- The Sovereign Signal

- Posts

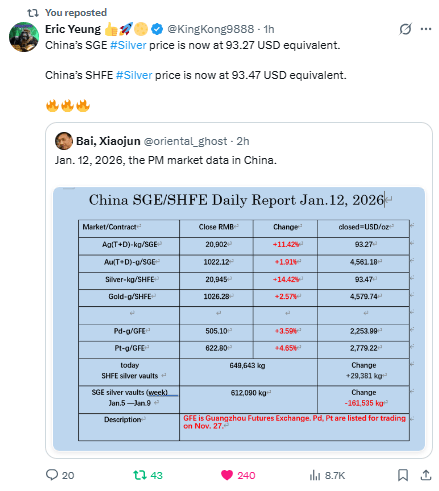

- US Silver Price Breaking Above $84 As It Chases Chinese Silver Priced Above $93 USD, Chinese Silver Inventories Remain Unsustainably Low, SLV Strike $73 Was Just Breached (May Trigger Margin Calls And Forced Buying Accelerating The Move Higher)

US Silver Price Breaking Above $84 As It Chases Chinese Silver Priced Above $93 USD, Chinese Silver Inventories Remain Unsustainably Low, SLV Strike $73 Was Just Breached (May Trigger Margin Calls And Forced Buying Accelerating The Move Higher)

It doesn't look like the world is going to slow down anytime soon.

Spot silver is currently trading above $84 in the US.

That tight bull flag? It’s a launchpad.

The energy stored in that coiling pattern is potential volatility compressed.

The fact it’s happening after a massive run suggests not exhaustion — but continuation.

If this breakout is paired with increasing participation, you’ve got fuel.

Retail’s still mostly absent and the “longs haven’t arrived yet,” remember?

Combine that with a wall of macro pressure (deficits, geopolitical noise, central bank indecision), and this chart might be front-running something bigger.

The $96 target isn’t a moonshot—it’s math. It’s the measured move of this pattern projected upward.

The real signal isn’t just that China’s silver spot is pushing $93+.

It’s that the market that runs more on physical demand — not leverage, not derivatives — is now flashing red-hot.

The Shanghai Gold Exchange (SGE) and SHFE aren’t paper casinos.

They're where real metal clears.

That makes their prices a far more accurate reflection of what silver is truly worth when people actually want to own it — not just trade around it.

So when SGE shows $93.27 and SHFE ticks $93.47 — 15–20% above Western benchmarks — that’s not a distortion. It’s revelation.

It’s a signal from the part of the system that still prices based on scarcity, utility, and urgency — not synthetic supply.

This isn’t about “tightness.” It’s about dislocation.

No one’s asking the right question: Why is this premium sticking?

When the physical market starts decoupling from the paper one, you’re not watching a price rally. We’re watching a monetary fracture.

The question now isn’t how high silver goes. It’s who controls the price signal when it breaks free.

You’d think at $93+ silver, inventories in China would be flooding in. They're not.

That’s not a bullish signal — it’s a warning shot. It means silver isn’t just expensive — it’s scarce.

Scarce enough that even at these levels, physical holders still aren’t selling into the rally. The price is climbing a wall of refusal.

This is the loudest signal yet: the Chinese market — the most physically driven silver market on Earth — is breaking from the paper price-setting West.

It’s not waiting for COMEX to catch up. It’s setting its own terms, and the message is crystal clear:

Silver at $93 is not expensive. It’s not even close to equilibrium.

Because inventory doesn’t lie. If $93 was “too high,” metal would be flowing in. It’s not. That means either 1) the metal’s not there, or 2) no one wants to part with it — at least not for double digits. Probably both.

The chart’s brutal logic? We haven’t hit the “sell zone” yet. That zone may not appear until $100+, maybe far higher. And even then, it depends on trust. In the system. In the currency. In the paper claims.

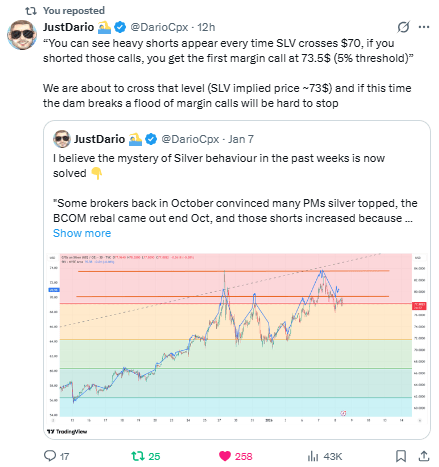

SLV pre-market at $76.12 means we’re within a hair’s breadth of the margin call tripwire at $73.50.

This has been a kill zone where shorts pile in — a mechanical reflex embedded into market behavior.

But this time? There’s blood in the water — and too many trapped traders on the wrong side.

What happens next? If SLV blows through $76 and margin calls start hitting in waves, we may be looking at a reflexive chain reaction.

Forced buying. Gamma squeezes. An acceleration higher.

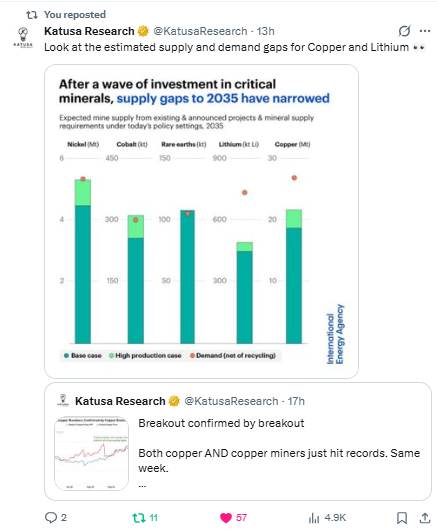

Even under optimistic production scenarios, copper and lithium supply falls short.

And those "base case" projections?

They're packed with assumptions that won’t hold: flawless permitting, zero geopolitical hiccups, infinite capital, and no delays in extraction or refining.

Now zoom out. Copper just broke out to new highs. Miners too.

That’s not a cheer for surplus — it’s a scream for structural scarcity.

Because copper isn’t just an industrial metal anymore — it’s the bottleneck of a high-voltage, AI-driven, defense-hardened, electrified future.

Lithium? Same deal. Batteries are the new barrels.

And here’s the real kicker: when supply-demand gaps narrow on paper but prices still rip, you’re not watching resolution — you’re watching the market front-run the realization that “catching up” isn’t coming.

Who would have thought that the greatest commodities bull run in history would have followed the greatest global debt bender in history?

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply