- The Sovereign Signal

- Posts

- ⛓️ When the Base Layer Breaks: Why the System Feels Wrong—And What the 10 Year Swap Spread Is Screaming Beneath the Surface

⛓️ When the Base Layer Breaks: Why the System Feels Wrong—And What the 10 Year Swap Spread Is Screaming Beneath the Surface

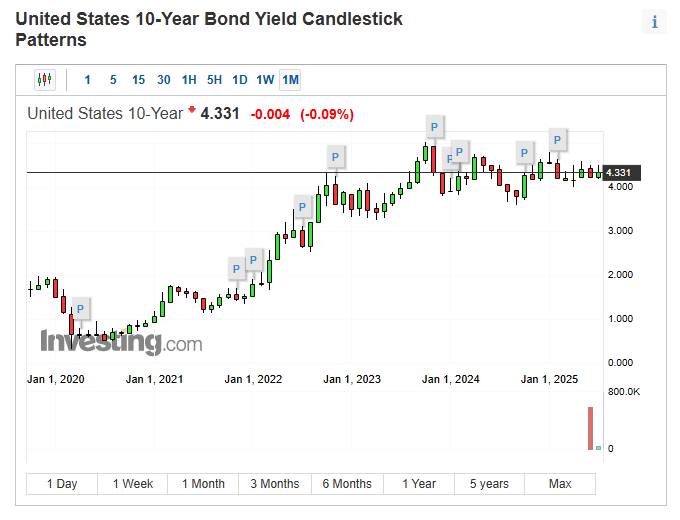

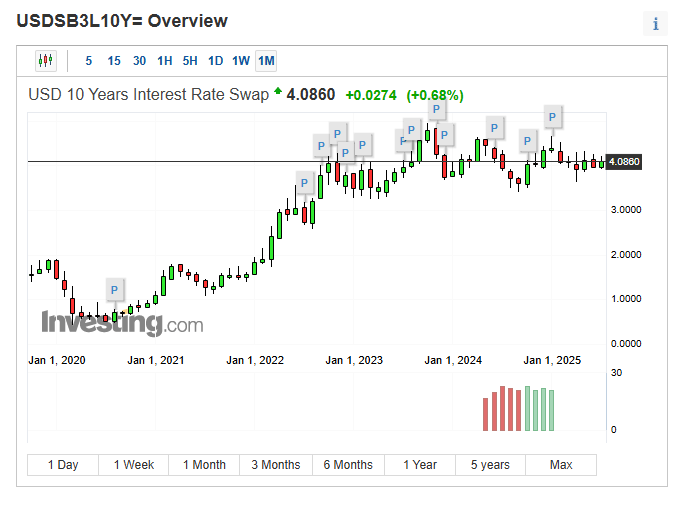

The 10-Year Treasury is supposed to be the safest asset in the world. So why is the market choosing the synthetic over the real thing? This isn’t just technical noise—it’s the quiet crack in global finance’s foundation. And the ground is shifting beneath our feet.

You Can Feel It—The Ground Isn’t Stable

You don’t need to trade bonds to sense the shift. You’ve built. You’ve endured. And now, deep in your gut, it’s back—that subtle quake beneath the surface.

The headlines say stability. But everything real says otherwise. The average homebuyer is now 56. First-time buyers? 38. That’s not upward mobility. That’s a generation being priced out of ownership.

Meanwhile, Americans spend 41% of their income on housing, healthcare, meds, and insurance—before they can even think about saving. The Fed talks “soft landing.” But the government is borrowing like there’s no tomorrow.

And markets are pretending the dysfunction can continue forever. It can’t. This isn’t just about data. It’s about instinct. And the foundation of the system is quietly shifting beneath our feet. Beneath all the noise… the shadow of one of the most-watched signals in global finance is flashing red: the 10-Year Swap Spread.

Signal | Latest Level | Interpretation | Zone |

|---|---|---|---|

10-Year Swap Spread | –24.6 bps | Still deeply inverted. System prefers synthetic exposure as opposed to actual Treasuries. | 🔴 Red |

Reverse Repos (RRP) | $171.018B | Watch out for a sustained break below $100B like we saw in February. | 🟠 Orange |

USD/JPY | 147.87 | BoJ defending JGBs over currency—amplifies carry trade fragility. | 🟡 Yellow |

USD/CHF | 0.8042 | CHF strength = quiet capital rotation to safety. Subtle signal of global preservation instinct. | 🟠 Orange |

3-Year SOFR–OIS Spread | 28 bps | Term funding stress worsening. Institutions uneasy about the future. | 🔴 Red |

SOFR Overnight Rate | 4.36% | Remains elevated after jump. Suggests background stress in short-term liquidity. | 🟡 Yellow |

SLV Borrow Rate | 0.79% (4.1M avail.) | Borrow strain eased, but tension remains. Short positioning lightening up. | 🟡 Yellow |

COMEX Silver Registered | 190.96M oz | Paper to metal leverage rising. Just 22.3% of OI could empty vaults. | 🟠 Orange |

COMEX Silver Volume | 49,378 | Momentum cooling. Still elevated in fragile conditions. | 🟡 Yellow |

Silver Open Interest | 170,483 | 852M oz paper vs 191M oz metal → 4.47:1 leverage. Structurally fragile. | 🟠 Orange |

GLD Borrow Rate | 0.5% (6M avail.) | Stable. No short squeeze or forced borrow pressure—yet. | 🟢 Green |

COMEX Gold Registered | 20.59M oz | Just 45% of open interest could deplete vaults. Firmer footing than silver—but still thin. | 🟡 Yellow |

COMEX Gold Volume | 288,652 | Active. Price formation suggests alert institutional presence. | 🟡 Yellow |

COMEX Gold Open Interest | 445,755 | 44.6M oz paper vs 20.6M oz physical → 2.17:1 leverage. | 🟠 Orange |

UST–JGB Spread | 2.778% | Cross-border duration stress. Signals global capital disequilibrium. | 🟠 Orange |

Japan 30Y Yield | 3.072% | Near multi-decade highs. BoJ pinned—next dislocation could be systemic. | 🟠 Orange |

US 30Y Yield | 4.876% | Long-end pressure high. Asset repricing ongoing beneath the surface. | 🟠 Orange |

SOFR Daily Volume | $2.783 Trillion | Massive dependency. Overnight markets bearing systemic load. | 🟠 Orange |

What’s a Swap Spread? And Why Should You Care?

The 10-Year U.S. Treasury is the bedrock of global finance. A swap? Just a synthetic contract that mimics it.

In a healthy market, the real bond is more valuable—safer, purer, collateral-grade. But today, the 10-Year swap spread has been deeply negative for months.

That means the market prefers the imitation over the real thing. This doesn’t happen in a healthy system. It signals stress at the base layer— where trust is supposed to be absolute. When the foundation buckles, everything built on it—credit, stocks, even currency—starts to strain.

Not Just Liquidity — A Signal From the Foundation

“Treasuries are scarce, especially older ones, so institutions hedge with swaps.”

Whether it’s trust or liquidity, the result is the same. In a market built on the illusion of infinite liquidity—where even minor corrections risk unraveling wildly distorted valuations—liquidity is trust.

Especially at the base layer. Especially in Treasuries. If that liquidity falters, it’s not just a mechanical issue. It’s a fracture in the perception that holds the whole structure together. If the most foundational asset in global finance isn’t flowing freely, then trust in the base layer is eroding.

And that erosion is partially self-inflicted. The Fed is effectively capping yields by buying long-dated Treasuries — trying to suppress borrowing costs and reduce pressure on equities. But in doing so, they’re distorting the natural supply/demand dynamic of the most important collateral in the world.

Then, to fix the shortage they helped create, they recycle those same Treasuries into reverse repos. It’s an elegant workaround —but one that compounds fragility over time. Because when the base layer of trust is strained, everything built on top becomes unstable. Credit. Equities. Derivatives. Currencies. If this is “just about liquidity,” it’s a liquidity issue in the bedrock of modern finance. That’s not noise. That’s signal.

What This Really Means

The system is quietly breaking at a structural level. Here’s the translation of what’s actually happening:

Treasuries are being hoarded by the Fed, pensions, and foreign governments. That means they’re not circulating in the market.

New issuance is skewed to short-term debt (T-Bills)—because no one wants to hold long bonds in a world of rising deficits and falling faith.

So when institutions need exposure to long-term rates, they choose swaps—not because they’re better, but because the bond market is broken.

This creates a synthetic illusion of liquidity. It’s not real trust. It’s just layers of abstraction papering over a shrinking base.

If your house had leaky pipes, low water pressure, and required rerouting the same water through a loop every night just to keep the faucets running — you'd call a plumber.

But when the plumbing of global finance leaks confidence, reroutes collateral, and recycles the same Treasuries in overnight loops to fake stability — it's called monetary policy. That's what we're seeing now. A base-layer so strained that the system can't function without constantly repumping trust.

The Takeaway

The 10-Year Swap Spread isn’t noise. It’s a red light flashing beneath the surface of global finance—a signal that abstraction is replacing substance because the foundation is eroding. Why?

Because global finance is hyper-interconnected. Japan’s debt spiral, swap spread inversion, short-term debt addiction, and equity bubbles—they all anchor back to one thing: The trustworthiness of the base-layer.

When trust disappears at the foundation—when real Treasuries are shunned, recycled, and distorted—the entire structure shakes. That’s why we watch these signals so closely. That’s why capital is quietly rotating back into real collateral. In a world this distorted, exposure isn’t safety. Ownership is.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

When liquidity means trust, and trust is cracking, the wise step out of the simulation and into sovereignty. Secure your foundation—before the next wave hits. Move before the headlines catch up.

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply