public attention is elsewhere. But zoom out—and the pattern sharpens.

Silver is now officially deemed a national security asset.

That reclassification opens the door to price controls, export restrictions, and prioritization of supply for strategic use.

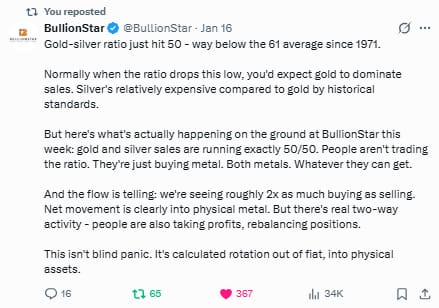

Meanwhile, the gold-silver ratio is flashing historically (recent history only) tight spreads—but retail buying is split 50/50.

This isn't a trade—it’s a rush out of an exponentially depreciating currency. A rotation from promises to property.

Central banks are the most well informed and well funded traders in the world, as Andy Schectman astutely points out.

They’re the ones who have been leading the move. They’re not speculating. They’re settling accounts. Mining stocks are still asleep…

but real metal demand is waking up—and accelerating. We are in the early innings of the great repricing of tangible value. The implications are equally exciting and concerning.

At the same time, geopolitical tensions are accelerating.

War drums are beating louder while supply chains are shifting.

A 3 day weekend means more potential for big moves while markets are closed.

This isn’t about silver going up.

This is about the monetary system changing.

Back to what has worked since the beginning of time.

Right as the existing world order is coming apart at the seams.

Strategic assets are being nationalized or locked down. And the institutions who understand this best aren’t telling the public—they’re just quietly acting.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply