- The Sovereign Signal

- Posts

- Why Is Nobody Talking About the Deeply Negative 10-Year Swap Spread❓

Why Is Nobody Talking About the Deeply Negative 10-Year Swap Spread❓

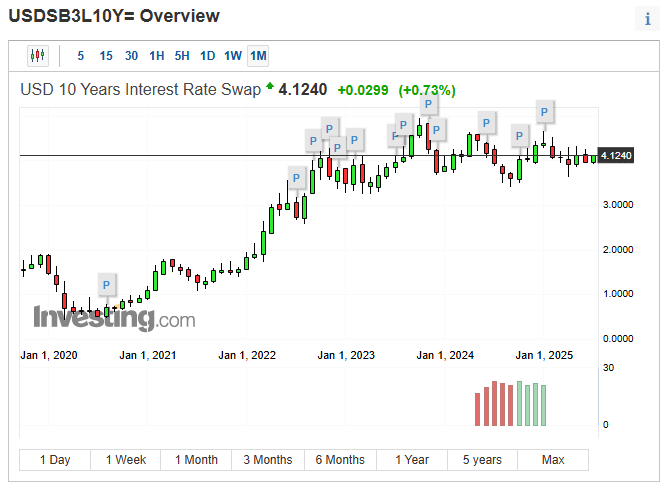

At -29bps This Morning - The 10 Year Swap Spread Has Been Near Record Levels For Months Now ➡️ It’s a leading indicator that the foundation of the system (Treasuries as perfect collateral) is under pressure.

📉 Most Investors Are Watching the Wrong Signals

Every day, talking heads point to the jobs print, CPI, or the 10-year yield as if they were the pulse of the market.

But those are all lagging indicators—reflections of a world that already happened.

Worse, many of them are shaped by assumptions, seasonal adjustments, and political convenience.

They are outputs of models, not raw signals.

Inputs can be revised.

Narratives can be smoothed.

Optics can be managed.

In a system this large and fragile, very few indicators remain purely organic—free from intervention, redefinition, or delay.

That’s what makes the 10-year swap spread so powerful.

It’s not a story crafted for headlines.

It’s a real-time whisper from the foundation of the global financial system.

It shows what’s happening beneath the surface—between the institutions that make the system run.

And when it dives deep into negative territory for months on end… it’s telling you that something in the base layer no longer adds up.

Not on paper. Not in trust. Not in collateral.

The signal is clean. The message is clear.

🧠 What It Is—and Why It Matters

The swap spread is the difference between the interest rate on a U.S. Treasury bond and the equivalent-maturity interest rate in the swap market—a synthetic market used by the biggest banks to hedge risk without touching actual Treasuries.

And when that spread goes deeply negative, it tells you something extraordinary:

The banking system no longer wants to hold Treasuries.

Why?

Because Treasuries, despite being the so-called “risk-free asset,” come with balance sheet baggage. When swap spreads go negative, it’s Wall Street’s way of saying:

“We’ll take synthetic exposure. But we won’t hold the bonds.”

🧱 Treasuries Are the Base Layer—And It’s Fracturing

Since 1971, U.S. sovereign debt has been the foundation—the base layer collateral—for the entire global financial system.

Everything else—derivatives, repo, eurodollars, even foreign exchange—rests on top of that foundation.

And what do investors watch most to gauge the strength of that foundation?

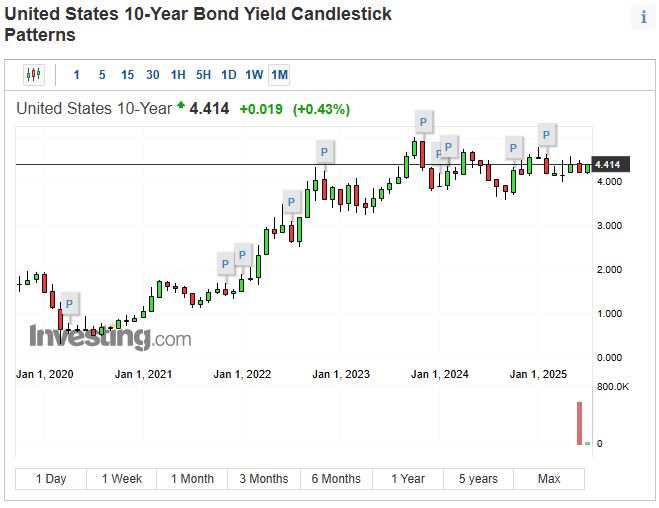

The 10-year Treasury yield—the most-watched benchmark in the world.

It anchors trillions in pricing.

It reflects U.S. credibility.

It’s supposed to be the deepest, most liquid, most trusted market on Earth.

But behind the curtain, the 10-year swap spread has been deeply negative for months.

That's not normal.

And it's not just a fluke.

🐉 Something Is Replacing the Foundation

While most investors are still watching surface indicators…

Smart money is already moving.

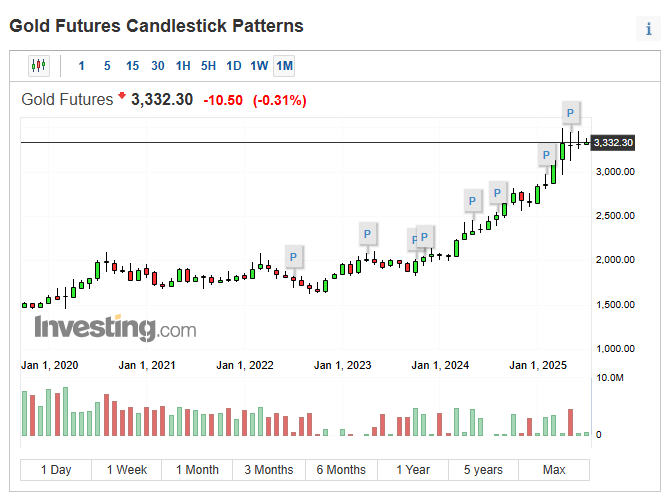

📈 Gold has quietly made new high after high after high—not because of inflation fears, but because trust is rotating away from the old base layer.

And if gold is returning as the foundation,

then everything priced in dollars must be revalued.

The repricing has already begun.

Signal | Level | Interpretation | Zone |

|---|---|---|---|

10-Year Swap Spread | –29 bps | Collateral stress deepening—Treasuries increasingly avoided in funding stack | 🔴 Red |

Reverse Repos | $218.03B | Stabilization attempt—but RRP levels still historically depleted | 🟡 Yellow |

USD/JPY | 146.2 | Yen weakening—carry trade fragility remains a key macro risk | 🟠 Orange |

USD/CHF | 0.7964 | Swiss franc still strong—capital flowing into non-USD safe havens | 🔴 Red |

SOFR 3Y OIS | 28.5 bps | Ongoing funding tightness—forward stress still unresolved | 🔴 Red |

SOFR Overnight Rate | 4.35% | Slight easing—but stress in short-term funding persists | 🔴 Red |

SOFR Overnight Volume | 2,846 | Heavy liquidity usage—structural strain on overnight funding | 🔴 Red |

SLV Borrow Rate | 0.71% | Silver shorting subdued—risk appetite returning cautiously | 🟡 Yellow |

GLD Borrow Rate | 0.59% | Gold stability persists—quiet demand for final-settlement collateral | 🟡 Yellow |

COMEX Gold | 36.7M oz (20.2M oz registered and available for physical delivery) | Open interest at 446,800 contracts. If all contracts took delivery would be 44.68M ounces | 🟡 Yellow |

Gold/Silver Ratio | 90.29 | Silver undervalued—gold premium signals structural mispricing | 🔴 Red |

🧭 Why Do Most Investors Obsess Over the 10-Year Treasury?

1️⃣ It’s the Benchmark for Everything

The 10-year U.S. Treasury yield is the reference rate for:

Mortgage rates

Corporate bond pricing

Discounted cash flow (DCF) models for stocks

Inflation expectations

Pension obligations

Global capital flows

2️⃣ It Represents Growth + Inflation Expectations

Investors treat it as the “cost of money” over the next decade.

If yields rise, it suggests expectations of:

Higher growth

Higher inflation

Or greater credit risk (if from supply/demand imbalance)

3️⃣ It Reflects Trust in the U.S. Government

When foreign governments or institutions lose confidence in the U.S. or want to diversify, they start selling 10s.

So watching the yield helps gauge faith in U.S. fiscal discipline, global demand for dollars, and overall risk sentiment.

🔥 Final Take

Most people watch the 10-year yield because it reflects how the surface looks.

But negative 10-year swap spreads tell you what's happening beneath the surface.

And when the foundation breaks first—the cracks appear in the swap market long before the walls start to shake.

🧬 The Swap Spread Signal: What the System Whispers Before It Screams

Most investors don’t know what the 10-year swap spread is.

Even fewer understand what it’s been trying to tell us.

That’s not a coincidence.

Because if you truly understand this signal, you understand that the entire monetary illusion we live in is coming undone—not in some far-off apocalypse, but in the fine print of the system’s most fundamental instruments.

And right now, this hidden signal—the 10-year swap spread—has been deeply negative for months (it’s the difference between the 10 Years Interest Rate Swap and the 10 Year Bond).

🩻 A CT Scan of the System’s Nervous Breakdown

This isn’t about short-term price moves or trader gossip.

This is about the deepest, most unconscious part of the system recoiling from what it was built on.

The 10-year Treasury isn’t just “a bond.” It’s the benchmark for:

Pension models

Duration hedges

Mortgage rates

Sovereign debt pricing

The repo system

The Eurodollar system

The entire hierarchy of global money

When the 10-year swap spread goes negative, it’s not volatility.

It’s repulsion.

And not a one-day fluke. We’re talking months of sustained inversion—an unnatural state where synthetic exposure is preferred over the actual collateral.

That’s like the body rejecting its own blood type.

🧠 Why Almost No One Talks About This

Because they can’t.

It’s not a headline. It’s not a ticker. It’s not on CNBC. It’s not taught in business school.

It lives in the dealer market—the twilight zone where only systemic operators play:

LCR arbitrage desks

GSIB balance sheet managers

FX basis hedgers

Sovereign bond repo specialists

It’s the part of the market where belief in the system itself is priced—not in narratives, but in leverage constraints.

And that belief is unraveling.

🧱 Treasuries Were the Base Layer — Until the Foundation Began to Shift

Since 1971, U.S. Treasuries have served as the bedrock collateral of the global financial system—a proxy for truth in a system running on trust, not convertibility.

But that trust rested on three core assumptions:

That Treasuries were infinitely liquid,

universally accepted,

and capital-light to hold.

All three assumptions are now under quiet, structural strain.

Basel III rules—particularly the NSFR—have reshaped incentives across the global banking system, penalizing duration risk and re-rating what counts as “clean” collateral.

U.S. regulators, seeing the cracks, proposed SLR relief in June 2025 to soften the blow—loosening leverage constraints on G-SIBs and potentially freeing up trillions in balance sheet capacity.

But this hasn’t reversed the deeper trend.

Foreign buyers like China and Japan—who anchor the long end of the Treasury curve—are stepping back.

Auction tail risk is rising.

And primary dealers are retreating to short-term T-bills and repo, not long bonds.

Meanwhile, the 10-year swap spread—the market’s quiet truth-teller—remains deeply negative, near record lows.

It tells us what the 10-year yield alone cannot:

That the institutional will to absorb long-dated U.S. debt is eroding from within.

In short, the illusion of Treasuries as the “riskless base layer” is no longer universally believed.

It hasn’t collapsed—

But it has been quietly marked down.

And as trust in sovereign collateral wanes…

Smart capital is rotating—

into the one asset Basel III made more desirable:

Real, unencumbered, zero-counterparty gold.

🐉 A New Foundation Is Quietly Being Laid

Meanwhile, something else is happening.

Something ancient.

Something physical.

Gold—the monetary asset that predates every bank and every nation—is breaking out quietly, methodically, relentlessly.

While nobody’s looking, it’s setting new all-time highs… over and over.

Not with fanfare. Not with hype.

But with the stoic confidence of something real.

Because here’s the truth most investors are not ready for:

When the synthetic system rejects its own foundation,

capital begins to re-materialize.

It seeks safety not in derivatives, not in government promises,

but in sovereign-proof value.

💥 Whoever Has the Gold—and the Guns—Calls the Shots

China isn’t just buying gold.

They’re quietly building the largest gold stockpile in human history—possibly 10,000 to 20,000 tons, when you add up official and shadow accumulation.

The BRICS bloc is following suit, realigning their reserves with hard assets, not promises.

Why?

Because they know what’s coming:

👉 A global financial restructuring is inevitable.

👉 And whoever holds the most gold will set the rules of the new game.

This isn’t speculation—it’s strategy.

The last 80 years of dollar hegemony were built on two things:

Military supremacy.

The US dollar as the world reserve currency.

We still have #1—for now.

But we’re squandering it by letting #2 rot while pretending the game isn’t changing.

If the West shows up to the restructuring table holding trillions in overleveraged debt and no real collateral…

…we’ll show up empty-handed, bragging about the glory days—while we argue over basic biology and identity politics, Beijing walks in with bullion and a blueprint for the future.

It’s time to get our shit together.

That means:

✅ Drop the illusions—credit can't function without the most valuable collateral at the foundation.

✅ Return to what works—real collateral, real discipline, real value.

✅ Start building reserves of gold—not to abandon growth, but to anchor it.

Because if gold becomes the base layer again—and it is—we need more of it than anyone else.

Before the next chapter is written without us.

🪙Preferred Access🪙

What’s flashing now in the funding markets isn’t noise.

It’s signal—deep, structural signal.

And the loudest of them all is the 10-year swap spread, which has been hovering near record lows for months.

Most investors watch the 10-year Treasury yield.

But the swap spread tells you what the 10-year can’t—

→ That banks no longer want to hold the debt that’s supposed to anchor the entire system.

→ That synthetic hedges are being favored over actual bonds.

→ That trust is evaporating at the base layer.

Why?

Because under Basel III, and even with recent SLR adjustments,

capital is still penalized for trusting paper.

The world is being forced back to fundamentals:

→ You either have real collateral—or you don’t.

→ You either hold the truth—or you rely on hope.

And in that shift, gold is rising—not as a trade,

but as a requirement.

If we’re entering a new system (and we are),

those who show up with gold will write the terms.

That’s why I built Sovereign Signal access to bullion that transcends counterparty trust:

📦 Fully insured delivery — to your vault, your doorstep, or wherever you store peace of mind

⚖️ Straightforward pricing — real bars, real rounds, real weight in your hand

📩 Just reply to this report or email [email protected] to secure access.

Because in a world of decaying trust, gold isn’t just insurance—it’s admission.

Luke Lovett

📲 Cell: 704.497.7324

🌐 Undervalued Assets | Sovereign Signal

📧 Email: [email protected]

🔐 Legal Disclaimer 🔐

The content provided herein is for informational and educational purposes only and should not be construed as financial, investment, legal, or tax advice. I am not a licensed financial advisor, investment professional, or attorney. The views expressed are solely those of the author and are not intended to be relied upon for making investment decisions.

While every effort has been made to ensure the accuracy of the information presented, no guarantee is given that all content is free from error, omission, or misinterpretation. Market data, trends, and conditions are subject to rapid change, and past performance is not indicative of future results.

Some views expressed may reference public insights from respected analysts and commentators. Some third-party content may be paraphrased or summarized for educational purposes only, with attribution, and does not imply endorsement or affiliation. All rights remain with the original creators.

Always conduct your own research and consult with a licensed financial advisor or registered investment professional before making any investment decisions. By reading this publication, you agree not to hold the author liable for any losses or damages resulting from the use of this information.

I am not a metals dealer. All orders are processed directly by a licensed precious metals dealer. I do not hold funds, process transactions, or provide personalized investment advice.

Reply