- The Sovereign Signal

- Posts

- Volatility Is Back, 🚨100% Silver Lease Rates, and $100 Silver By April 2026

Volatility Is Back, 🚨100% Silver Lease Rates, and $100 Silver By April 2026

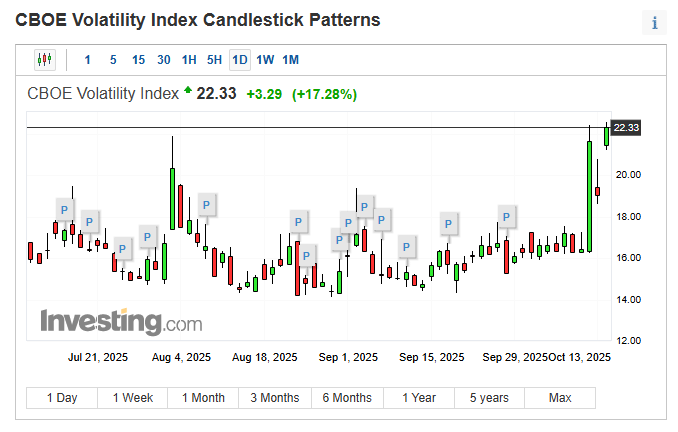

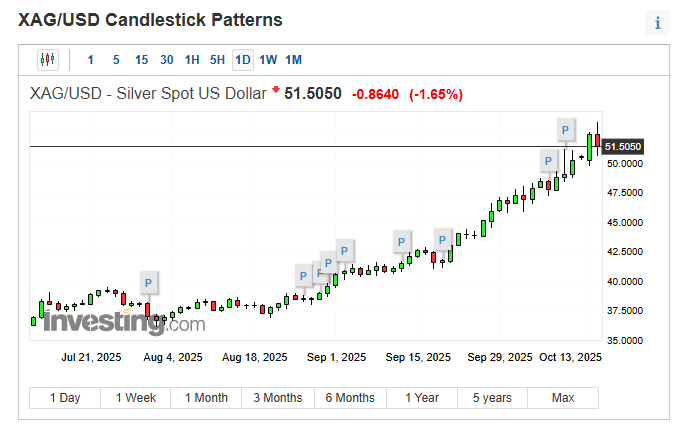

VIX just printed a higher high than Friday (22.58 > 22.44), spot silver at $53.55→$51.50 vs futures ~$50.71 keeps backwardation alive, SLV borrow = zero shares, and the Shanghai Gold Exchange is rationing metal while silver lease explodes >100%—classic shortage math. Add a momentum regime shift (Oliver’s $100 target) and the debasement trade finally priced as central banks rotate from sovereign IOUs to gold/silver: dips are air pockets, not relief; the path of least resistance is up and violent until actual bars show up—or price forces them to.

VIX making a new high pre-market (22.58 > Friday’s 22.44) says the stress didn’t “resolve”—it rolled forward.

That’s dealers buying volatility / selling delta again, which forces more index selling into the open and pushes correlations toward 1.

A higher VIX with no fresh news = positioning pain (short-vol, crowded longs) rather than narrative; the short-vol carry machine is still unwinding.

Spot ripped to $53.55 overnight, then cooled to ~$51.50.

Futures sit ~$50.71. The backwardation (spot > futures) narrowed—not because the squeeze is over, but because paper chased up and some spot froth bled off.

The tell that tightness remains: SLV borrow is still at zero shares (even if the fee/rebate eased). That means shorts can’t easily source inventory; the float is scarce.

When borrow vanishes, price dips don’t equal “problem solved”—they often mean risk managers took profits and hedges got shuffled while the underlying shortage persists.

Translation: last night was air out of the balloon, not a pin. As long as borrow stays scarce, registered bars keep bleeding, and EFP/lease metrics are tight, the path of least resistance is still higher—with violent snap-backs as futures and options desks try to keep up with the cash market.

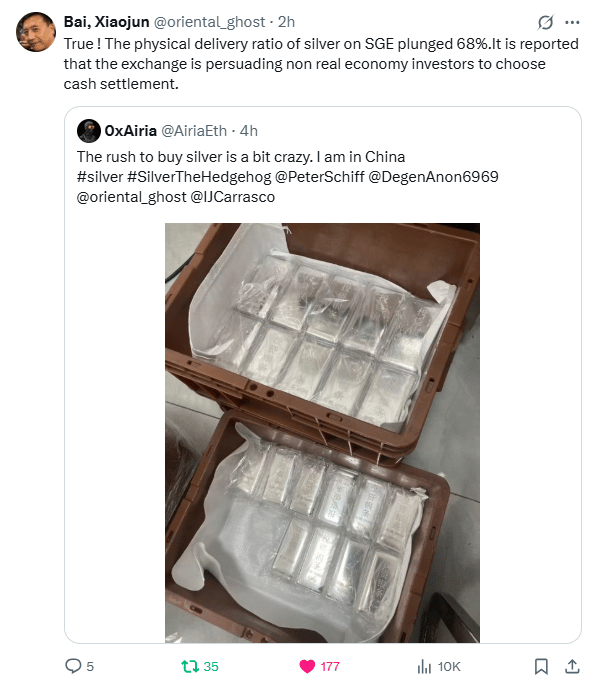

Translation: the Shanghai Gold Exchange is quietly rationing metal.

A 68% plunge in the physical delivery ratio and “please take cash settlement” means: demand is stampeding, bars are tight, and the exchange is prioritizing real-economy users over speculators.

Read-through: when venues push paper over atoms, it’s not calm—it’s shortage management. Expect wider spreads, stickier backwardation, and higher spot premia until supply catches up—or price forces it to.

⚠️ Liquidity & Funding

Signal | Latest Level | Interpretation | Zone |

|---|---|---|---|

10-Year Swap Spread | −21.00 bps | Still deeply negative — collateral premium extreme; dealers prefer synthetic over cash USTs. | 🟠 Orange |

Reverse Repos (RRP) | $4.124 B | Emergency cash buffer effectively empty — the Fed’s pressure valve is near dry. | 🔴 Red |

USD/JPY | 152.05 | Carry still on; intervention risk lurks beneath the surface. | 🟠 Orange |

USD/CHF | 0.8039 | Near fear extreme — capital rotating toward hardest-fiat safe zone. | 🟠 Orange |

3-Year SOFR–OIS Spread | 20.45 bps | Elevated but easing — funding stress persists. | 🟠 Orange |

SOFR Overnight Rate | 4.13 % | Stable; mild relief at the margin. | 🟡 Yellow |

SOFR VOL | $2.923 T | Heavy reliance on overnight funding — market running hot to maintain flow. | 🟠 Orange |

🪙 Gold & Silver

Signal | Latest Level | Interpretation | Zone |

|---|---|---|---|

SLV Borrow Rate | 11.33 % (0 shares avail, −7.23 % rebate) | Hard-to-borrow with no inventory — squeeze risk high. | 🔴 Red |

COMEX Silver Registered | 183.04 M oz | Deliverable supply continues to bleed. | 🔴 Red |

COMEX Silver Volume | 148,529 | Elevated activity; aggressive repositioning continues. | 🟠 Orange |

COMEX Silver Open Interest | 171,513 | Firming — shorts under pressure as conviction builds. | 🟠 Orange |

GLD Borrow Rate | 0.73 % (2.9 M shares avail, 3.37 % rebate) | Tightening showing up in gold — early shortage signal. | 🟠 Orange |

COMEX Gold Registered | 21.42 M oz | Thin but steady — physical backing still tight. | 🟠 Orange |

COMEX Gold Volume | 333,731 | High churn — rotation toward real collateral. | 🟠 Orange |

COMEX Gold Open Interest | 485,827 | Solid — conviction intact in monetary metals. | 🟠 Orange |

🌍 Global Yields

Signal | Latest Level | Interpretation | Zone |

|---|---|---|---|

UST – JGB 10-Year Spread | 2.351 % | Wide and sticky — Japan stress bleeding into global funding. | 🟠 Orange |

Japan 30-Year Yield | 3.243 % | Ruh roh — BOJ cornered; defense costs rising. | 🔴 Red |

U.S. 30-Year Yield | 4.593 % | Long end repricing; collateral layer still shaking. | 🟠 Orange |

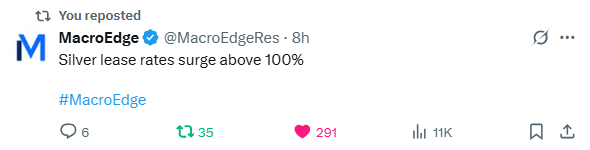

Silver Lease Rates >100% = fire alarm.

When it costs triple-digit annualized to borrow physical silver, it means large bars are scarce right now to a higher degree than we have never seen.

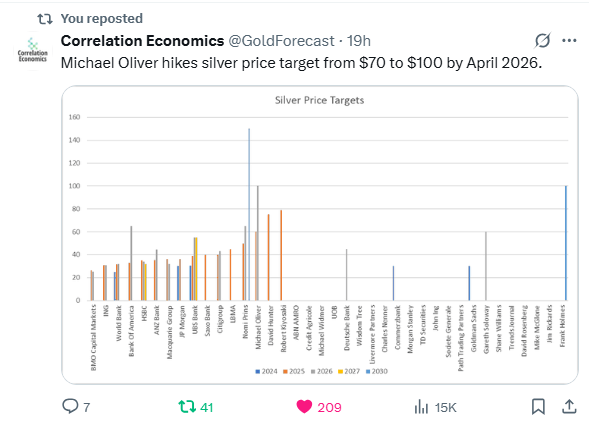

Signal, not hype: Michael Oliver—who nailed the momentum break that ignited silver’s latest run—just lifted his target to $100 by April ’26.

His work isn’t about vibes; it’s structural trend math: once momentum flips and supply is tight (backwardation, lease spikes), big money chases the new regime. Translation: the trend change is real, and the ceiling investors used to trade against just moved way higher.

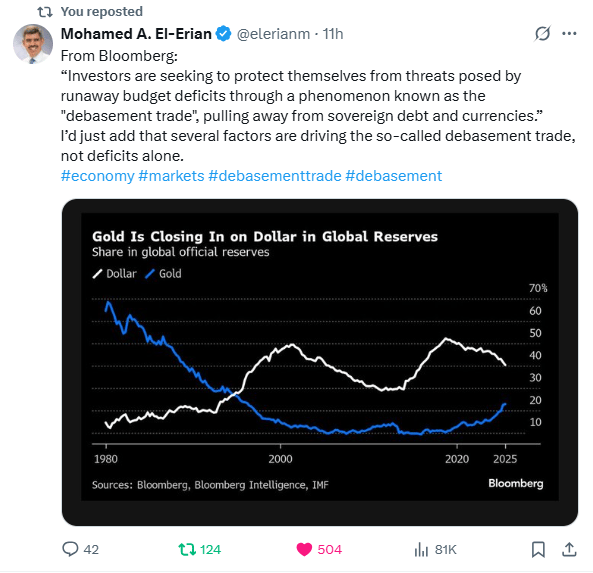

Yes—this is the “debasement trade” finally getting priced.

For 54 years we pretended paper could replace base-layer collateral; a whole generation of managers only knew the Fed put.

Now deficits are runaway, real yields are volatile, sanctions risk is real, and collateral quality is suspect—so central banks are rotating from sovereign IOUs to gold.

Translation: this isn’t a fad; it’s a structural reserve shift. When the backstop is faith and the printer, you buy the asset that settles on contact. Gold (and monetary silver) are simply reclaiming the job paper dodged.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply