- The Sovereign Signal

- Posts

- Venezuela's Market Up 100% Since Maduro Capture as Chinese Foothold In Latin America Was Severed, Dow To Gold Ratio Suggesting Severe Stress In Markets Are Just Beginning, Silver Volatility To Continue As It Goes Higher, Global Battle for Control Over Commodities' Is Heating Up

Venezuela's Market Up 100% Since Maduro Capture as Chinese Foothold In Latin America Was Severed, Dow To Gold Ratio Suggesting Severe Stress In Markets Are Just Beginning, Silver Volatility To Continue As It Goes Higher, Global Battle for Control Over Commodities' Is Heating Up

Things are heating up around the world. Nation states know that who controls commodities' are who can finance/sustain war time efforts the longest.

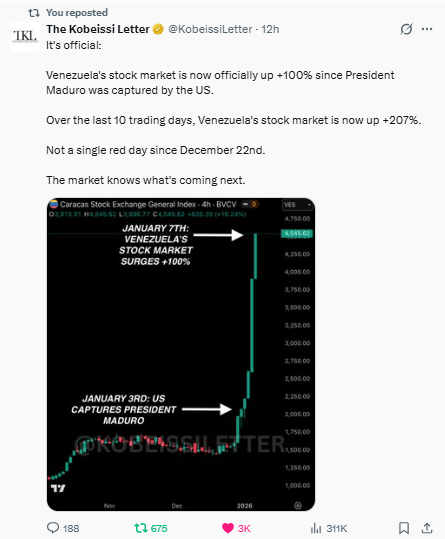

A communist dictator vanishes. In days, the market doubles. No red candles. No hesitation.

Maduro’s removal signals regime-controlled assets are up for grabs.

U.S. corporations and partners are likely being positioned to benefit.

The Caracas stock market isn’t surging on local growth — it’s front-running foreign capital flooding in to tap Venezuela’s oil and minerals under new political terms.

This is a soft coup for hard assets.

The market isn’t reacting to politics — it’s reacting to control over resources changing hands.

And as always, money moves first.

Venezuela wasn’t about Maduro.

He was just the lock on the door.

China spent years turning Venezuela into a forward base — oil, ports, logistics, leverage over sea lanes.

Sanctions forced cheap oil straight into Beijing’s hands.

That was the real pipeline.

Now that pipeline is gone.

Markets aren’t celebrating politics — they’re repricing control.

Control of the largest oil reserves on Earth.

Control of the Caribbean.

Control of who feeds energy into the next phase of global power.

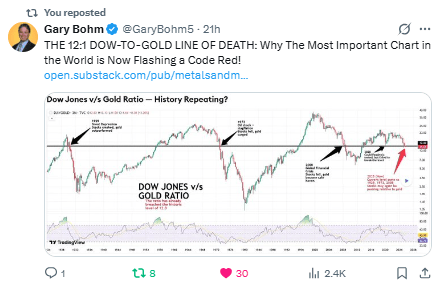

The 12:1 Dow-to-Gold ratio isn’t just a chart level — it’s a warning siren.

Every time this line breaks, something snaps: dot-com bubble, 2008, stagflation.

It marks the moment when real assets start reclaiming dominance from financial fantasy.

We're flirting with that line again.

Paper assets are bloated, gold is rising — not because people want it, but because they need it.

When trust in the system cracks, gold doesn’t just go up… it re-prices everything else.

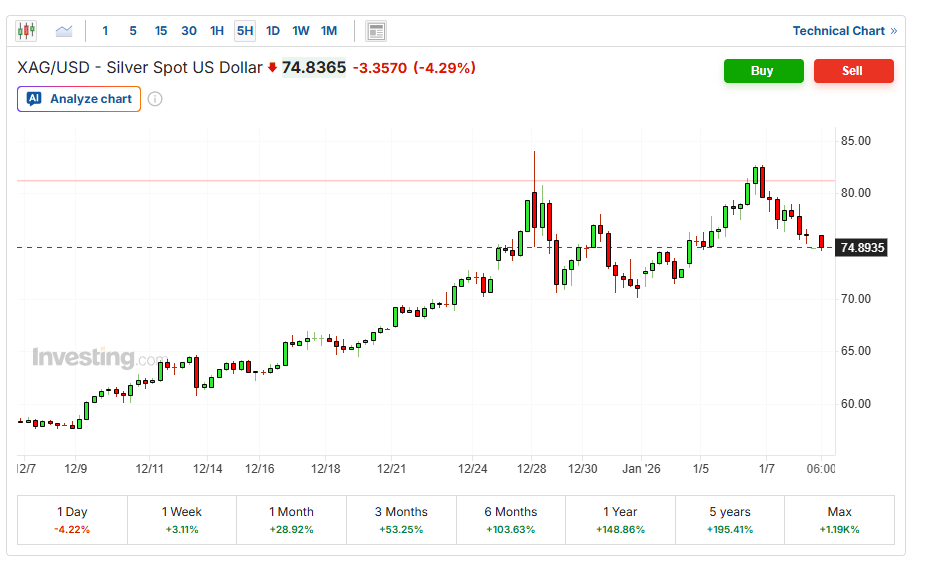

Silver’s not volatile by accident — it’s volatile because something’s breaking.

This kind of turbulence in the $70–$80 range isn’t random noise.

It’s the market wrestling with a new reality:

Paper supply is running into physical scarcity.

Big money is trying to reposition before the dam fully breaks.

That’s why we’re seeing huge daily swings — not at $20… but at $75.

This isn’t a top.

It’s the shakeout before liftoff.

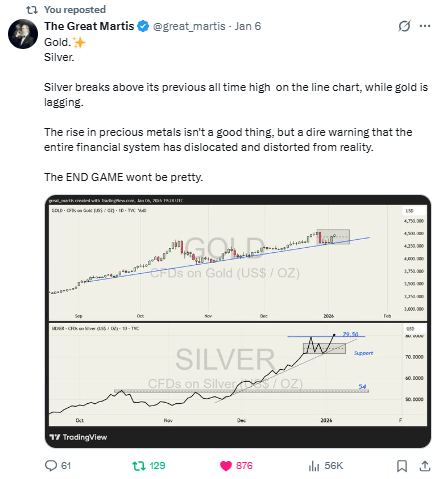

Gold broke out first, quietly signaling systemic stress — a flight to safety.

But instead of continuing its ascent, it stalled, grinding sideways as capital waited to see what came next.

Then silver exploded.

Not as a follower — but as the confirmation.

When the "poor man's gold" breaks out after gold already has, it’s not just momentum — it’s deterioration at the margins.

Gold is the warning.

Silver is the escalation.

This isn’t inflation. It’s not speculation.

It’s the market repricing risk across the system — and silver just took the lead because pressure is now showing where the system is thinnest.

Nickel isn’t just running — it’s being weaponized.

China's hoarding. Indonesia’s squeezing supply.

This isn’t a market move — it’s a power move.

In a world drowning in debt and distrust, commodities are the new currency.

Real stuff, not promises, is what nations want. This is economic warfare in slow motion.

Who controls the inputs, controls the future. And the board is already in motion.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply